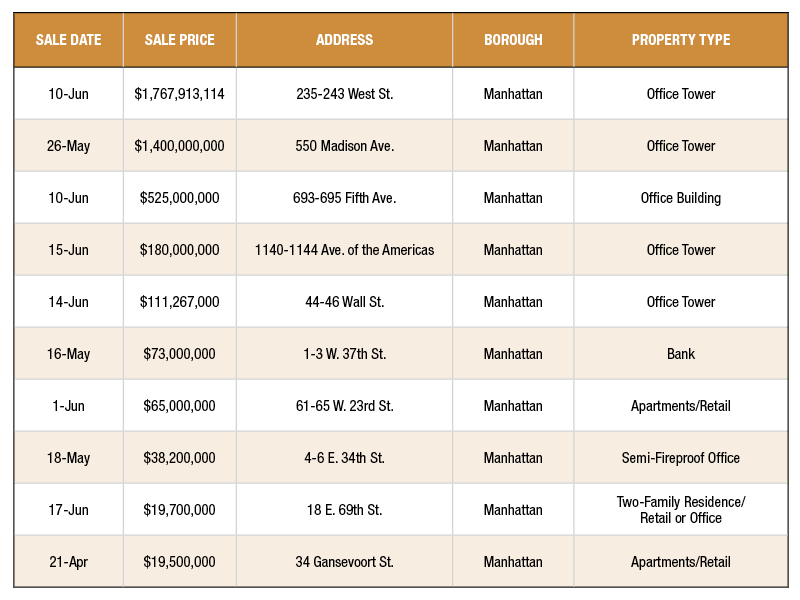

Top 10 NYC Commercial Property Sales Recorded in June 2016

The data is in and we’ve compiled the list of the priciest commercial property deals recorded in New York City in June. Keep reading to find out which borough claimed all ten spots and which property types were most popular. 1. 235-243 West Street, Manhattan Sales Price: $1,767,913,114 Located by Pier 26 in ultra-prime…

The data is in and we’ve compiled the list of the priciest commercial property deals recorded in New York City in June. Keep reading to find out which borough claimed all ten spots and which property types were most popular.

1. 235-243 West Street, Manhattan

Sales Price: $1,767,913,114

Located by Pier 26 in ultra-prime Tribeca, this NYC office building is surrounded by incredible restaurants. The property contains 4 commercial units on a 90,004 sq. ft. lot.

2. 550 Madison Avenue, Manhattan

Sales Price: $1,400,000,000

This 37-story tower was previously known as the Sony Tower and AT&T Tower. The sellers, the Chetrit Group, had planned to redevelop this building to include 96 luxury condominiums with prices running up to $150M per unit. That plan was cancelled earlier in 2016.

3. 693-695 5 Avenue, Manhattan

Sales Price: $525,000,000

This Central Midtown office building was formerly owned by Thor Equities after an intense bidding war among NYC’s top real estate players in 2010. It is a stylish building sporting a glass front on New York’s Fifth Avenue.

4. 1140-1144 Avenue of the Americas, Manhattan

Sales Price: $180,000,000

Housing 84 commercial units, this Central Midtown office building boasts an incredible location. It was acquired by the American Realty Capital New York City REIT and it adds 22 stories and a quarter of a million square feet of rentable space to the REIT’s portfolio.

5. 44-46 Wall Street, Manhattan

Sales Price: $111,267,000

This Financial District office building with 280,000 square feet of space reportedly sold to Blackstone as part of a $2.7B portfolio purchase which included properties in at least 4 countries. Although the transaction faced several legal challenges due to complications among previous owner-partners, the property is now reported as having been transferred for almost double the $65M Kent Swig paid for it in 2004.

6. 1-3 West 37 Street, Manhattan

Sales Price: $73,000,000

This is a historic Garment District bank building featuring 11 floors and boasting the maximum Walk Score of 100. This property has 9 commercial units.

7. 61-65 West 23 Street, Manhattan

Sales Price: $65,000,000

This mixed use Flatiron building reportedly sold to a group of private investors after having been off market for 5 decades. The 7-story building hosts 8 commercial units, retail on the ground floor, and residential apartments above. The building is said to be the leased home of <f>intech firm Betterment. It is located in the heart of “Silicon Alley” which has been buzzing with new TAMI firms as well as trendy health clubs.

8. 4-6 East 34 Street, Manhattan

Sales Price: $38,200,000

In total, the new buyers Leo Tsimmer and the Caerus Group reportedly paid as much as $80M for this parcel including additional air rights from neighboring buildings. The new owner had expressed a desire to transition the NoMad office and retail building into condos. After waiting 17 months to actually close on the transaction due to legal troubles with a previous tenant it is unclear how the property will be repositioned now.

9. 18 East 69 Street, Manhattan

Sales Price: $19,700,000

Described by Sotheby’s as being on the best block on the Upper East Side, this stunning Lenox Hill mixed-use property combines 2 residential units and one commercial unit. 6sqft reveals a peek inside at the Chanel inspired interior design which led to it originally being listed for $26M in 2015.

10. 34 Ganeswoort Street, Manhattan

Sales Price: $19,500,000

This West Village mixed use property is zoned for retail on the ground floor and apartments above. It sold for more than double the price it was acquired for by the Sitt family less than 10 years ago.

You must be logged in to post a comment.