October Issue: Finance & Investment—Builders’ Bonanza

Lenders reveal why they love net-lease construction.

By Poonkulali Thangavelu, Contributing Writer

Fueled by the broader economic comeback and readily available financing, net-lease construction activity has picked up considerably in recent years. “Generally speaking, we’ve seen a good level of new construction activity on all fronts,” said Jeff Hughes, a managing director at Tulsa, Okla.-based Stan Johnson Co. “With the capital markets dislocation that occurred in 2008, we saw corporate America really hit the brakes on new construction. They held off on many strategic moves. “But as we’ve weathered that storm, the last few years we’ve seen a substantial pickup in new construction in the single-tenant space.”

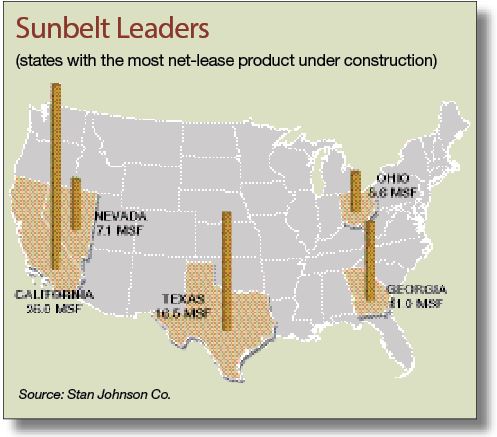

To underscore Hughes’ point, more than 40 million square feet of single-tenant retail, industrial and office space  was delivered nationwide during the second quarter, according to Stan Johnson Co. research. The Southeast accounted for 11 million square feet of the total, led by 7.8 million square feet of industrial product. Four out of the five states with the most net-lease inventory under construction are in the Sunbelt: California, Nevada, Texas and Georgia.

was delivered nationwide during the second quarter, according to Stan Johnson Co. research. The Southeast accounted for 11 million square feet of the total, led by 7.8 million square feet of industrial product. Four out of the five states with the most net-lease inventory under construction are in the Sunbelt: California, Nevada, Texas and Georgia.

The rest of the country is represented only by Ohio, with its 5.6 million-square-foot construction.

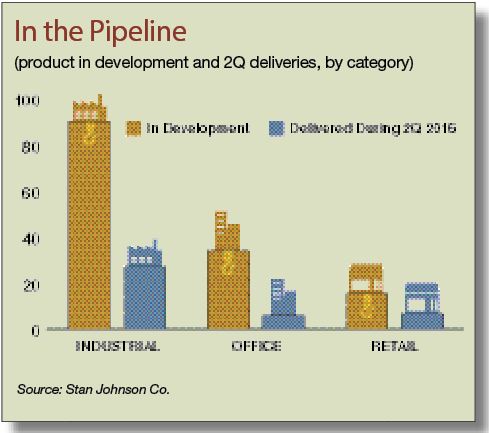

In comparison to the 2005-2008 market peak, construction activity in the current cycle tends to be less speculative. Also of note, industrial development is well ahead of the office and retail sectors. At midyear, 90.3 million square feet of net-lease industrial space was under construction, nearly twice as much as the combined total of single-tenant office (34.3 million) and retail projects (15.5 million).

“Online retailers as a whole are driving a lot of construction within the net-lease industrial sector,” observed Randy Blankstein, president of Northbrook, Ill.-based Boulder Group. This trend coincides with the much-discussed needs of Amazon and other online retailers for a vast quantity of distribution space. Earlier this year, for example, Amazon opened a 1 million-square-foot fulfillment center in Kenosha, Wis. Such facilities are in greatest demand to serve densely populated downtown areas, Blankstein pointed out.

Lenders Leap In

Fueling the current wave of net-lease development is the availability of funding from a variety of sources. The attractive characteristics of the single-tenant space, such as the bond-like income stream flowing from long-term leases, provides strong incentives for lenders. “If the tenant is considered investment-grade, and the term of the lease is 10 years and above, there is plenty of construction financing at very attractive pricing,” explained Jonathan Hipp, president & CEO of Herndon, Va.-based Calkain Cos. “Not to say that there is no financing available for non-credit tenants. It’s just a limited number of lenders.” The list of favored tenants includes those with credit ratings of BBB or higher.

Fueling the current wave of net-lease development is the availability of funding from a variety of sources. The attractive characteristics of the single-tenant space, such as the bond-like income stream flowing from long-term leases, provides strong incentives for lenders. “If the tenant is considered investment-grade, and the term of the lease is 10 years and above, there is plenty of construction financing at very attractive pricing,” explained Jonathan Hipp, president & CEO of Herndon, Va.-based Calkain Cos. “Not to say that there is no financing available for non-credit tenants. It’s just a limited number of lenders.” The list of favored tenants includes those with credit ratings of BBB or higher.

Lenders lining up to supply capital include local, regional and national banks, as well as insurance companies. Mezzanine financing is also available from private equity sources and institutional investors. “We see developers use that source of capital pretty frequently,” Hughes reported. “It is a decent way to bridge the gap between construction debt that’s available and the total project cost. It’s a growing slice of the capital stack.” Financing in the 70 to 80 percent loan-to-cost range is available, with interest rates around 3 percent. Mezzanine financing can further improve that leverage.

Flexibility carries weight with lenders, too. “It has to be multi-use, a box like a Dollar General, for example,” explained Farhan Kabani, a vice president at Mark One Capital, a Dallas-based Marcus & Milllichap affiliate. “It’s just a box and you can easily convert it” in case the tenant bows out during construction. “I would say that those are probably more attractive to lenders than, say, a specialized restaurant or gas station.”

Tenants Take the Wheel

As the market shifts towards in favor of tenants, they have more leverage. While triple-net terms are still standard, leases are more likely to offer tenants more flexibility. As a result, tenants can often negotiate commitments of 10 or 15 years, rather than 20 years. Annual rent escalations are more modest, as well—1 to 1.5 percent, down from 2 percent. In particular, large credit tenants have the muscle to negotiate flatter leases.

Cap rate compression has also influenced the single-tenant sector for several years. Retail cap rates averaged about 6 percent in the second quarter, according to Stan Johnson Co. Compression, in turn, has boosted property values.

If—or when—the Federal Reserve starts raising interest rates, the increases will probably be priced into cap rates as well. Even then, market participants expect that supply-demand dynamics will continue to attract financing to net-lease properties. This means that a hike in interest rates may not immediately nudge net-lease cap rates upwards, as investors could be willing to trade more moderate returns for continued exposure in this high-performance niche.

You must be logged in to post a comment.