Miami Center Trades Owners; Crocker Pays $262M for Trophy Tower

Miami’s best-known office address, 201 South Biscayne Drive—where the Miami Center stands—has just traded for $262.5 million in what the Wall Street Journal calls the deal of the week. Boca Raton-based Crocker Partners purchased the 35-story building from Sumitomo Corp. of America, a unit of the Japanese global trading firm Sumitomo Corp.

By Georgiana Mihaila, Associate Editor

Miami’s best-known office address, 201 South Biscayne Drive—where the Miami Center stands—has just traded for $262.5 million in what the Wall Street Journal calls the deal of the week. Boca Raton-based Crocker Partners purchased the 35-story building from Sumitomo Corp. of America, a unit of the Japanese global trading firm Sumitomo Corp.

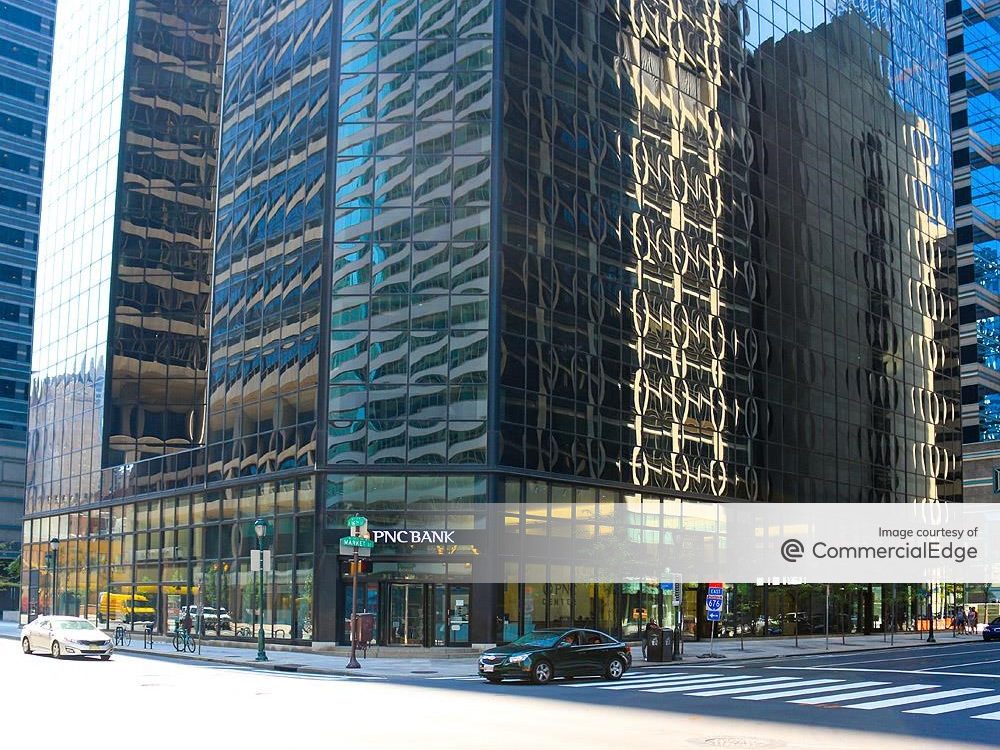

Built in 1983 and renovated in 2008, the 784,000-square-foot skyscraper is located in downtown Miami, adjacent and connected to the InterContinental Miami. The trophy tower is serviced by a nine-story parking garage with about 1,400 spaces.

The marble-clad Miami Center lists as major tenants Citigroup and law firms Shook Hardy and Shutts & Bowen. The office building was reportedly 87 percent occupied as of September 2011, following the 2009 loss of a big tenant—Stanford Group—which vacated nearly 90,000 square feet. New tenants moved into the Miami Center last year, including Apex USA, Jones Walker and Morgan Stanley, which signed leases totaling 80,000 square feet.

Citigroup has written a $172.5 million fixed-rate loan to finance Crocker Partners’ purchase of Miami Center; the previous debt on the property—a $170 million securitized mortgage maturing in September—was paid off in conjunction with the sale. That loan was originated by UBS in 2007 and securitized in a $3.2 billion transaction. The original borrower was a joint venture between J.P. Morgan and Crescent Real Estate—the company that sold the building to Sumitomo back in 2008.

Crocker is now paying about $334 per square foot for the building, roughly the same price that the building fetched in late 2008 when Sumitomo bought it for about $260 million—or about $332 per square foot. Sumitomo put the tower on the market earlier this year and hired Miami broker John Bell of Rockwood Real Estate Advisors to find a buyer. At that time, Sumitomo wanted to retain a 10 percent ownership interest and “restructure the capital stack” by creating a joint venture with another investor, but in the end Crocker bought the building outright.

According to the Wall Street Journal, the Miami Center sale is the biggest office deal in the city since 2008 and a gutsy bet that the city’s commercial real estate market is on the road to recovery.

Image courtesy of Daniel Christensen via Wikimedia Commons

For more market data from Miami, click here.

You must be logged in to post a comment.