Are Core Returns Headed to Zero?

Within the next two years, the downshift in the commingled funds index could put some institutional investors at risk, says CenterSquare's Scott Crowe.

By Scott Crowe

Scott Crowe

We believe it is likely over the next two years that core real estate returns—represented by the index of real estate funds known as ODCE, the NCREIF Open End Diversified Core Equity Index—will approach a zero percent total return. This has tremendous consequences for institutional real estate investors who risk having the majority of their real estate allocations stranded at no return.

Our prediction is based upon on three factors. First, the fundamental backdrop of low cap rates, decelerating NOI growth and rising interest rates makes higher cap rates a near-forgone conclusion in our view. Second, the REIT market, with trading volume that represents the equivalent of all U.S. commercial real estate transactions and has a demonstrable track record of predicting the direction of private real estate values, continues to send a clear signal that cap rates will rise in 2019. Third, we find that ODCE fund flows are a reliable leading indicator of ODCE returns, and the direction of these flows is unambiguously down (and could turn negative). These factors lead us to the uncomfortable conclusion that core real estate cap rates will rise, which will likely offset any NOI growth and return from yield and lead to net returns from ODCE funds approaching zero over the next one to two years.

The starting point for real estate values is vulnerable, with ODCE cap rates at record lows below 5 percent and bond yields rising, which is leading to significant erosion of yield spreads. In fact, cap rate spreads to bonds are now about 45 basis points below their long-term average, according to Bloomberg, Nareit and CenterSquare implied cap rate research as of Sept. 30, 2018. (REIT Implied cap rates are generated by a proprietary calculation that divides a company’s reported NOI adjusted for non-recurring items by the value of its equity and debt less the value of non-income producing assets.)

What makes this cycle unique

This phenomenon is exacerbated by a steady build of new supply that has accelerated with the aging economic cycle. In fact, a unique feature of this cycle is that the “supply-constrained” gateway markets are those with the most cranes as a direct result of 1) capital flooding into the safety of these markets following the global financial crisis and driving up real estate values, 2) low interest rates leading to low development yield hurdles and 3) the superior willingness of debt providers to facilitate development capital in these cities versus other markets.

The punchline of the late-cycle increase in supply is that NOI growth for real estate owners has meaningfully decelerated even as the economy has accelerated. For instance, REIT same-store NOI peaked at approximately 5 percent in 2016 and has decelerated to less than 3 percent today, according to Nareit. This lack of income growth makes core real estate values particularly susceptible to higher interest rates given the starting point of low initial cap rates.

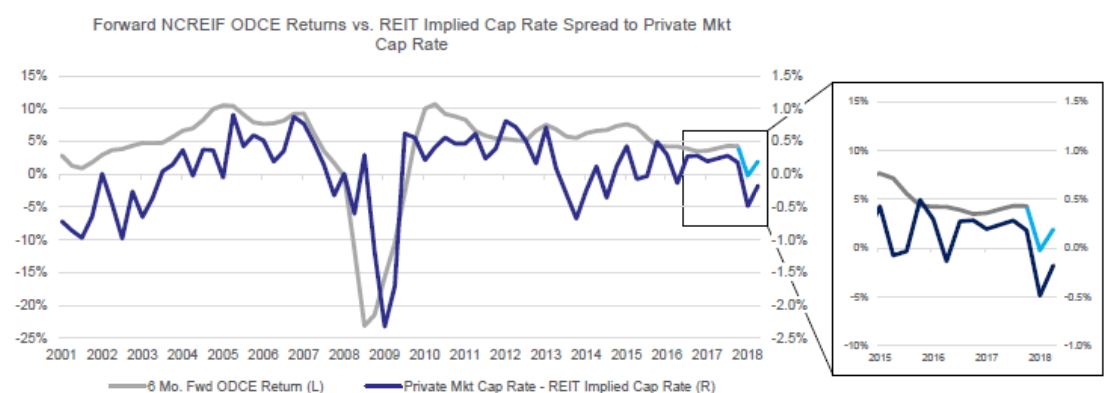

The second part of our argument is based on our experience that the REIT market has been a reliable predictor of the direction of future real estate values. In fact, we see a strong relationship between REIT implied cap rates and forward private real estate returns, and the current spread between REIT implied cap rates and private market cap rates suggests forward returns for the private market could decelerate to less than 5 percent per year, according to CenterSquare proprietary REIT research. Although REIT market signals can include noise from short-term volatility, the data shows that when the REIT market delivers a consistent signal for real estate values, it is usually correct.

Note: Light blue data reflects CenterSquare’s prediction. All implied cap rate data presented above is based on financials reported by companies within CenterSquare’s REIT coverage universe during August 2018. Sources: CenterSquare Investment Management, NCREIF ODCE Index, REIT Company reports.

What fund flows tell us

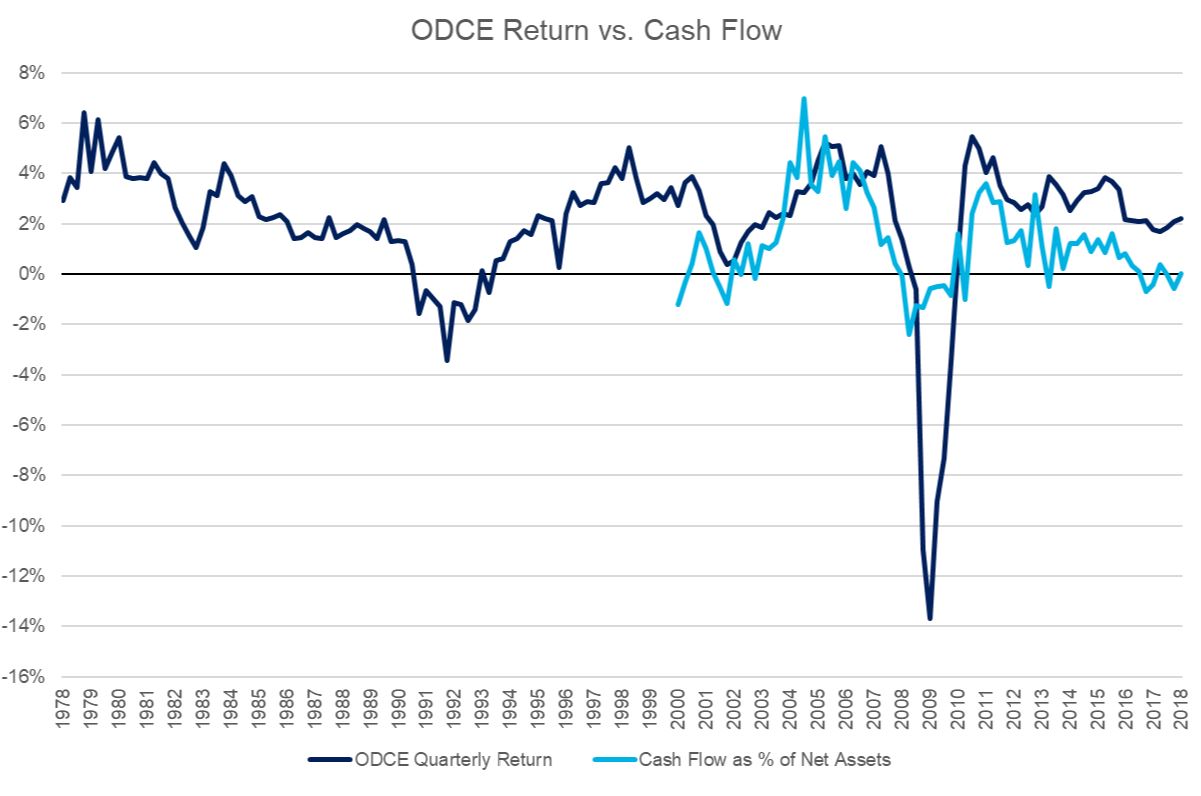

Our final point is that an analysis of historical fund flows into and out of ODCE funds has proven a reliable leading indicator of future ODCE returns.

Note: Data current as of September 2018. Cash flow refers to net inflows into the constituents of the NCREIF Open End Diversified Core Equity Index as a percentage of the index net assets. Source: NCREIF.

The trend of current flows to ODCE funds is clearly decelerating. Anecdotally, we have seen many large investors de-weighting to core real estate in favor of value-add, debt and niche strategies including REITs (which have already priced in cap rate shift and hence present a potentially more attractive means to access core real estate at this point in the cycle). Hence, we would be very surprised if flows to ODCE funds do not turn negative in 2019, heralding a markdown in asset values for these funds.

If our prognosis is correct, most of the “risk” for real estate investors at this point in the cycle may actually be in core real estate. This situation is counterintuitive for many investors who are used to core real estate being a safe haven, particularly later in the cycle. Therefore, it leaves investors with an interesting allocation challenge and an incentive to consider more non-core real estate options, like value-add, niche sectors, REITs, real estate debt and even infrastructure. While this may be a sensible approach to generate return, the implementation of each necessitates a unique approach to mitigate late-cycle risk.

Scott Crowe is the chief investment strategist of CenterSquare. The statements and conclusions made in this presentation are not guarantees and are merely the opinion of CenterSquare and its employees. Any statements and opinions expressed are as of the date of publication, are subject to change as economic and market conditions dictate, and do not necessarily represent the views of CenterSquare.

You must be logged in to post a comment.