MDH Partners Enters Las Vegas With $94M Buy

The deal marks the investor’s first foray into Nevada's industrial market.

MDH Partners has acquired a portfolio of two industrial properties in Las Vegas. The acquisition represents the Atlanta-based company’s first move into the Nevada market. Link Logistics sold the assets for $94 million, according to CommercialEdge.

Sunrise Industrial Park One and Two total more than 509,000 square feet. The larger of the two buildings, 3101 Marion Drive, totals more than 271,600 square feet and dates from 1997, based on CommercialEdge data. The other building, the 237,600-square-foot 4601 E. Cheyenne Ave., is of the same vintage. Put together, the buildings are currently 78 percent leased to 10 tenants.

The assets feature 24- to 30-foot clear heights, dock-high loading, ESFR sprinklers and evaporative cooling systems, as is common in this part of the country, though they are banned in new commercial buildings. Floorplans between 20,000 square feet to 89,000 square feet are currently available, with Jerry Doty of Colliers International representing the new owner.

MDH Partners’ James Hwang oversaw the acquisition for the company, with Newmark’s Bret Hardy and Andrew Briner representing Link Logistics.

READ ALSO: Industrial Real Estate’s Future Depends on Adaptability

The company has been on an acquisition roll recently. In 2024, MDH acquired more than 9 million square feet of industrial space in various markets, including a near year-end deal that saw it buy a portfolio of 12 buildings ranging from 140,300 square feet to 1 million square feet.

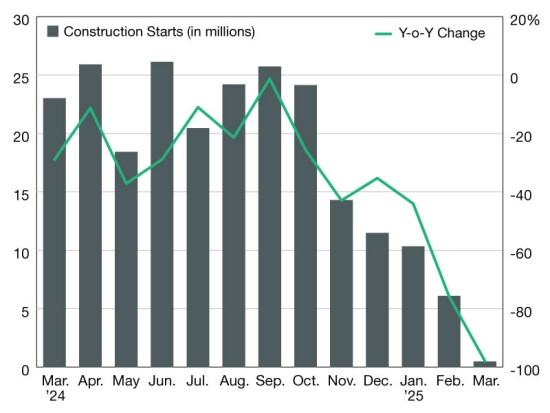

Supply overshoots industrial demand in Las Vegas

Preleasing on newly completed industrial projects in Las Vegas fell dramatically in the fourth quarter of 2024, bringing the market’s vacancy to 8.6 percent, according to Colliers data. A year earlier, vacancy was roughly 3 percent, and throughout 2022 and much of 2023, the rate hovered around 2 percent.

Net industrial absorption in the fourth quarter of 2024 was 467,260 square feet, Colliers noted. That brought net absorption for the entirety of 2024 to 4.7 million square feet, a decrease of 38.9 percent compared with 2023.

Even so, developers are still quite active in the Las Vegas industrial market, with 5.9 million square feet slated for completion during 2025, Colliers reported. Only 2.5 percent of that space preleased.

You must be logged in to post a comment.