Neighborhood Centers Quietly Winning the Retail War

Consumers are increasingly buying their goods on the Internet, but services need a brick-and-mortar location, notes Scott Crowe of CenterSquare Investment Management.

Scott Crowe Photo courtesy of CenterSquare Investment Management

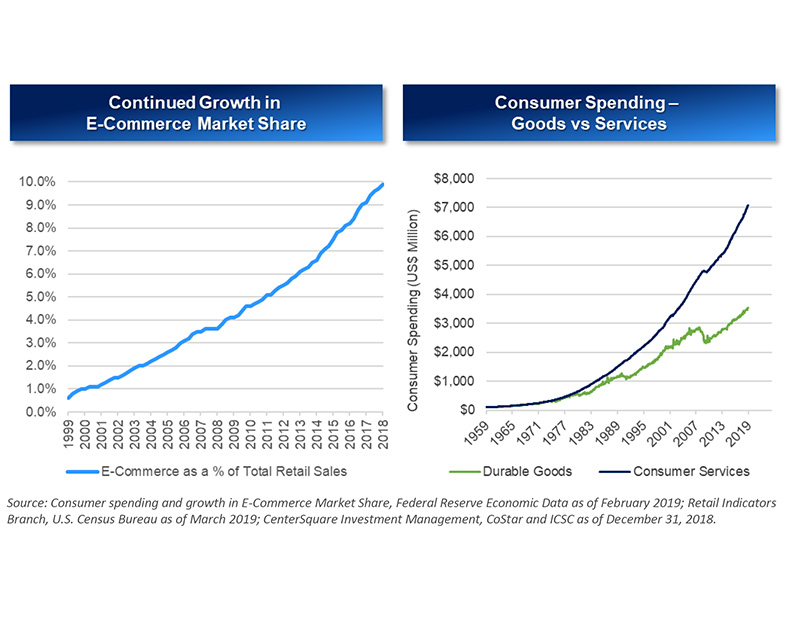

The retail real estate investment landscape has shifted dramatically in recent years. But at the heart of it, we see two major mega trends at play. The first trend is well known: The exponential growth of ecommerce is changing how consumers purchase physical goods. This has benefitted logistics warehouse real estate while massively disrupting the fundamentals of retail real estate, especially malls—the epicenter of the death of the department store. The second trend is less known but equally powerful: Consumers have changed not only how but also what they purchase and are spending less on goods and more on services. Though this trend has accelerated since the financial crisis, it has been underway for decades, driven by a general increase in affluence, coupled with the increased efficiency and decreased cost of distributing physical goods. These services (i.e. food and beverage, fitness, beauty, health and medical, and business services), unlike goods, require a brick- and-mortar interface for point of sale consumption.

While most of retail real estate is being negatively disrupted by today’s trends, a winner in the asset class has emerged, hidden by the uncertainty and confusion surrounding retail in general. The winner is a property type we call “neighborhood retail,” which has become the brick-and-mortar interface for the last-mile delivery of services.

The retail evolution

The retail evolution

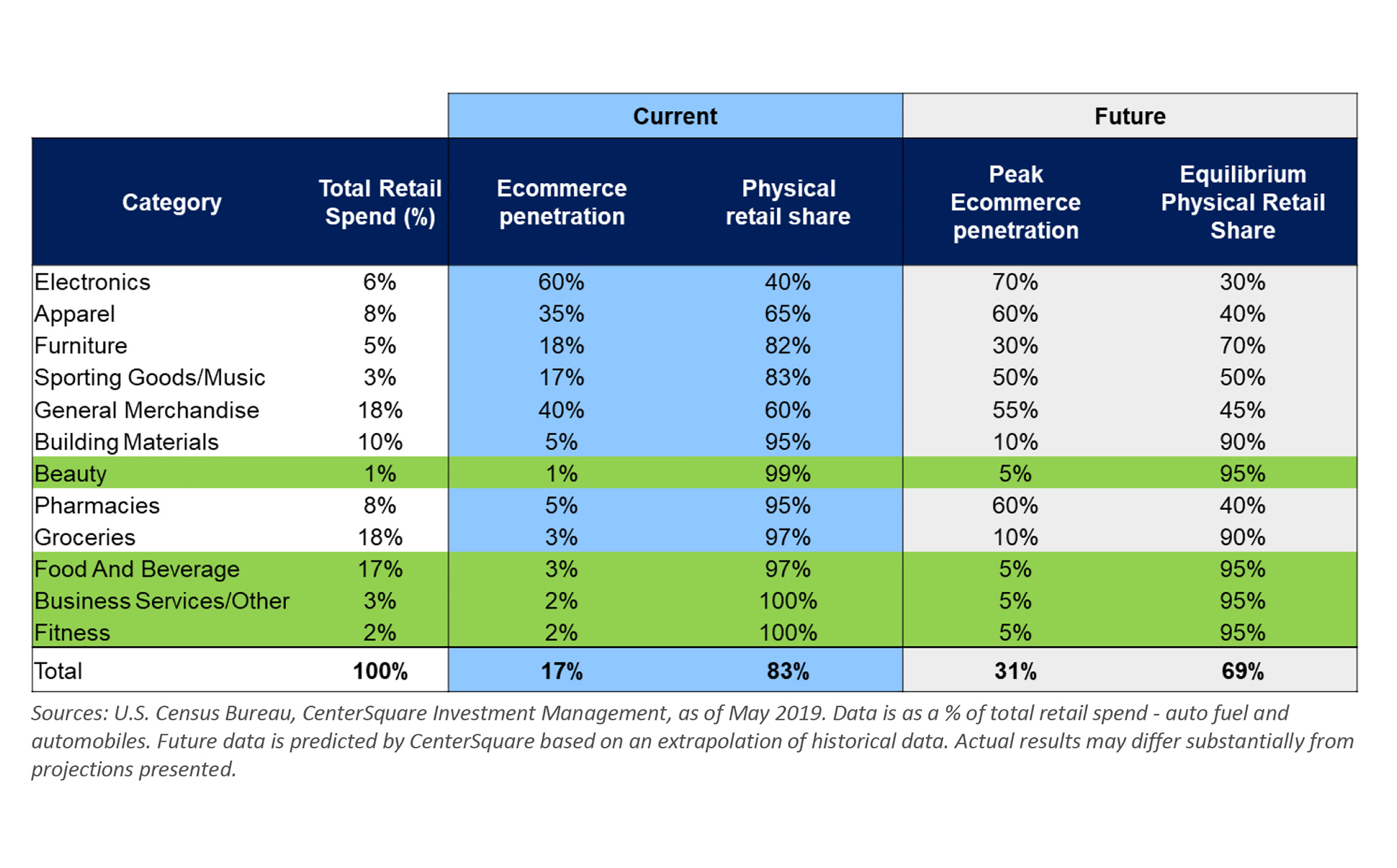

As we think about ecommerce and evolving consumer behavior, our analysis yields a bifurcation in the consumer spending categories most impacted by ecommerce. Ecommerce currently accounts for 17 percent of consumer spending (excluding auto and fuel), and our analysis shows that percentage expanding to 31 percent over the next five to seven years. We expect goods categories like apparel, sporting goods and pharmacies to see the biggest change in their physical versus online retail shares. On the other hand, services categories like beauty, food and beverage, and fitness will be most insulated by the shift toward ecommerce as brick-and-mortar locations are required for their consumption. These services categories account for almost one-fourth of consumer spending, and we expect that to continue growing over time, supporting the growing demand for retail space suited to these services and readily available to local consumers.

Assets for the last-mile delivery of services

Neighborhood retail centers are the winners in this evolution of retail as they provide the physical space required for the last-mile delivery of these services. We classify neighborhood retail as multi-tenant strip centers between 10,000 and 50,000 square feet, unanchored, and with greater than 5 tenants occupying highly fungible space. These centers do not have an anchor tenant by design as we see inherent risks for the big box tenants—they are expensive to backfill, account for a large portion of the asset’s cash flows, have more negotiating leverage, don’t have contractual rent escalators, have co-tenancy clauses that can impact other tenants, and have more exposure to being disrupted by ecommerce.

We believe the most attractive centers are located in growth markets with strong demographics supporting demand, built after 2000, and situated on high-traffic roads in dense and affluent markets. Historically, these assets have proven to be very resilient, with consistent occupancy in the mid-90 percent range during the worst of times, including the last recession.

An opportunity ripe for institutionalization

Given the lack of appetite for retail assets in the current environment, there is very little institutional investment in neighborhood retail today. This creates an opportunity to institutionalize the asset class, similar to what occurred in self-storage and student housing over the past few decades.

In today’s environment where so many other real estate assets appear richly valued, neighborhood retail assets trade at high cap rates (6-7 percent) because of the lack of institutional competition. Additionally, they generate high cash yields because they are efficient to own. These assets utilize triple net leases with annual rent escalators and are inexpensive to lease because they are simple, fungible spaces with a variety of tenants that can backfill vacancy. They require limited tenant improvements and little frictional leasing costs.

In addition, investment returns can be further enhanced through institutional asset management. Most of these properties have been owned by local operators that have neither invested capital into maintenance nor managed occupancy and rents to maximize revenues. This investment opportunity is especially attractive right now given the NCREIF Open End Diversified Core Equity Index is expected to decelerate to mid-single digit returns (partly driven by write-downs from mall exposure), while neighborhood retail can outperform on the cash flow alone. With an approach that features the aggregation of multiple centers across growth markets in the U.S., institutional investors have a compelling option to rebuild retail real estate exposure in a diversified portfolio insulated from the impacts of ecommerce and with a significant amount of current income.

Neighborhood retail

With real estate markets priced seemingly to perfection, there are few remaining opportunities for the risk-adjusted returns presented by neighborhood retail. We believe the disruption in retail has hidden one of the better opportunities in real estate today—a property type that is quietly benefitting from the mega trend of growing services consumption and the increasing demand for their brick-and- mortar delivery point, Neighborhood Retail.

Scott Crowe is chief investment strategist for CenterSquare Investment Management.

You must be logged in to post a comment.