MBA CREF21: Highlights from Day 1

Property types and policy issues were all on the table at the Mortgage Bankers Association’s 2021 Commercial Real Estate Finance Conference.

Expanding minority home ownership and affordable rental housing “is the single best way” for the residential, commercial and multifamily industries to combat injustice and build strong communities, said Mortgage Bankers Association Chair Susan Stewart as she kicked off the 2021 CREF conference.

As the first day of the two-day virtual conference (San Diego was not a possibility this year) proceeded, lenders, investors, and servicers looked inward at the challenges facing finance professionals and outward to such topics as tax changes, GSE reform, affordable housing and other legislative and policy matters.

Here are some of the insights and foresights that emerged from the first half of the program:

Equity and Justice for All

“The past year has shined a spotlight on injustice in America,” said Stewart, the CEO of SWBE Mortgage, on why she chose promoting minority home ownership, and affordable rental housing as a stepping stone or alternative to home ownership, as her goal for 2021.

Diversity, equity and inclusion was a recurring theme of the conference, mirroring the urgency being expressed by its members and much of the nation. Andrew Young, former U.N. Ambassador and former mayor of Atlanta will speak at the opening session of Day 2.

Refinancings Rising

MBA typically releases some key market indicators to coincide with their conference. On Wednesday, it announced that mortgage applications climbed 8.1 percent for the week ending Jan. 29 on a seasonally adjusted basis from the prior week. The rise in the Market Composite Index was attributed to an increase in refinancings, driven by the 30-year fixed mortgage rate dropping 3 basis points to 2.92 percent, after having risen for three weeks in a row.

Delinquencies Stabilizing

MBA announced on Tuesday that commercial mortgage delinquency rates had dipped slightly, according to its MBA-CREF Loan Performance Survey. This was supported by 94.3 percent of loans being current in January vs. 94 percent being up to date in December. To no surprise, lodging and retail produced the worst results, with 21.5 percent of the balance of lodging loans delinquent in January, down from 22.5 percent a month earlier, and 11.8 percent of retail loan balances being delinquent, down from 11.9 percent a month earlier.

Industrial, of Course

During a panel on underwriting, lenders and intermediaries are most enthusiastic about industrial.

Five years ago, industrial real estate would have been 5 to 10 percent of Goldman Sachs’ loan count, according to Ted Borter, managing director and co-head of real estate finance at Goldman Sachs. Last year, around 40 percent of the firm’s total number of loans were industrial. That was partly because other property types, like hotel and retail, were out of favor, Borter said, but it is also a “testament” to how much demand there has been from investors to enter the class and build their holdings.

“I would continue to expect growth in this sector and you see it in the investor support,” said Borter.

Multifamily Still Ranks High

Multifamily has retained its stable status for lenders despite some rent collection challenges, and investment has been healthy.

“We had a record year with Fannie Mae, Freddie Mac, FHA combined,” said CBRE Capital Markets Executive Vice President Jeff Majewski. “It was an interesting ride. Looking back to April and May, we thought the business was going to be off dramatically.”

Tale of Two Cities

Multifamily occupancy, meanwhile, has been a “tale of two cities,” said JP Morgan Chase Managing Director Candace Chao, with urban locations seeing a decline and suburban markets, particularly the sunbelt markets, relatively steady or ticking up.

Suburban rents will also remain strong, Chao said, since the trend that was already underway before the pandemic has accelerated. Rents in urban locations, meanwhile will take some time to recover.

“It’s going to be sluggish for some time unless there is a compelling reason to return back to cities,” she said. “Offices have to be open again. The vaccine has to be more widespread where people can resume their normal activities.”

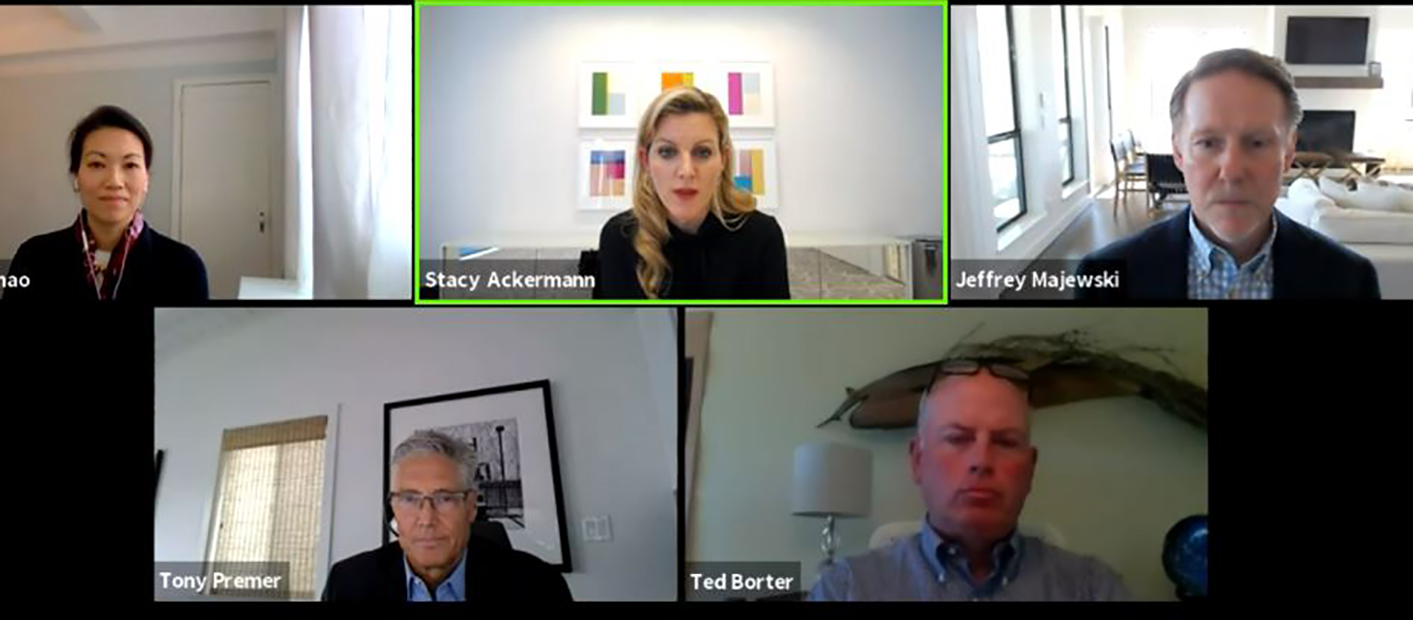

Clockwise: Candace Chao, Managing Director, JP Morgan Chase; Stacy Ackermann, Partner, K&L Gates; Jeffrey Majewski, Executive Managing Director, Debt & Structured Finance, CBRE Capital Markets; Tony Premer, Senior Vice President and Head of Real Estate Investment, Pacific Life Insurance Company; Ted Borter, Managing Director, Goldman Sachs.

Office Stuck in the Middle

Office is “the Goldilocks” property sector, said Tony Premer, senior vice president of real estate investments for Pacific Life Insurance Co. It’s not too hot and not too cold. Leasing and investment will lag while companies determine their long-term occupancy plans.

But, while there is likely to be a 10 to 20 percent contraction in office demand, Premer said, you cannot “indict” the entire asset class. “Even within submarkets, there can be radical differences of where the demand might be,” Premer said.

Niches Becoming the Norm

While the major real estate food groups each present underwriting challenges, there are a number of so-called alternative property types that are gaining in popularity and strength. Those include data centers, life sciences, manufactured housing and single-family rentals.

“We like SFR because it’s performed really well,” said Chao. “And it’s performed really well during the pandemic. There are a lot of urban renters who wanted more space and the privacy to ride out the storm so they moved into homes.”

Student Housing Hanging In

While students took longer to commit to leases, occupancy did not suffer as much as expected. Many students still chose to study in off-campus housing and be part of the campus community even if class-time was limited. That was the owner’s view during a panel on student housing.

The lender’s view is more cautious, according to John Hope, senior vice president/South Market Manager for Capital One Commercial Real Estate Finance. They are still interested in the property type, but they are favoring larger university towns that are not overbuilt, larger operators, and close proximity to campus. “The agencies are still in the space, but there are pressures,” said Hope.

MBA President & CEO Bob Broeskmit and A.B. Stoddard,Associate Editor and Columnist, RealClearPolitics

Eyes on Washington

Speaking on a panel devoted to the industry’s “priorities and policy playbook,” Michael Flood, senior vice president of Commercial/Multifamily Policy and Member Engagement, laid out the four pillars of the Biden agenda: COVID-19; diversity, equity and inclusion; affordable housing; and climate change.

“No matter what issue we are going to be looking at that is the frame the Biden Administration is going to be taking,” said Flood.

Items in the president’s proposed $1.9 trillion relief package that will benefit multifamily and commercial property owners include direct payments to individuals of $1,400; $400 in additional unemployment benefits until September; and additional rental assistance.

“Of course, you have to give in order to get,” Flood said. “So one of the challenges we will also have is the proposal has in it the extension of the eviction moratorium until September.”

It potentially could contain further forbearance on the multifamily side.

After COVID-19 is resolved, the next big issues will probably be taxes, said Meghan Sullivan, senior vice president, Governmental Relations and Public Policy, Wells Fargo Home Mortgage.

“We’ve spent more than $5 trillion on COVID-19 relief, which is more than the entire Federal budget,” she said. “Eventually, we are going to have to pay for that as a country.”

You must be logged in to post a comment.