Mixed-Use Malls and the 15-Minute Neighborhood

Why older indoor shopping centers are the next live-work-play opportunity.

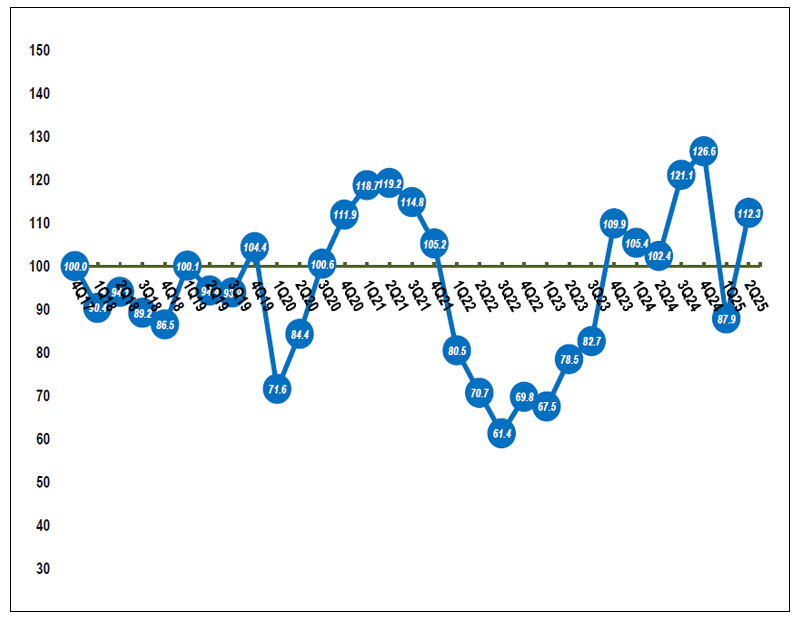

The pandemic was rough on indoor malls, but these properties were losing shoppers at least a decade before open-air shopping centers were designated as “essential retail.” Four years later, the malls that survived are being updated with tenants more relevant to today’s shopper, while many B and C malls are being redeveloped as mixed-use properties.

“Preferences of American shoppers have changed radically over the last decade,” said James Cook, director of North American Retail Research at JLL. “Shoppers today, especially younger people, want a live-work-play environment,” he added.

Mixed-use is the next phase of the mall’s natural evolution to a more viable and sustainable investment, said New York-based Rick Latella, executive managing director and retail practice group leader for Cushman & Wakefield’s Valuation & Advisory group. “If done properly,’ he noted, “it will offer investors a much higher return than it would have if left as-is.”

READ ALSO: What’s Ahead for Retail in 2024?

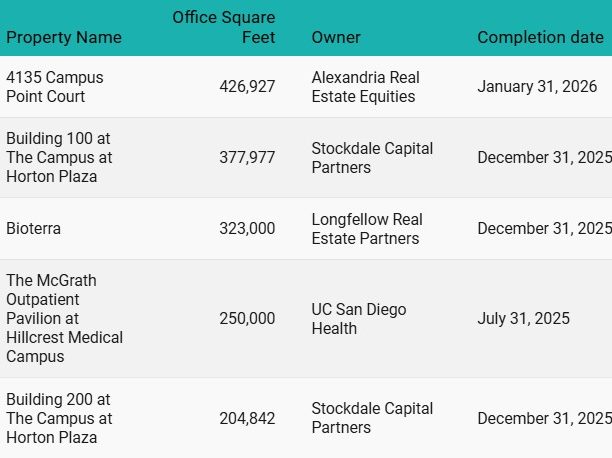

An analysis by JLL of 153 U.S. mall redevelopments underway found that 46 percent are mixed-use projects incorporating at least three uses. The most popular additions are housing (53.5 percent), office (34.6 percent), hotels (22.2 percent) and health and medical facilities (13.1 percent).

These projects are the easiest to justify financially in metro areas with large dense or growing populations. California is seeing the most mall mixed-use redevelopments, followed by Texas and Florida, which have the fastest-growing populations, according to U.S. Census Bureau data.

Converting malls to town centers

Dallas-based Centennial specializes in transforming underperforming retail centers into small-scale, 15-minute town center-like neighborhoods with experiential shopping and entertainment venues.

“We are an active investor and redevelop and repurpose shopping centers in a way that makes them more vibrant, more relevant to today’s retailers, communities and shoppers,” said Michael Platt, Centennial’s senior vice president of Mixed-Use Development.

Centennial, according to Platt, acquires underachieving properties with solid real estate attributes, like a quality location and substantial surrounding infrastructure. Currently, the company has eight mall mixed-use redevelopment projects underway. Rather than scraping a mall site and starting over, Platt’s firm works with the pieces that are functioning well to add vibrancy, and then fills the spaces around them with a mix of uses.

All Centennial centers, for example, will have multiple spaces for community engagement that can be programmed to provide outdoor venues for the enjoyment of on-site occupants and the community at-large. The firm’s Mainplace Mall in Santa Ana, Calif., features four gathering places for the community, replacing former department stores with green spaces to host events that drive consumer engagement, such as farmers markets, concerts and movies under the stars.

The economic advantages

Multifamily and office connected with vibrant retail amenities lease up faster at higher rents, according to Platt. This is true for hotel guests, too.

“It’s great to be able to stay in a hotel where you can walk out and very quickly find a few different restaurant options and entertainment in a close synergistic relationship to the hotel,” Platt said.

Further, having residents, hotel guests and office workers on-site extends the property’s activity to 18 hours daily, he added.

These additional uses bring a captive population with purchasing power to mall retailers’ doorstep, increasing vibrancy and viability and helping with leasing of retail and other uses. Platt finds that retail sales performance improves in these centers, residential and office components generate top rents, and hotels garner higher daily rates and occupancy.

A mix of uses also makes projects more feasible today because it lowers the risk for lenders if there are less risky components like multifamily in the mix suggests Zach Demuth, JLL’s global head of hotels research.

READ ALSO: Why Retail Is Back in Focus for Investors

And it may be best to finance the components separately, notes John Marshall, senior director for capital markets at JLL. “If a parcel is divided into a shopping center and a multi-housing development, there is a wider debt market for discrete uses, which provides better options than a mixed-use execution,” he explained.

“Timing also rarely lines up, impacting interest costs, reserves and covenants, and the cost of capital is generally less when separating uses,” Marshall added.

Forces driving mall evolution

But financials are not the only impetus for mixed-use malls. Retail trends are also behind the push, and today it can be virtually impossible to keep a pure-play retail mall full.

“I think the biggest thing is, quite frankly, that most regional shopping centers are simply too large,” said Platt. “Retailers, communities and shoppers today are looking for a more varied experience, one more reflective of how they live right now.”

There’s also population and employment migration and a desire by municipalities not to have a “zombie mall” in their community, Latella noted.

Empty anchor spaces are being replaced with a variety of uses, including entertainment concepts, sports and fitness facilities, community colleges, coworking spaces, offices, municipal service offices, post offices, food halls, museums and casinos.

“The whole idea of putting in entertainment is to attract families and extend their visit—eat, maybe see a movie and then shop,” explained Latella.

Expect more grocers and large tenants, like hypermarkets or a Target superstore, to locate in former mall department store footprints in the coming years, especially in dense markets, predicts Sarah Cafaro, senior director for the capital markets group net lease at Avison Young.

Health care also is a big player in the transition of malls. Moorestown Mall in Southern New Jersey, for example, was a dying mall that was saved when Cooper University Healthcare replaced a Sears store with an outpatient services facility. Another example is The MarketPlace mall in Rochester, N.Y., where University of Rochester Medical Center filled almost the entire footprint of the mall with an ambulatory orthopedic outpatient and sports medicine campus.

Redevelopment challenges

Redeveloping malls can be challenging, however. First, there must be consensus among all mall center partners and owners, like department stores that own their own parcels.

Mall owners are limited in what changes can be made by what’s in their reciprocal easement agreement, a legal agreement between mall property owners that lays out terms for maintaining and repairing common areas, easements and shared utilities. These documents commonly contain covenants that set forth accepted uses of the property, operating hours and limitations to the number or type of tenants that may enter the complex.

“RCAs can hamstring mall owners’ plans to improve or modify space or redevelop the structure if anchor tenants deem the changes detrimental to their business,” Cafaro said.

Community opposition can also stall or stop projects altogether. Concerns often involve the impact on already overcrowded schools, as well as an increase in traffic. Traffic concerns, however, may be overcome with an understanding that mixing housing with retail and office reduces the number of car trips because work and everyday shopping needs are within a short walk for residents, Platt noted.

Mall redevelopments also require navigation of entitlements and rezoning to allow a mix of housing with commercial uses. Platt finds that city leaders are generally agreeable to adding new uses, particularly housing, especially if the mall is in decline.

You must be logged in to post a comment.