MBA Forecasts Another Record Year for Originations

Loans originated for banks and life companies reached unprecedented levels, according to the Mortgage Bankers Association.

Jamie Woodwell, VP of Commercial & Multifamily Research, MBA.

Commercial and multifamily mortgage originations wrapped up 2019 with the strongest quarter on record since the second quarter of 2007, according to the Mortgage Bankers Association. Fourth quarter originations were up 7 percent over fourth quarter 2018 and 15 percent over the third quarter of 2019.

“That means that probably last year was up near double-digits over 2018,” said Jamie Woodwell, vice president of Commercial/Multifamily research for MBA. The fourth quarter results were released at the MBA CREF/Multifamily Housing Conference in San Diego.

MBA’s final tallies for 2019 will be out in March, but they are estimating that the final total of originations will be $628 billion—a 13 percent increase over 2018. Their estimate for 2020 is $683 billion—a 9 percent increase over the 2019 estimate.

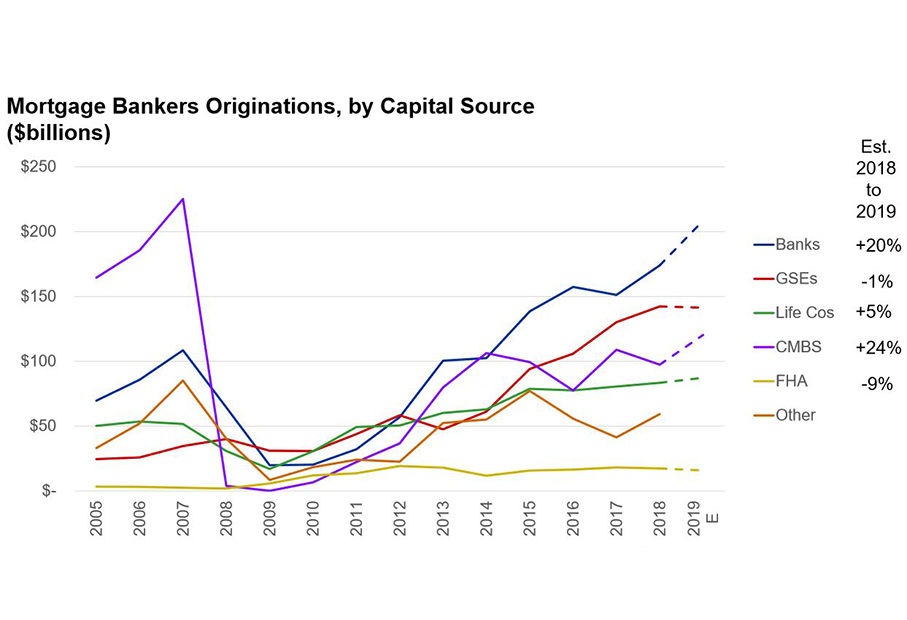

Capital Sources Embrace Real Estate

Last year, according to MBA, was a record year of originations for banks (up 20 percent) and life companies (up 5 percent). Despite some pullback in the summer, the GSEs (down 1 percent) were also at or above their record. CMBS (up 24 percent) also saw the strongest year since the downturn though spreads were tighter. Meanwhile, originations by investor-driven lenders are now up to $70 billion. FHFA lending was down 9 percent.

“Every capital source wanted to put more money to work in commercial real estate,” said Woodwell.

As for property types, multifamily (up 8 percent) and industrial (up 50 percent) were the big drivers of activity. Office (up 23 percent) and health care (up 92 percent) originations also rose. Retail (down 6 percent) and hotel (down 19 percent) originations fell.

MBA also announced a 48 percent increase in commercial and multifamily maturities in 2020. This year, 7 percent—$163.2 billion of the $2.2. trillion—of outstanding commercial and multifamily mortgages held by non-bank lenders and investors will mature. The figure is based on the results of MBA’s Commercial Real Estate/Multifamily Survey of Loan Maturity Volumes.

Source: MBA

You must be logged in to post a comment.