NAIOP Sentiment Index Points to Rising Optimism

This is the survey’s first favorable view of the industry's future in two years.

A majority of respondents to NAIOP’s latest CRE Sentiment Index survey predict that conditions across commercial real estate demand, investment and development are likely to improve over the next 12 months.

The Index’s final score for the study, which averaged sentiment scores for 10 separate categories, was 52 out of 100, the highest in two years, and a 6-point increase from the last poll in September. Any score above 50 means than conditions have been predicted to be favorable for the next 12 months, while any below the same number presages an unfavorable environment for CRE stakeholders.

The survey which took place from April 3rd through April 11th, queried 456 developers, owners, operators, brokers, analysts, lenders, investors and consultants from 343 unique companies, and asked about predictions around occupancy rates, rents, construction material costs, labor availability, equity and debt availability, alongside cap rates and employment predictions across their firms.

READ ALSO: Bears Dominate but Bulls’ Numbers Grow in DLA Piper Survey

A tabulation of the respondents’ primary property types revealed that the vast majority were involved in industrial assets, which 72.1 percent listed as their top prospects. Office assets came in second, at 52.4 percent, while retail, medical office, life science properties and data centers all clocked in below 40 percent. In a similar vein, 40.6 percent of respondents expect to be most involved in the industrial sector in the next 12 months, dwarfing the second-place multifamily, which 24.1 percent listed as their primary focus.

Improvements across the board

According to NAIOP’s key findings for the report, many of the positive developments came from the economy’s performance through the past seven months, furthered by predictions of interest rate cuts that are likely to take place at some point over the next year. Conversely, the scores for construction materials and labor costs, the lowest of the bunch, have gone nearly unchanged from the previous survey, owed to presently high interest rates.

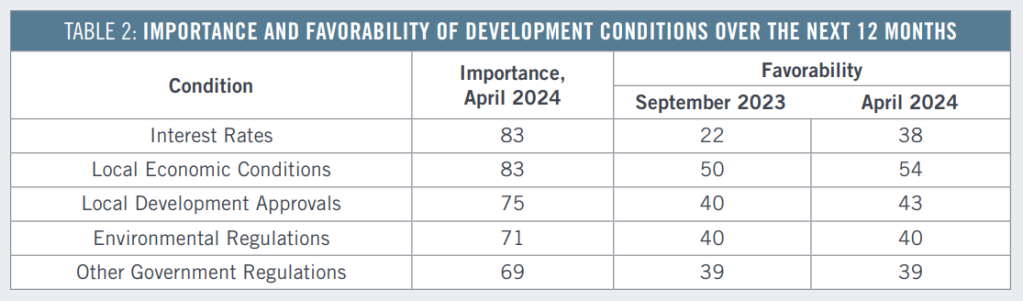

The most important determinants for respondents include interest rates and local economic conditions, tied with scores of 83. Local development approvals, environmental regulations and miscellaneous government regulations ranked third to lowest, respectively, suggesting that many of the structural determinants for the industry’s performance are matters of jurisdiction.

As for how favorable these factors are, local economic conditions are the only metric to score above 50, with the rest ranging between 38 and 43. In contrast to its importance, favorability toward interest rates remains a low 38, albeit significantly higher than September’s 22. The rest, outside of local economic conditions, have changed little.

Additional nuances within the survey results include respondents personally anticipating starting an increased number of projects, in addition to acquiring new properties.

Sentiment components, scores, changes

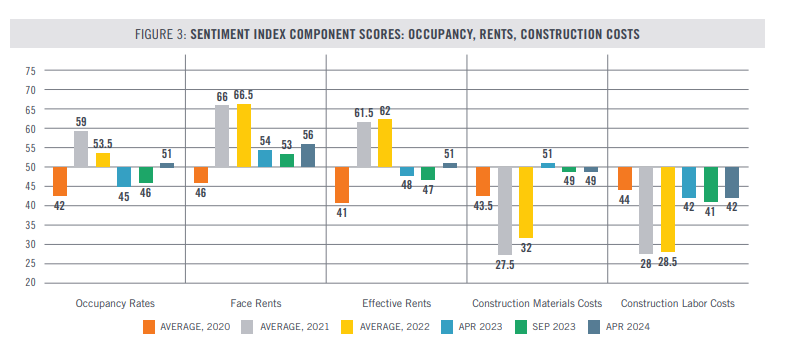

The survey’s score for portfolios’ occupancy rates increased by 5 points since September, passing the 50 mark for the first time since 2022. With the majority of survey respondents involved in the industrial sector, this increase is likely due to persistent demand for space, as new supply slows.

Face rents across CRE saw a similar 3-point increase to 56 from 53, inching upward, but coming close enough to 2022’s grade of 66.5. Effective rents tied occupancy rates, inching up 4 points from 2023. Data from CommercialEdge’s latest office and industrial reports shows that the latter category continues its upward march, growing by 7.3 percent, year-over-year, while the former’s listing rate contracted by 1.3 percent over the same period.

The only components to score below 50, construction material and labor costs ended at 49 and 42, respectively, nearly unchanged from last year. Still, they are a far cry from 2021’s historic lows of 27.5 and 28.

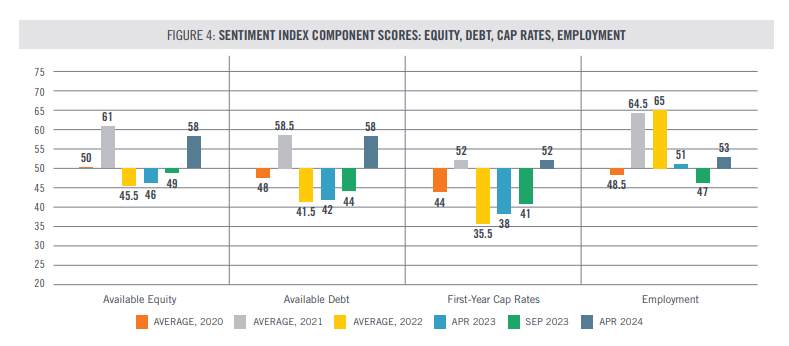

The most dramatic increases came on the debt and equity side, which the report’s analysis believes to be the result of both an end to interest rate hikes, alongside stability in nearly every aspect of the economy except for inflation. Equity availability’s score shot up to 58 from September’s 49, while the assessment of available debt saw the most dramatic increase of all, ending up 14 points higher than September’s average of 44. Employment, which has changed little over the past 3 years, flipped back to a positive outlook, increasing to 53 from 47.

Finally, a lower, or at least stable rate environment means that cap rates stand to benefit. Respondents seemed to agree, with the score averaging 52, up 11 points from September.

You must be logged in to post a comment.