New York City’s Recovery: Can History Help Estimate the Timeline?

A Newmark Knight Frank report takes a close look at inflections and recoveries in the city’s office sector during previous periods of decline.

New York City’s real estate sector has faced several unprecedented events since the turn of the century and has been seriously tested, especially in the past two decades. Following the Sept. 11 attacks and the Great Recession, the COVID-19 crisis has now taken a firm hold on the city, prompting drastic measures aimed at containing the effects of the outbreak.

Gov. Andrew Cuomo extended his March 20 New York State on PAUSE executive order to April 29. The order bans large gatherings of any size and directs all nonessential businesses to require employees to work from home, with state schools also remaining closed.

READ ALSO: Past Downturns Offer Perspective to Hospitality Sector

Although no one can say exactly how long it will take for the economy to rebound to precoronavirus levels after all restrictions are lifted, a new report from Newmark Knight Frank provides some insights on how things might unfold. NKF researchers analyzed how the 9/11 attacks and the 2008 global financial crash impacted New York City’s office sector, zeroing in on inflection and recovery periods in Manhattan, while also comparing these events to current circumstances, in an effort to estimate the extent of the pandemic’s effects and forecast a prospective recovery from the coronavirus downturn.

“Following 9/11, there were no restrictions to enter office buildings except those in the area, and there were no social distancing efforts. A major difference between the two prior downturns was that, while we reached a trough quicker following the financial crisis than following 9/11, the recovery lasted nearly twice as long,” Jonathan Mazur, senior managing director of research at NKF, told Commercial Property Executive.

Sept. 11 – Manhattan & Downtown

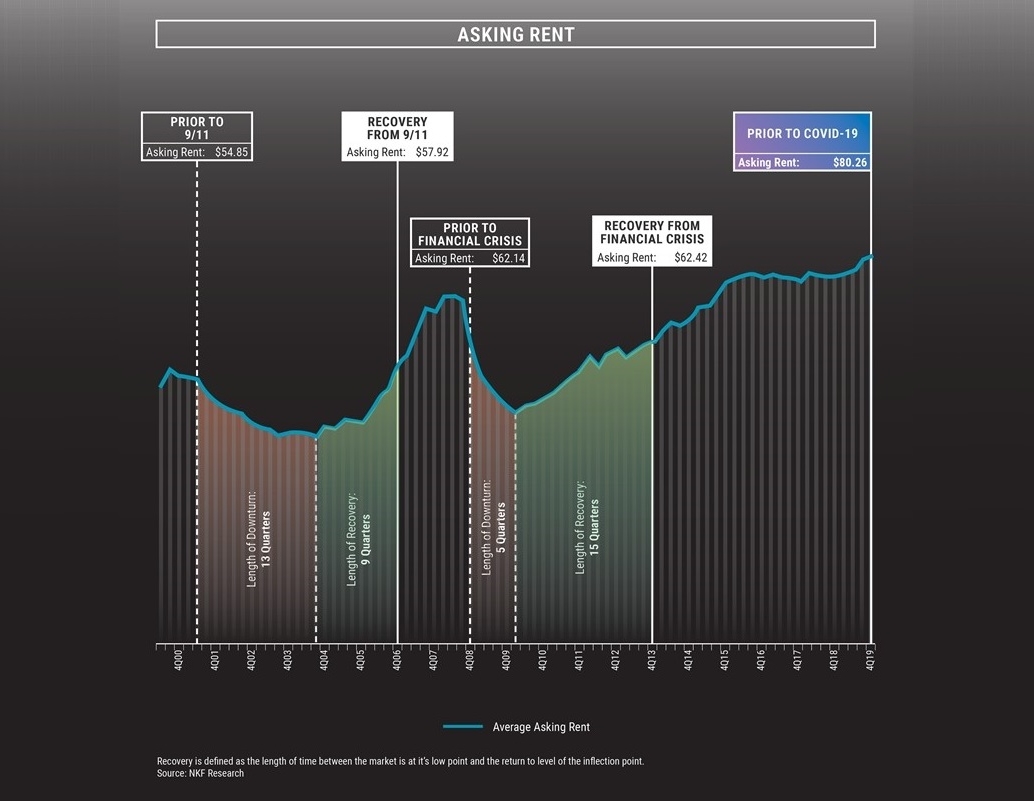

Recovery from inflection points; Manhattan asking rents. Chart courtesy of Newmark Knight Frank research

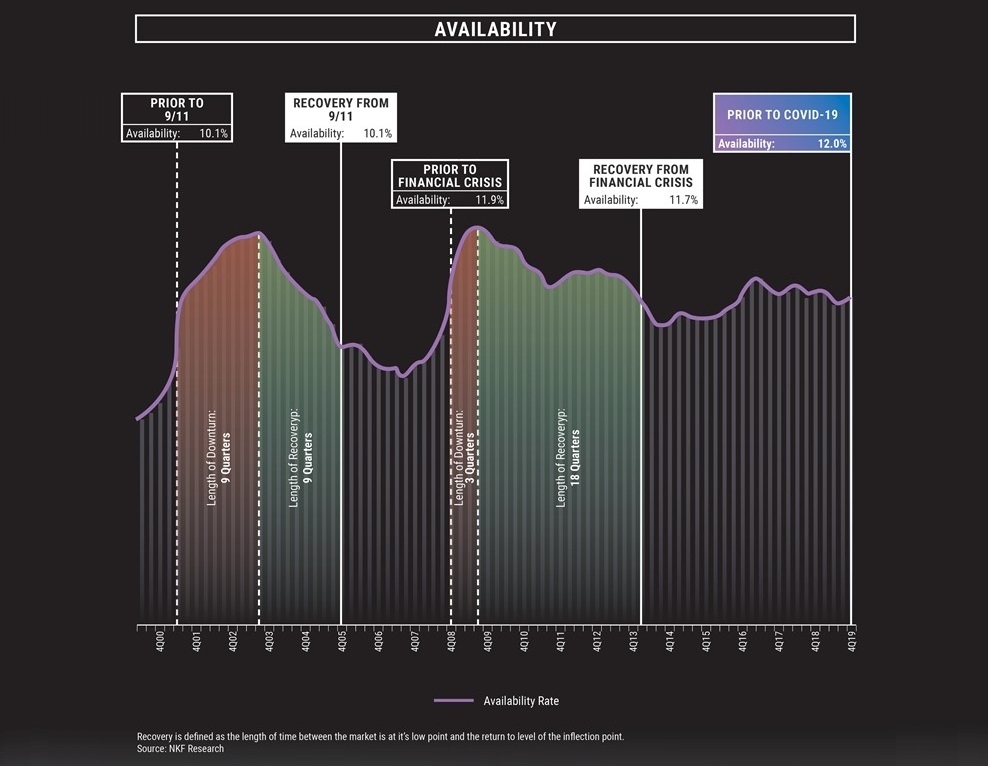

Growth had been moderating and effects of a potential slowdown were starting to show in downtown Manhattan’s office availability prior to the terrorist attacks, rising from 7.5 percent in Q2 2000 to 10.1 percent in the same period of 2001. Availability increased for four consecutive quarters following 9/11 and average asking rates fell for three consecutive years after Q3 2001. In addition, leasing velocity decelerated from 2002 through 2005, averaging 3.5 million square feet.

Overall, Manhattan made a quicker recovery than downtown Manhattan alone, as availability levels bounced back in approximately three years, while rents picked up in five years. Availability in downtown Manhattan took five years to recover and dip below 16 percent, while average asking rates returned to pre-9/11 levels only in Q1 2007. Leasing started to gain momentum after 2005, exceeding 5 million square feet in 2006.

The Great Recession – Manhattan & Midtown

Recovery from inflection points; Manhattan availability. Chart courtesy of Newmark Knight Frank research

Availability in Midtown stood at 9.6 percent in Q3 2008, and as the global financial crisis hit Manhattan, availability levels in the submarket surged in just one year, jumping 45.8 percent from Q3 2008 to Q3 2009. Midtown average asking rates were at $74.58 per square foot in Q4 2008, and, while rents bounced back and even surpassed prior levels by the time the market recovered, availability has yet to fall below 10 percent in the 11+ years since the crash.

Overall Manhattan availability stood at 11.9 percent in Q4 2008—the downturn lasted three quarters in terms of availability levels, while recovery took 18 quarters, with availability reaching 11.7 percent in Q1 2014. Asking rates in Manhattan peaked in 2008 at $71.26 per square foot and fell by as much as 32.6 percent in Q3 2008, taking seven years to get to that level again.

Between 2003 and 2007, lease renewals amounted to 16.6 million square feet. Following the financial crisis, landlords focused on retaining tenants by offering lower rents, while tenants looked for stability and took advantage of these incentives. As a result, lease renewals spiked, totaling 29.2 million square feet in the five years following the crash.

COVID-19

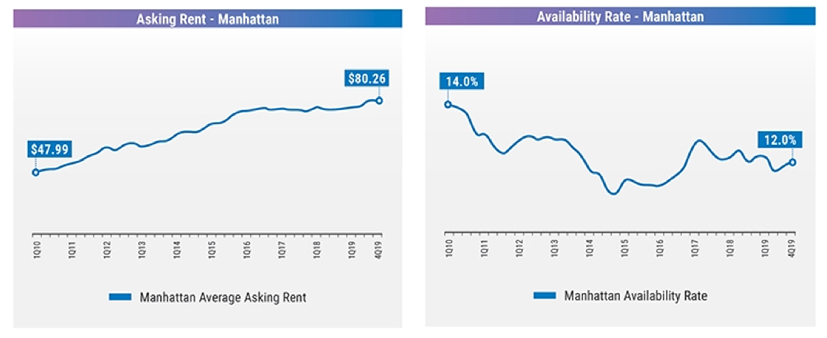

When the 2008 global financial crisis occurred, the market was performing well and was, perhaps, a little bit overheated. Most real estate players had a similar market sentiment before the current health crisis took over U.S. metros. “As we entered the corona period, we were coming off two spectacular leasing years, with 2019 topping 50 million square feet for relocations and renewals. Rents were still establishing peaks, albeit 10 years into a cycle,” Mazur said about the New York City market.

Manhattan asking rents and availability prior to COVID-19. Charts courtesy of Newmark Knight Frank research

In terms of what to expect going forward, Mazur believes that “absent of some magic antidote,” a correction in fundamental market statistics—one we haven’t seen before—is to be expected, as this is clearly another inflection point. Prior to COVID-19, availability was already increasing and was due to rise over the coming years, as new projects delivered and tenants relocated. However, with all nonessential construction halted in New York City, some of that negative absorption may not occur right away.

“I imagine there will be a wave of sublease space hitting the market at some point. Available sublease space doubled in a year following the financial crisis, tripled following 9/11 and we are likely to see a similar impact. With the additional inventory delivered over the past few years, maybe a new, higher norm for availability might be a reality, as we never did reach the same low availability point we did prior to the financial crisis,” Mazur explained.

You must be logged in to post a comment.