NYC Sees Strong RE Investment, Leasing Activity

New York City holds strong to its reputation as the world’s largest real estate investment market.

By Amalia Otet, Yardi Marketing Writer

New York City holds strong to its reputation as the world’s largest real estate investment market. According to a recent report from Cushman & Wakefield, New York has seen volumes growing 10.9 percent on an annual basis to $55.4bn, landing the city in the top spot for property investments for the fourth consecutive year. With a 40.5 percent increase in investment activity, second-placed London remains however a favored destination for cross-border investors. Third-placed Tokyo has witnessed investment volumes grow a whopping 30.4 percent to $35.5bn.

NYC RE Sales Highlights

With 2014 coming to an end, we thought it would be instructive to look back at this year’s real estate market activity and pinpoint some of the hottest deals NYC has seen so far. In one of the largest transactions of the year, Hilton Worldwide sold the Waldorf Astoria New York to Beijing-based Anbang Insurance Group for a cool $1.95 billion. But we have several other contenders for the “hottest deal” title, each responsible for driving a considerable amount of capital to the commercial real estate sector.

Here are NYC’s ten biggest deals of 2014, according to research data from PropertyShark:

|

No. |

Property Location |

Borough |

Sale Price |

Sale Date |

Buyer |

Seller |

Property Type |

|

1 |

Manhattan |

$3,330,132,711 |

Jun |

St-Dil LLC |

St Owner Lp |

Apartment building |

|

|

2 |

Manhattan |

$1,310,000,000 |

Jan |

Columbus Office, LLC |

Time Warner Realty, Inc |

Commercial Condo Unit |

|

|

3 |

Manhattan |

$1,110,044,237 |

Jun |

Pcv St-Dil LLC |

Pcv St Owner Lp |

Apartment building |

|

|

4 |

Manhattan |

$585,000,000 |

Sep |

Mip One Wall Street Acquisition LLC |

The Bank Of New York Mellon |

Office Building |

|

|

5 |

Manhattan |

$545,750,000 |

May |

450 Property Owner (Us) , LLC |

450 Park Avenue LLC |

Office Building |

|

|

6 |

Manhattan |

$502,000,000 |

Aug |

Rar2 – 222 Broadway Owner Spe, LLC |

222 Broadway Owner LLC |

Commercial Real Estate |

|

|

7 |

Manhattan |

$460,000,000 |

Jun |

685 Fifth Avenue Owner LLC |

Gucci America, Inc. |

Office Building |

|

|

8 |

Manhattan |

$395,000,000 |

Sep |

Cf E 86 LLC Lsg E 86 LLC Sm E 86 LLC |

Yorkshire Towers Company Lp |

Apartment building |

|

|

9 |

Manhattan |

$368,571,303 |

Aug |

Ph New York L L C |

Extell West 57TH Street LLC |

Commercial Real Estate |

|

|

10 |

|

Manhattan |

$335,000,000 |

Aug |

Arc Ny24549W17, LLC |

245 West 17TH Street Property Investors Ii, LLC 249 West 17TH Street Property Investors Ii, LLC West 17TH Street Property Investors Ii, LLC |

Office Building |

Booming Tech Industry Spurs Growth Across All RE Sectors

The confluence of a number of key factors – including New York City’s growing technology industry, consistent demographic growth, and a significant increase in household income – has resulted in a thriving real estate sector.

Major tech players such as Google, Facebook, Yelp, and Dropbox continue to expand their corporate presence in the city, reducing the numbers of office properties lying vacant and driving local employment numbers up. Other digital services start-ups and e-commerce businesses are starting to migrate to NYC, seeking to take advantage of the favorable market conditions and the talented work pool. Etsy, the online handmade and vintage goods marketplace, is one of them. This burgeoning company inked a deal to lease 200,000 square feet at the forthcoming Dumbo Heights tech campus in Brooklyn while bringing new jobs to the NYC market.

“From relatively humble roots in an apartment in Fort Greene, we’ve become one of New York City’s largest homegrown tech employers”, Etsy said in a post on its blog. “We currently have more than 350 employees in Brooklyn, and our new space will allow us to grow our local staff by more than 300 people in the next five years. It will be LEED-certified and support our bike-to-work program, enabling us to continue our efforts to reduce Etsy’s environmental footprint. We’ll remain firmly planted in Brooklyn, where so many independent, creative businesses are flourishing. We’ll continue to influence and be influenced by the mix of industries here, from media to fashion to a burgeoning manufacturing renaissance.”

NYC M-F Market Maintains Positive Momentum

The growing economy and booming tech sector have generated an increased demand for city living, as many of the young professionals staffing the tech companies are predominantly urban-minded.

Both the Gen Y (Millennials) and Baby Boomer generations are now showing interest in sustainable locations where mass transit and lifestyle-oriented amenities are readily available and accessible. They seek convenience in their housing choices and prefer living in high-density, mixed-use neighborhoods within close proximity to jobs, shopping and dining destinations.

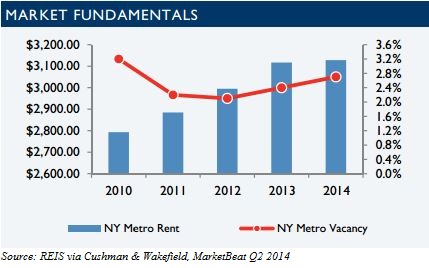

The influx of new residents into the city has pushed apartment vacancy rates to less than 3 percent which is well below the national and northeast levels for the second quarter of 2014. While the average monthly rate for a one-bedroom apartment unit is approximately $2,931 in New York City, asking rents in the Upper West Side average $4,617, making it one of the costliest submarkets in the city. On the other end of the affordability index stands Bronx County, where rents range around $1,175.

Amalia Otet is an online content developer and creative writer for RENTCafé, a full marketing and leasing platform featuring social media and reputation management tools, plus online leasing solutions, rent payments and maintenance requests.

You must be logged in to post a comment.