Moving Forward

The long-anticipated rate cuts have finally begun to materialize, but lenders have already been pricing them in, according to Avison Young's Jay Maddox.

At long last, it appears our hopes for multiple Federal Reserve rate cuts, on hold for most of this year due to persistently high inflation numbers, are finally becoming a reality. The entire commercial real estate industry had been holding its breath to see how much the Fed would lower rates this week (which we now know is 50 basis points) as well as in the coming months (the Fed has suggested another 50 basis points in the last two meetings of the year). But lenders and investors, while guardedly optimistic, have already been incorporating future interest rate declines into their underwriting, which will potentially lead to increased investment activity and better deal metrics.

What can we expect?

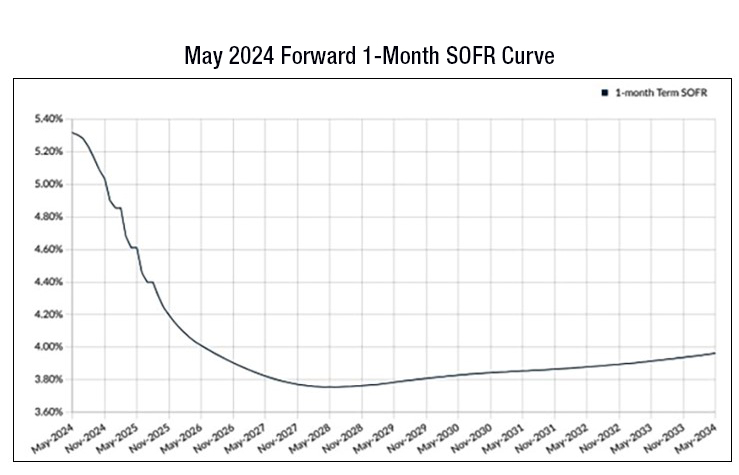

Perhaps the best indicator of market expectations is the so-called forward rate curve. It’s interesting to note that the market expectations for a decrease in short rates have changed dramatically since May. Since most construction and bridge loans are priced off the one-month SOFR index, the forward SOFR curve is the most relevant indicator of the capital markets rate forecast for commercial real estate. As the charts below indicate, a steep decline in the SOFR index was expected in May. However, a decline to the 3.80 percent range was still not expected until late 2027.

Flashing forward to the current market, the forecasted decline is much more dramatic, with SOFR expected to fall 200 basis points into the 3.0 percent range by the middle of 2025 and well below 3.0 percent by Q3 2025.

Positive impacts

Should rate decreases continue, this will likely have a very positive impact on loan pricing for short-term floating-rate construction and bridge loans. We are already seeing signs of improved loan pricing and underwriting metrics, particularly for bridge loans on high-quality value-add projects, in anticipation of lower rates and increased investment activity. Further, loan sizing’s slightly more aggressive. For example, lenders on high-quality multifamily bridge loans sizing to an 8.5 percent to 9.0 percent debt yield a few months ago are now pushing to the mid-to-high 7 percent range. And in many cases, lenders are sizing their required interest reserves based on the forward curve, which will help to bring down project costs. Lower financing costs will potentially result in projects moving forward that had been put on hold.

In conclusion, the current market dynamics are much improved as compared to just a few months ago. Barring the unforeseen, it appears that at least a modest market recovery’s in the offing.

Jay Maddox is principal, capital markets with Avison Young. He is a regular Viewpoints contributor. You can find his most recent article here.

You must be logged in to post a comment.