North America Construction Trends: RLB Reports

Taken together, the Rider Levett Bucknall Quarterly Construction Cost Report (QCR) and Crane Index provide an overall look at the state of the North American construction industry.

By Gail Kalinoski

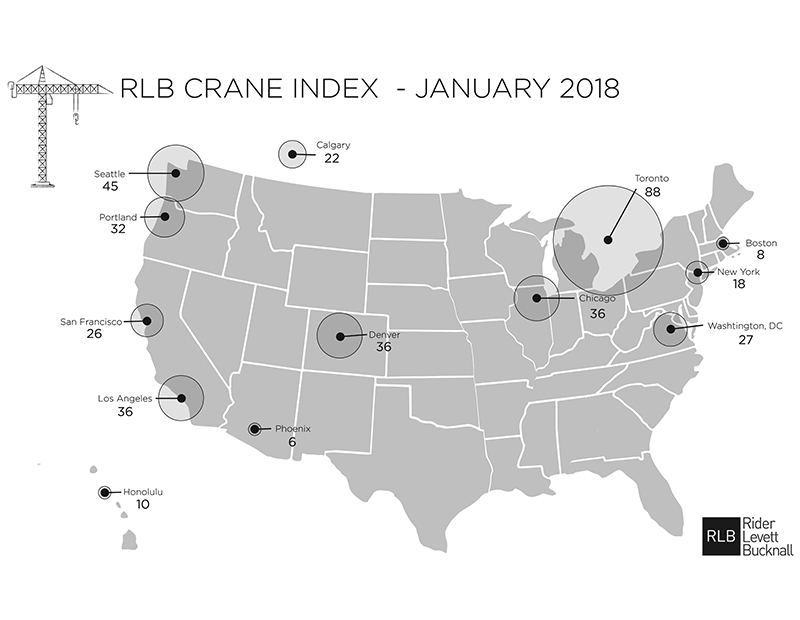

Two reports issued by Rider Levett Bucknall, an international property and construction consultancy, show construction activity is strong across North America, with the West Coast seeing a high crane count and construction costs up about 1 percent on average. Other cities where cranes are dominating the skylines are Denver, Chicago, Washington, D.C. and New York in the United States and Toronto and Calgary in Canada.

Taken together, the Quarterly Construction Cost Report (QCR) and Crane Index provide an overall look at the state of the North American construction industry. “Our outlook for the industry through the end of the year remains positive,” Julian Anderson, president of RLB North America and chairman of its Global Board, said in a prepared statement.

Between July 1, 2017, and Oct. 1, 2017, the national average increase in construction costs was approximately 1 percent while the Crane Index found 383 cranes counted in January 2018 compared to 381 in July for an increase of 0.5 percent, according to RLB research.

Six of the 13 cities in the Crane Index held steady from July while five had an increase in cranes and two had fewer cranes. At nearly 40 percent of the total crane count, the residential market dominates sector activity with Toronto leading the pack with 70 of its 88 cranes dedicated to high-rise condominium projects. Mixed-use development is the second largest market, making up nearly 25 percent of all cranes in North America with Los Angeles, Seattle, Portland and Washington, D.C., leading that sector, according to the Crane Index.

Commercial projects make up 13 percent of the crane count with San Francisco the most active city in this sector. San Francisco saw an 18 percent increase in its crane count and a 7.63 percent hike in construction costs. The report notes that San Francisco’s construction activity is being driven mostly by the growth in the tech industry spurring development in commercial, office and mixed-use/residential projects. The South of Market (SoMa) area is particularly busy, with close to double the number of cranes (26) compared to the July 2017 index. Five new crane applications have been filed since May 2017 so the construction activity is not expected to abate.

At 45, Seattle has the highest number of cranes in the sky along the West Coast. While that is still a strong number, the Crane Index notes it’s the first time the city’s crane count has dropped below 50 for the first time since 2015. However, the report also notes that as soon as cranes come down new ones rise quickly to take their place along the skyline and many projects are planned for 2018. Developers will have to contend with a 5.21 percent increase in construction costs. Mixed-use development comprises a third of the crane count followed by residential, education, commercial, healthcare, hospitality and transportation.

Los Angles has the second highest crane count along the West Coast at 36, matching the number of cranes in Denver and Chicago. Portland follows with 32. Elsewhere in the U.S., Washington, D.C., had 27 cranes; New York City, 18; Honolulu, 10; Boston, 8, and Phoenix, 6. In Canada, Toronto led that country as well as North America with 88 cranes, followed by Calgary with 22.

Toronto had the highest crane count of all the cities surveyed for the second consecutive reporting period. In addition to residential, the city is seeing many mixed-use and commercial developments. The boom is expected to continue as the report notes more than 400 high-rise projects have been proposed and spending in infrastructure should trigger additional construction.

Eying Construction Costs

The QCR report for Canada stated construction costs rose about 1.42 percent in Toronto and dropped about 0.85 percent in Calgary.

In the U.S., San Francisco had the highest boost in construction costs at 7.63 percent followed by Los Angeles with an increase of 7.08 percent and Portland with 5.76 percent. Honolulu was the only city surveyed to see construction costs decrease, down 0.51 percent.

Anderson points to the tight labor market as a key ingredient in the increases in construction costs. He notes that those labor shortages have been exacerbated by the hurricanes in Texas and the Caribbean along with the wildfires throughout California. Costs of construction materials like gypsum board and lumber are also up and will only increase as builders and developers wait on insurance claims and federal emergency relief funds to be paid out.

Images courtesy of Rider Levett Bucknall

You must be logged in to post a comment.