Net Lease Cap Rates Continue to Rise

And why this trend is unlikely to slow down anytime soon, according to The Boulder Group’s latest report.

Prices for single-tenant net lease investment properties, as reflected by cap rates in the sector, edged down in the third quarter of 2024, according to The Boulder Group, a brokerage firm specializing in net lease deals. The overall rise in cap rates was small, however, up 3 basis points quarter-over-quarter, with the average cap rate coming in at 6.73 percent in the third quarter, compared with 6.7 percent in the second quarter.

All property types saw an uptick in cap rates, Boulder reported. Office sector net lease properties experienced the largest increase, at 8 basis points, with industrial up 5 basis points. Retail edged up 3 basis points for the quarter.

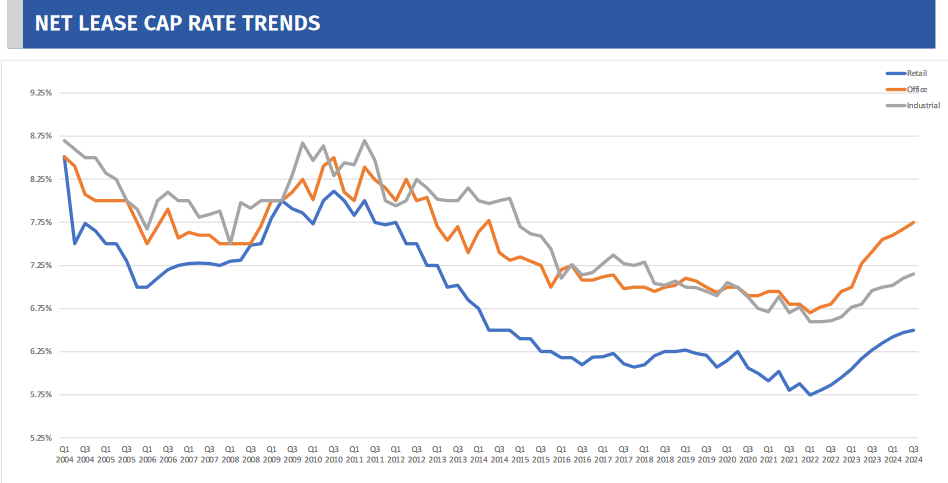

Cap rates have been rising consistently for net lease properties since mid-2022, or when interest rates began their rise. Cap rates still aren’t as high as they were in the aftermath of the Great Financial Crisis, but they have been headed that way.

Average cap rates for industrial net lease properties, for example, now stands at 7.15 percent. Back in 2010 and ’11, industrial cap rates peaked at about 8.75 percent.

“The Fed rate cut, while a good headline, has an impact largely limited to the institutional side of the business that uses short-term financing,” Boulder Group President Randy Blankstein told Commercial Property Executive.

“Most individual investors in the net lease sector borrow long-term based off the 10-year Treasury benchmark and that yield has moved higher over the last month, and thus the benefit from the Federal Funds Rate cut has been muted,” Blankstein said.

The expectation is that the fourth-quarter activity will be slightly better than the third for net lease, but still light on a historical basis, he noted.

“Once the election is over and the Federal Reserve’s future policy becomes clearer, many participants believe the stage will be set for a stronger volume in 2025 that will likely increase as next year progresses,” Blankstein said.

Besides higher interest rates, a surfeit of single-tenant net leased properties on the market is also putting upward pressure on net lease cap rates, according to the report. The supply of properties in the sector rose during the third quarter of 2024, up by 6 percent compared to the previous quarter.

Moreover, the company posits, the supply of net lease properties will grow as tenant expansion plans continue to move forward, and sellers add supply to the market for such reasons as the timing of loan or lease maturities, or tenant concentration issues.

READ ALSO: Unlocking the Sun Belt’s Retail Potential

While the market welcomed the recent half-point interest rate cut, those other factors will continue to put upward pressure on cap rates, Boulder noted.

“Furthermore, it is expected that the 1031 market will need two or three quarters of increased activity… to absorb supply in the net lease market,” the report stated. “It is important to note that historically, interest rate moves do not immediately correlate to net lease cap rates as a lag exists.”

Restaurants, Dollar stores all see cap rate increases

The report offers some relatively granular detail about the state of the net lease market. For instance, compared with the previous quarter, properties leased to specific restaurant chains generally ticked upward as well, though not always.

In the restaurant sector, Applebee’s properties saw a 15-basis-point increase, while IHOP properties experienced a 10-basis-point rise. Olive Garden properties, on the other hand, actually saw cap rate compression of 5 basis points for the quarter.

In the Dollar Store sector, properties associated with Family Dollar saw a 20-basis-point rise for the quarter, while Dollar General saw a 5-basis-point change.

Movement in the net lease drug store sector was even more pronounced, especially for Walgreens, with a 25-basis-point increase for the quarter. CVS saw a 10-basis-point increase, while Rite Aid properties saw no increase or decrease.

You must be logged in to post a comment.