Office Shows Biggest Uptick in CMBS Special Servicing

The rate for this asset category just hit a peak that it hasn’t reached since 2017.

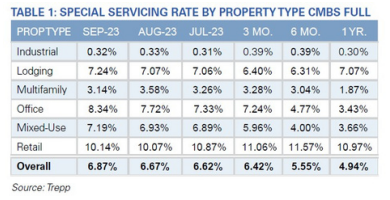

The Trepp U.S. CMBS Special Servicing Rate has hit 6.87 percent, having increased by 20 basis points in September, after rising steadily every month this year, Trepp has reported.

This consistent uptrend followed a dip of six basis points, to 5.11 percent, at the start of this year.

For better context, the special servicing rate (combined CMBS 1.0 and 2.0+) one year ago was 4.94 percent.

Among the various property types, office saw the largest respective increase, of 62 basis points, to 8.34 percent, marking the first time the office special servicing rate has topped 8 percent since May 2017.

READ ALSO: When Will CRE Investment Stabilize?

Not surprisingly, retail has the highest overall special servicing rate, 10.14 percent, having risen by 8 basis points in September.

The rate for mixed-use properties rose by 26 basis points, to 7.19 percent, and the industrial rate was a minuscule 0.32 percent, unchanged from the previous month.

Latest transfers

The dollar value of loans transferred to special servicers in September totaled $2.41 billion. Of this, office properties represented 54.0 percent and retail properties accounted for 12.9 percent.

The $350 million 1407 Broadway loan was the largest for an office asset to enter special serving in September. Image courtesy of CommercialEdge

The second-largest loan to transfer in September was for 1407 Broadway, due to payment default. (The largest was a $400-million-plus loan in the hospitality sector.)

The $350 million 1407 Broadway loan backs the single-asset BBCMS 2019-BWAY deal, whose collateral is a 1.1 million-square-foot office building near Times Square in Manhattan. Trepp’s report comments that “the transfer does not appear to be the relatively benign transfer that usually surrounds negotiations over an embedded extension option.” Instead, the September special servicer comments reference the borrower’s ‘inability to pay monthly debt service.’

You must be logged in to post a comment.