Net Lease Investment Volume Surges

One sector dominates transaction activity, according to CBRE’s latest research.

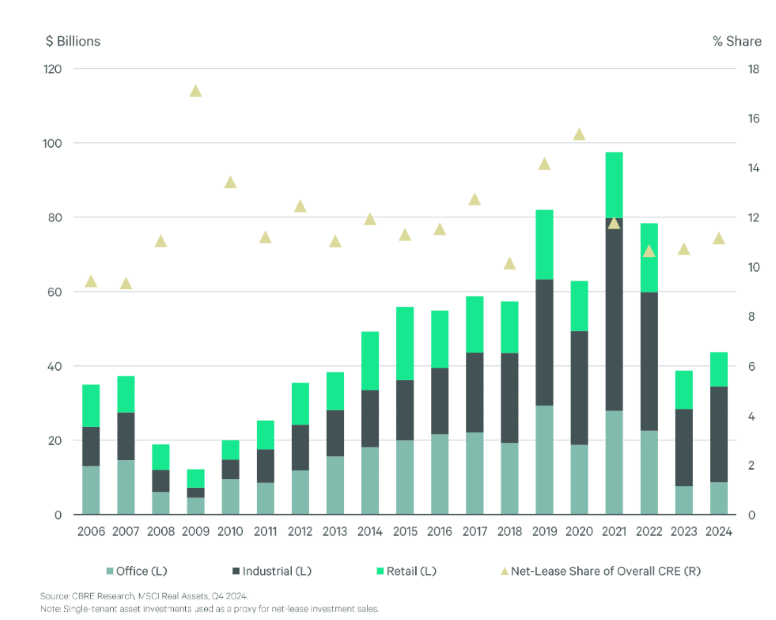

Dominated by the industrial and logistics sector, net lease investment volume increased by 19 percent quarter-over-quarter and 57 percent year-over-year in the fourth quarter of 2024, reaching $13.7 billion, according to a new report from CBRE.

That quarter helped to create a 13 percent increase in full-year 2024 net lease investment volume, totaling $43.7 billion.

Industrial and logistics increased its share to 64 percent in the fourth quarter from 54 percent a year earlier. In 2024, net lease investment volume for industrial assets increased 87 percent from the prior year.

Net lease properties are characterized by a lease structure in which the tenant agrees to pay a portion or all of the taxes, insurance fees and maintenance costs in addition to rent.

Predictable cash flow

The net lease sector’s strong performance was generated by its predictable cash flow and mass appeal to investors seeking solid risk-adjusted returns, Will Pike, vice chairman of net lease properties for capital markets at CBRE, told Commercial Property Executive.

“We expect continued momentum this year, especially in retail and the industrial sector, as capital has proven to prioritize low-risk opportunities amid potential capital markets volatility in 2025,” he said.

Joseph Yiu, a partner at Leste Group, a global alternative investment manager, told CPE he was not surprised because the asset class has always performed well in times of uncertainty.

“With fundamentals and rent growth starting to deteriorate and plateau in other commercial real estate asset classes, 2 percent to 3 percent annual escalations on long-term net leases are beginning to look attractive on a relative value basis,” according to Yiu. “Cap rates on net leases have also widened over the last 24 months, so obtaining neutral or positive leverage is slowly becoming available for creditworthy borrowers.”

Deals consummated at year-end

As some traditional retailers struggle to maintain their customers or credit ratings, Damon Juha, partner & real estate practice vice chair at Saul Ewing, sees investors explore outside the traditional single-tenant NNN retail deals into other product types, such as industrial.

“There seemed to be a convergence of influences: investors responding to the Fed’s interest rate cuts, investors paying all cash (particularly for smaller deals such that the interest did not matter) and parties needing to consummate deals before year-end, particularly in light of the change of the administration,” Juha said.

READ ALSO: Understanding the Net Lease Reset

Net lease deals have historically provided a relatively low-risk alternative at price points where private investors can enter the market without financing, Juha added. ”Our clients continue to want to do deals, but time will tell if inflation risk and interest rates quell this sentiment.”

Growth in logistics and distribution facilities reflects trends like the continued expansion of e-commerce, supply chain shifts and the need for strategically positioned assets, according to Lanie Beck, Northmarq senior director, content & marketing research.

“Private investors drive the bulk of transaction activity, even as economic pressures like elevated interest rates and inflation influence the market,” Beck said.

Recent cap rate increases indicate a recalibration of risk, while stabilized single-tenant net lease properties continue to attract the attention of both private and institutional buyers, she observed.

“Industrial assets, as noted previously, have outperformed. On the other hand, retail and office sectors face mixed dynamics, with investors focusing on essential tenants and niche opportunities like health care or medtail,” Beck added. “Ultimately, the net lease market’s resilience comes from its knack for striking the right balance between stability and opportunity. The sector offers investors a relative haven in uncertain times.”

NNN energy leases

It’s also worth looking at the rise of triple-net multifamily leases, according to Sean Doak, chief revenue officer at PearlX.

“While most often employed in mixed-use developments, NNN energy leases that provide multifamily properties with energy amenities like solar power have been on the rise in the sector as a solution to various problems, most notably as a creative source of capital in a constrained investment environment,” Doak said.

“With elevated interest rates, limited capital availability, rising construction costs and aggressive building code regulations, multifamily developers are having to think outside of the box to make projects financially viable.”

Through an NNN energy lease, multifamily developers can lower development costs, comply with stringent regulations and enhance cash flow after the property’s delivery, all while offloading the insurance, taxes and maintenance overhead onto the tenant—a key feature of what makes NNN leases attractive in the first place, Doak said.

However, not all net lease is the same, Dave Sobelman, founder & CEO of publicly traded REIT Generation Income Properties, told CPE.

“It would be important to disaggregate the data into more defined categories considering more specific outlooks,” Sobelman said.

“For instance, industrial has become a very popular asset class since the advent of the pandemic. However, the bulk of industrial transactions in today’s market are typically sale-leaseback transactions to non-investment grade tenants who require capital and can no longer borrow at rates accretive to their balance sheets. These transactions were few and far between before 2020.”

Additionally, he noted that late in 2024, overall net lease transaction volume may have increased slightly from 2023, but it is still at historically low levels, reflected in a Northmarq report.

“These low levels of transactions have not been seen since approximately 2009 to 2010, immediately after the GFC,” he added.

You must be logged in to post a comment.