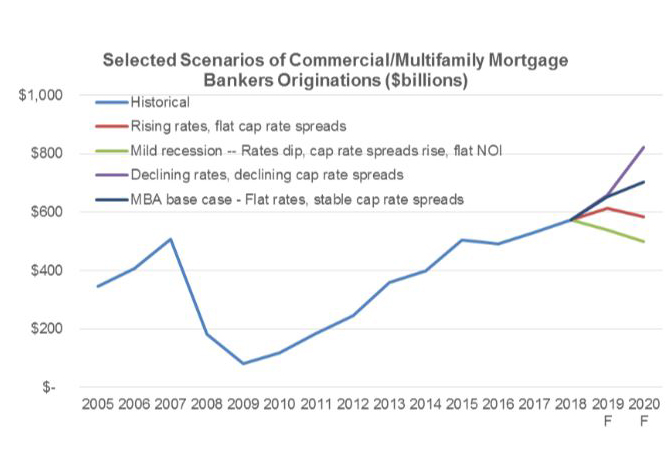

MBA Predicts Record 2020 for Originations

MBA's more optimistic forecast is driven, in part, by lower interest rates and favorable market conditions, according to Vice President of Research and Economics Jamie Woodwell.

Source: Mortgage Bankers Association

Thanks to low interest rates and sustained demand in the sector, 2019 and 2020 are poised to top the record books once again.

The Mortgage Bankers Association forecasts that commercial and multifamily mortgage bankers will close a record $652 billion of loans backed by income-producing properties this year, 14 percent higher than last 2018’s record volume ($574 billion).

Total multifamily lending, which includes some loans made by small and midsize banks not captured in the overall total, is forecast to rise to $359 billion, which is also a record and is 6 percent higher than last year’s record total ($339 billion). MBA anticipates volumes will rise again in 2020, reaching $700 billion of commercial/multifamily mortgage bankers originations, and $390 billion of total multifamily lending.

The low interest rate environment, coupled with continuously strong demand for commercial and multifamily assets, has pushed property values higher and increased demand for mortgages. It wasn’t long ago (think: early in 2019) that many economists, investors, and others anticipated long-terms rates would be around 3 percent and rising—potentially putting pressure on property values and decreasing demand for debt. Instead, the 10-year Treasury yield is at approximately 1.8 percent, and many market participants are planning for rates to remain ‘lower for longer.’ The result is heightened demand and higher volumes.

MBA’s forecast is higher than its previous projections, driven by the lower interest rates and favorable market conditions, as well as by a re-benchmarking of the size of the multifamily lending market. Based on recently released data, banks lent considerably more in multifamily mortgages in 2018 than previous estimated – making more than $100 billion in multifamily loans.

As long as rates still low, the commercial real estate sector is poised to remain active.

Jamie Woodwell is vice president of Research and Economics for the Mortgage Bankers Association.

You must be logged in to post a comment.