MBA Releases 2018 Outlook

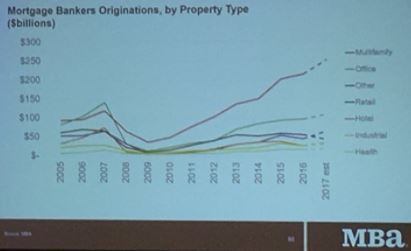

The Mortgage Bankers Association unveiled its predictions for commercial and multifamily mortgage originations. Overall, volume will be slowing, but the picture varies by property type.

By Sanyu Kyeyune

Origination volume is slowing, according to the Mortgage Bankers Association. The real estate finance organization released its 2018 outlook last night during its annual CREF/Multifamily Housing Convention & Expo in San Diego. MBA Vice President of Research and Economics Jamie Woodwell and Chief Economist Michael Fratantoni presented the findings, highlighting prevailing trends and emerging risks.

The MBA forecasts $549 billion in commercial and multifamily originations by year-end 2018, down 3 percent from 2017, and near-flat volume in 2019.

According to the MBA, mortgage bank multifamily issuance should reach $248 billion in 2018, with total multifamily originations coming in at $271 billion and remaining steady in 2019.

But a closer look at the numbers reveals a more varied picture. “For a number of years, we were in a situation where the rising economic tide coming out of the recession was really floating all boats, but now we’ve got different stories for each property type,” noted Woodwell.

Woodwell’s take, by property type

Multifamily: You’ve got this fundamental challenge between supply and demand. On the demand side, you’ve got Millennials, (Baby) Boomers—and lots of households looking for rental housing. At the same time, on the supply side, we’re now … at 600,000 multifamily units under construction,which is the largest number we’ve seen since the mid-1970s.

Office: We continue to see solid, long-term employment growth. In 2010, it was something like 225 square feet per employee. If you look today, it’s 150. We’ve been seeing trends like coworking and teleworking, which make office use more efficient.

Retail: You definitely see shifts in demand for space. If 9 percent of retail is through e-commerce, then that means that 91 percent isn’t, which is why we’re still seeing strong consumer growth.

Industrial: What e-commerce takes away from retail, it gives to industrial. Like the new multifamily, industrial is an investor darling that’s seen tons of demand.

Originations by property type. Source: Mortgage Bankers Association

Headwinds and tailwinds seem to align, noted MBA, generating what’s likely to be a nominal effect on the industry. Rising interest rates, slowing NOI growth and price appreciation, reduced sales volume, fewer maturities and moderating new development in some markets are putting pressure on origination volume. At the same time, economic growth, capital availability, favorable tax provisions and investor confidence continue to fuel the commercial real estate and multifamily lending markets.

You must be logged in to post a comment.