Medical Offices Bounce Back in Spite of Telehealth

As pandemic restrictions are lifted, medical office buildings get back to business.

In-person visits to physician practices declined by more than 65 percent in April, according to John Wilson, president of HSA PrimeCare. The American Hospital Association reported estimated losses of $202 billion—from lost revenue and COVID-19 expenses—for hospitals and health systems from March through June.

In June 2020 Marcus & Millichap sold this multi-tenant medical office building in Danville, Ill. for $9.7 million. The 65,900-square-foot asset is fully leased with a strong anchor tenant and good net cash flow. Photo courtesy of Marcus & Millichap

“In most cases, for both hospitals and physician practices, the volumes are back to 80 percent to 100 percent of pre-COVID-19 levels,” said Wilson.

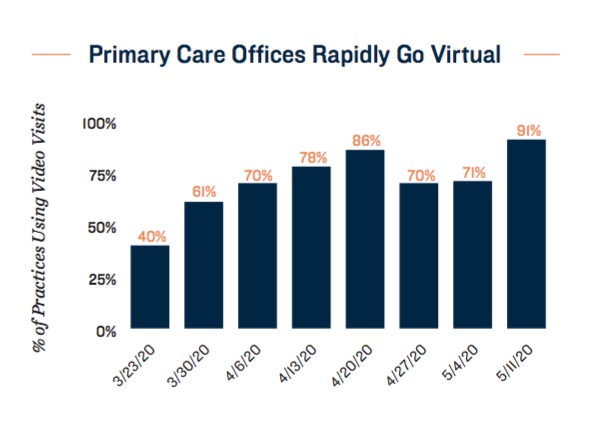

Now that medical office buildings have weathered the COVID-19 shutdowns, they’re back doing brisk business thanks to pent-up demand for medical services—and in spite of telehealth. The pandemic has accelerated the adoption of telehealth across all patient ages. Further fueling this trend, according to Wilson, the federal government has extended payment and policy to support access to telehealth.

CMS reported before the pandemic approximately 13,000 beneficiaries received telemedicine in a week. During the last week of April, 1.7 million beneficiaries received telehealth services.

“I see telehealth as a net positive, not a competitive risk or threat to medical office building investment,” said Alan Pontius, senior vice president & national director of the office and industrial division at Marcus & Millichap. “Telehealth appointments can convert to in-person appointments. It’s a way for doctors and health systems to build relationships with patients. It builds efficiency into the system.”

Newer facilities that provide check-in by phone or touchless entry are well-positioned during the pandemic. “Older vintage assets that are ’70s or ’80s’ construction and well-located will continue to thrive,” added Pontius.

Telehealth and digital monitoring tools enable providers to better manage patients with chronic conditions and attract new patients, according to the Marcus & Millichap report “Beyond the Global Health Crisis: 3Q Medical Office.” Chart courtesy of Marcus & Millichap

“But the reality is the ability to deliver modern care, the ability to integrate multiple practice specialties into a seamless delivery model, into one facility is creating some level of outdating for older facilities, particularly those that are divided into small, separate practice groups.”

Another trend, noted Pontius, is the expanding interest on the part of the drugstore chains to provide primary care and clinical services. This is a competitive element within the business that might play a role in how fast a neighboring medical office building leases-up. Investors need to be cognizant of these trends as they evaluate the sustainability of the income stream and rental growth of a given asset.

“We have a marketplace that is extremely thin of product right now,” added Pontius. “The supply of quality investment offerings is extraordinarily low relative to equity demand. We have an undersupplied condition relative to investor interest. There is, however, a word of caution on operations. Providers are slower to expand now, so lease-ups may slow down for some period of time as a result of COVID-19. Vacancies may sit a little longer, but there is a solid and strong bounce-back expected.”

Sector Insights rotates among office/medical office, industrial, retail, multifamily, self storage and hotel/hospitality.

You must be logged in to post a comment.