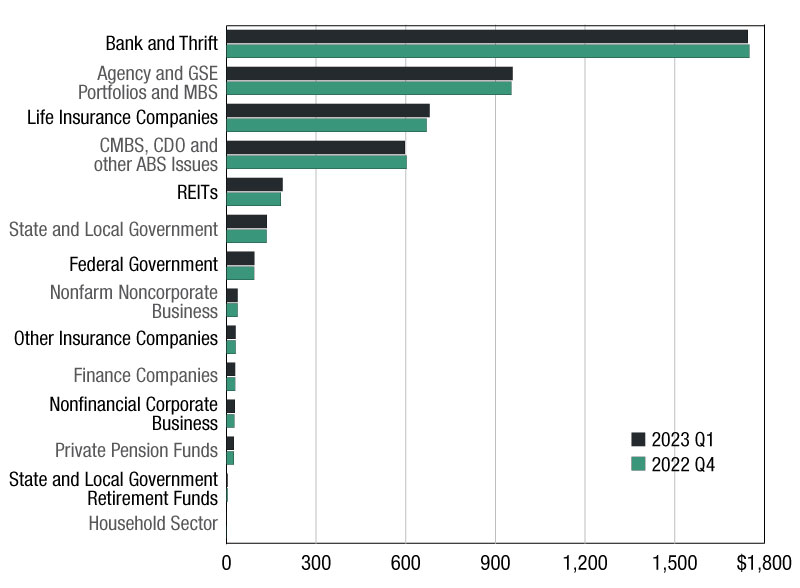

MBA Analysis on Q1 2023 Mortgage Debt Outstanding Results

MBA's analysis of residential and and commercial mortgages and who holds them.

Every quarter, MBA releases an analysis of the amount of commercial and multifamily mortgage debt outstanding (MDO) detailing the total amount of MDO as well as the holdings of different capital sources. For our Q1 2023 release, we urge users to take the numbers with a grain of salt, or two.

The bulk of the data in MBA’s analysis comes from the Federal Reserve Board’s Financial Accounts of the United States but because of the way the Fed tabulates its accounts, MBA makes certain adjustments to present the data in a way more consistent with how we believe commercial real estate (CRE) professionals see the market.

One example is that MBA excludes loans backed by owner-occupied commercial properties, while the Federal Reserve does not. These bank loans are very different than mortgages backed by income-producing properties and are not part of the world of leases, rents, vacancy rates, cap rates and more. The inclusion in the Fed’s numbers boosts their reported total by more than $600 billion. A direct use of the Fed’s data implies more than $5 trillion of CRE mortgage debt outstanding while MBA pegs the number at $4.5 trillion.

As markets and the data change, MBA has worked to adjust its analysis to keep up, which is why we are cautious about the data covering the first quarter of 2023.

In March, the FDIC took over $60 billion of loans formerly held by Signature Bank, many of which are CRE loans. The resulting decline in CRE loans held by banks was captured in the FDIC data that feeds both the Fed and MBA’s analysis. But it is not obvious that these loans were captured in the holdings of the federal government. If they are in fact missing, the overall level of MDO is likely understated by tens of billions of dollars.

There is an abundance of data on the commercial and multifamily mortgage markets. In times of rapid change, sometimes the data – and the way we manage it – takes a bit of time to catch up. We appear to be seeing that in the Q1 MDO numbers.

You must be logged in to post a comment.