Tackling CRE’s Investment Challenges: DLA Piper Summit Highlights

Executives share fresh ideas for creating value amid inflation, war and policy shifts.

Capital markets panel at DLA Piper summit. From left, Anar Chudgar, Brian Kavoogian, David Lentz and James Reynolds.

Challenges not seen for generations, higher operations costs and a fluid global situation: These issues are all shaping capital markets trends and strategy. But at DLA Piper’s Global Summit, industry leaders offered the audience fresh strategies to surmount a variety of hurdles.

Inflation was a topic on the minds of every panelist during the Tuesday morning discussion moderated by Todd Rich, founder of Declaration Partners. James Reynolds, chairman & CEO of Loop Capital, noted that it takes an industry veteran to recall the inflationary climate of the late 1970s and early 1980s. But no one alive, he added, is likely to recall both 8, 9 or 10 percent inflation along with the question of whether the Federal Reserve’s actions will make the situation worse.

READ ALSO: CRE Confidence Is Up in DLA Piper’s Annual Sentiment Survey

As a result, investors are looking in new directions. “We’re seeing a resurgence of interest in fixed-income investment,” Reynolds added. “The fact that you are in bonds and that you can get your principal and interest is an attractive deal after you’ve just lost 30 percent of your equity.”

Asked whether firms can take steps operationally to deal with higher costs, David B. Lentz, managing director of Green Courte Partners LLC reported that his company is using technology in a new way: to build a dynamic pricing approach to airport parking, which had not had such a model before. “That made a huge difference in our business,” he said.

Brian Kavoogian, managing partner at National Development, noted that he and his colleagues believe the ability to add value at the property level will prove increasingly vital. But the panelists agreed that value-add capabilities will ultimately come down to solving the staffing issues so many employers face.

Noting that foreign investors have long been attracted to the stability of the U.S. real estate market, Rich asked how the war in Ukraine has impacted U.S. real estate. Artemis Real Estate Partners Co-president Anar Chudgar noted that international investors—whose office holdings in their home countries have been relatively less impacted by Covid than the U.S. office sector—remain interested in buying office properties in the U.S.

Reynolds said he’s seen less “swinging for the fences,” as well as investors moving away from equities and transitioning from risk-on to risk-off. Kavoogian and Chudgar both voiced their belief in ground-up industrial development.

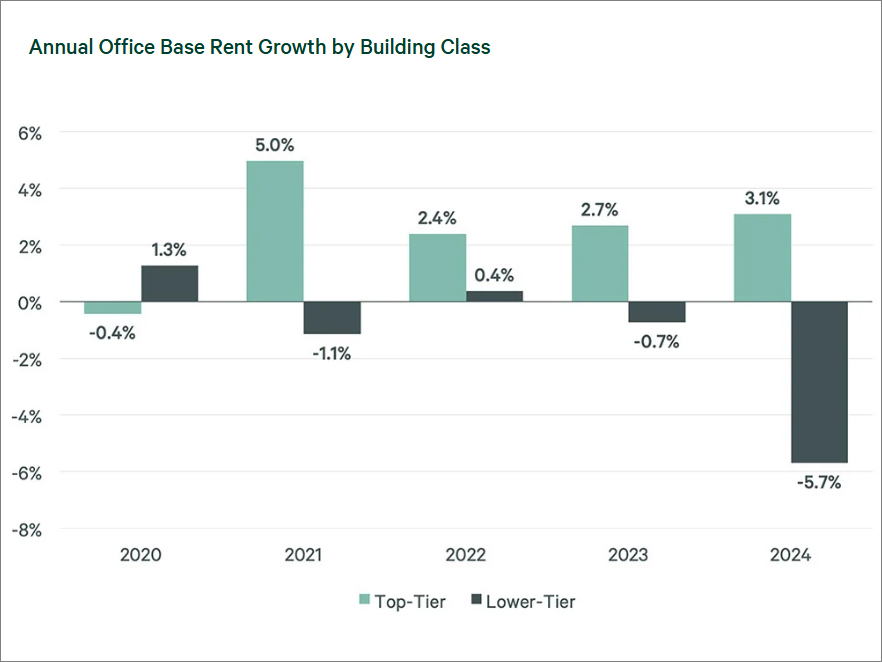

For Kavoogian, policy trends in big cities present a major challenge. Another is rent growth. “As these cities become bluer, we are not the heroes in town and we’re easy to beat up on,” he said. “I’m very worried about rent growth, which will cause even more backlash in our cities.”

You must be logged in to post a comment.