More Data Centers, Please!

The skyrocketing need for computing capacity is driving up investor demand.

In CBRE’s Investment Intentions Survey, 97 percent of respondents, many of whom are the world’s largest institutional real estate investors, said they plan to increase capital deployment to data centers. The survey authors noted that data center transaction volume for all of North American totaled $4.8 billion in 2023, a 29 percent YOY increase.

Investment in data centers is expected to increase significantly over the next few years. Thirty-eight percent of respondents had less than five percent of their capital assets invested in data centers, but 82 percent of them expect to increase investment in this sector over the next five years.

READ ALSO: Are Microgrids the Answer to CRE’s Power Struggle?

Currently, investor appetite is strongest in the high-yield, opportunistic and value-add real estate segments with solid market fundamentals, but 80 percent of CBRE respondents indicated a preference for this asset type, up from 65 percent in a 2023 survey. High inflation and interest rates have reduced investor interest in core assets, down from 50 percent in 2021 to 30 percent this year. Similarly, core-plus asset interest among respondents dropped from 58 percent in 2021 to 34 percent in 2024, with investor interest broadly shifting to turnkey offerings from powered shell for the second consecutive year.

Looking forward, 31 percent of respondents believe the best data center opportunities over the next two years will be in build-to-suits for the hyperscale data center market—no change from last year’s survey but a significant increase over 2022 and 2021, when 22 percent and 17 percent, respectively, expressed this preference.

The past few real estate cycles demonstrated that demand for data centers is nearly recession-proof, and many applications, particularly those with high-credit tenants, such as large enterprise private deployments, are typically sticky,” said Dallas-based Todd Smith, who leads the Technology Properties Group at Transwestern. “There is confidence that despite any ebbs and flows on the demand in this area that may occur, demand and subsequent investment will be buoyed by continued macro needs for ever- increasing data,” he added.

“The scale of the capital required to meet demand is allowing both existing and new investors to support attractive opportunities, which are especially appealing given data centers’ positioning as the backbone of the broader AI-driven digital revolution that is creating long-term, secular tailwinds,” added New York-based Brent Mayo, Newmark’s executive managing director of Data Center and Digital Infrastructure Capital Markets.

He noted that building costs will continue rise, with new facilities designed to support larger and denser workloads with more challenging cooling requirements and infrastructure needs. “Deeper pools of capital will need to be formed to support the industry,” he added, noting the scale of development opportunities and sizing of in-place, stabilized portfolios will require an unprecedented amount of capital to support existing operators, developers, and end-users.

Fabulous fundamentals

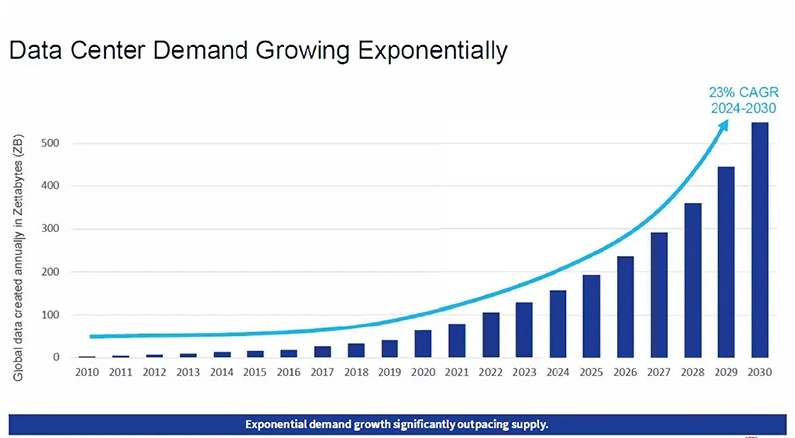

There’s good reason for the data center fever. Demand for data center capacity is growing exponentially, outpacing supply due to increases in remote and hybrid work, cloud computing, artificial intelligence workloads, and overall use of digital devices. Based on current demand, demand for data center capacity globally is forecast at 23 percent CAGR according to JLL (see below).

Commercial real estate funds with data centers among their targets have raised $48 billion over the last three years, and major mergers and acquisition and take-private activity in this space totaled almost $75 billion over the same period, with much of this investment coming from private-equity sources or REITs, according to San Francisco-based Jacob Albers, head of Alternative Insights at Cushman & Wakefield..

This alternative real estate sector, a blend of real estate, technology and infrastructure, has experienced surging demand and record absorption, producing strong development yields and overall returns. Overall annual returns for data center REITS in 2023, for example, increased a whopping 30.08 percent, according to a NAREIT report.

“The high performance of major tech companies behind cloud service, social media and now AI models, and their requirements for larger computing capacity is the key driver for investor activity in the data center space,” Albers said. “Annual cloud revenues have grown by 66 percent since 2020.”

Rising demand and high absorption translated to significant YOY rent growth across the board in Q1 2024, reported CBRE. Five primary markets, however, experienced extraordinary rent growth, with Silicon Valley rents surging 54 percent to $170-$200 kW/month); Northern Virginia 47.5 percent to $135-$160 kW/month; Chicago, 47 percent to $125-$140 kW/month; Dallas-Fort Worth, 29 percent to $125-$135 kW/month; and Phoenix, 20 percent to $130-$170 kW/month.

Come one, come all

Mayo predicted, however, that capital availability in the near-term will tighten given how quickly demand has increased and development has surged. But capital flows to data centers are expected to normalize over time as demand patterns become more predictable.

The top commercial real estate investors in this space, according to Smith, are Blackstone, GI Partners, Digital Bridge, The Carlyle Group, KKR, EQT, Berkshire Partners, and Stonepeak. But Denver-based Gordon Dolven, research director for CBRE Americas Data Centers, noted that Big Tech users, such as Microsoft, Google, Oracle, Amazon, and Meta, are increasingly developing their own data centers.

A large portion of capital entering the sector involves major investors that are acquiring or partnering with operators to expand development pipelines, while a number smaller-scale investors entering this space are acquiring land sites and taking pre-development steps of securing power, entitlements, utilities, and other site preparation before selling to data center developers, Albers said.

CBRE reported that in midyear 2023, U.S data center development jumped 26 percent YOY increase, to 5,174.1 megawatts (one MW is equal to one million watts), and a record 3,077.8 MWs was under construction. In 2024, however, construction activity in primary markets alone is expected to reach a new all-time high of more than 2,500 MWs.

Preleasing activity in primary markets is accelerating new construction, as 2,553.1 MWs or 83 percent of the new capacity under construction is already leased. Top capacity users continue to be cloud service providers, but AI is driving up demand significantly, especially in primary markets where the overall vacancy rate remains near a record low of 3.7 percent. And with few relocation options, the report noted that most tenants are renewing existing leases rather than seeking new facilities.

Northern Virginia, the largest data-center market nationally, remains preeminent for capacity and development, but other major markets continue to see substantial pipeline growth, with multiple markets experiencing double or triple the pipeline capacity of just a couple years ago, Albers noted.

Smaller markets are experiencing unprecedented growth, driven by less latency-sensitive workloads, the availability of power at scale, and economic incentives that can materially impact the cost of data center development and operations, noted Mayo.

“Secondary markets, such as Columbus, Kansas City, Salt Lake City, Reno and Charlotte, have witnessed major campus announcements, with more rural large-scale development rising across U.S. states, such as Indiana, Mississippi, Alabama and New Mexico,” added Albers.

According to CoreSite, proximity to a corporate headquarters or concentrations of customers or partners, along with connectivity options, latency requirements, financial incentives, power cost and availability, environmental hazards and the business ecosystem within the region that provides the data center industry infrastructure and interconnection solutions, are driving new data center development. This report listed the 10 largest data center markets, in order of MW capacity: Northern Virginia, Dallas-Fort Worth, Silicon Valley, Los Angeles, the New York Tri-State area, Chicago, Washington, D.C., Atlanta, Miami and Phoenix.

The power of data

Data centers require intensive energy capacity, which is spurring tremendous growth in development and investment in infrastructure, too. Mayo contended that power availability is the biggest challenge the industry will face in the coming years. Conservatively speaking, he suggested that data center energy demand will require at least 35-45 GWs of additional electricity by 2030.

New chips used in servers today require exponentially more power than 10 years ago, Dolven said, and AI center demand, which requires about 10 times as much power as other computing workloads, is adding undo stress to both power generation and grid systems.

“Load growth, for lack of a better term, will have to increase,” Dolven continued, noting that the transmission-distribution network is the biggest problem data center developers and operators are facing. “The grid is mission critical, as it is the new railroad or 21st Century plumbing that enables all of this information that we’re generating and receiving.”

Albers noted that data center development is following where large-scale power generation—hundreds of megawatts and ideally more than a gigawatt—will be available within the next few years. “In some cases,” he added, “development of power generation in the form of solar or other renewable micro-grids adjacent to a data center have been considered.”

As the industry continues to embrace sustainability, these assets present significant challenges to ensure resiliency and tie into existing and new energy infrastructure development to sustain growth, stated a midyear 2024 U.S. Real Estate Deals report from PwC. It noted that increasing energy demand by digital-economy properties, coupled with a broad push to transition to clean energy resources, presents significant growth opportunities for real estate and infrastructure investment

Dolven emphasized that data center growth depends on expanding utility infrastructure, as the current grid isn’t designed to deliver massive amounts of electricity to small parcels of 10-50 acres. “This need is generating a willingness among developers to fund or assist in construction of substations on the parcels where they’re building data centers, rather than wait in line for the utility to build a substation for them,” he continued, noting that this also speeds up connectivity.

In addition, Dolven said that investors are increasing capital investment to colocation of renewable energy facilities and data centers. “The dream goal is for data centers to be fully electrified by an adjacent renewable energy source,” he added, noting that the complication is energy production with wind and solar are unreliable or impossible 24 hours a day.

“The global colocation market is estimated at approximately $85 billion in 2024 and is expected to grow to over $120 billion in three years,” said Albers.

You must be logged in to post a comment.