Office Conversions Off to a Slow Start

While expected to ease the housing shortage, this trend has mostly produced luxury units in one region, according to the latest CommercialEdge report.

The pandemic acted as a catalyst for different real estate trends, one of them being office-to-multifamily conversions. Experts believed this adaptive reuse movement to be a viable solution for decreasing office demand and housing shortages. More than two years later, these types of conversions proved to be difficult thanks to logistical challenges and other factors, resulting in high-end apartments condensed on the East Coast where developable land is scarce, the latest CommercialEdge office report shows.

The pandemic acted as a catalyst for different real estate trends, one of them being office-to-multifamily conversions. Experts believed this adaptive reuse movement to be a viable solution for decreasing office demand and housing shortages. More than two years later, these types of conversions proved to be difficult thanks to logistical challenges and other factors, resulting in high-end apartments condensed on the East Coast where developable land is scarce, the latest CommercialEdge office report shows.

READ ALSO: Adaptive Reuse or New Construction?

The office-using sector added 100,000 new jobs in June and nearly 1.6 million jobs year-to-date, increasing by 4.8 percent year-over-year. Some of the slower markets were Washington, D.C. (1.0 percent growth year-over-year), Phoenix (1.2 percent), Pittsburgh (1.6 percent) and the Twin Cities (2.2 percent), alongside gateway markets such as New York and the Bay Area.

Some 151.7 million square feet of office space was under construction across the nation at the end of June, accounting for 2.2 percent of total stock, according to CommercialEdge data. Only some 26.5 million square feet of office space broke ground in 2022. The bulk was concentrated in Sun Belt markets, with Dallas (3.8 million square feet) and Austin (2.7 million square feet) leading the way in this aspect, followed by Charlotte (2 million square feet) and Phoenix (1.1 million square feet).

Gateway markets: highs and lows

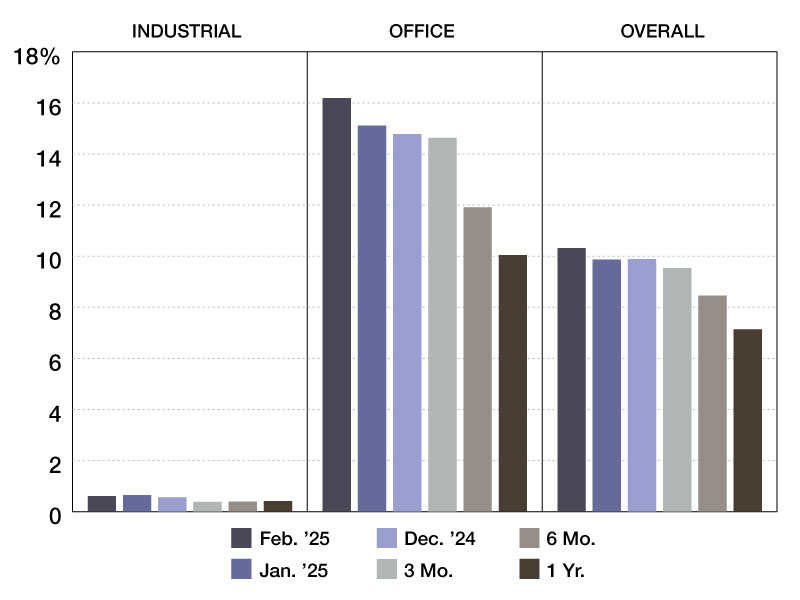

National average full-service equivalent listing rates averaged $37.58 per square foot at the end of June, decreasing by 260 basis points year-over-year. Meanwhile, the national office vacancy rate stood at 15.2 percent in June, 20 basis points higher on a year-over-year basis and 20 basis points lower month-over-month.

While most gateway markets continue to struggle with office vacancies above the 10 percent mark, Boston was the only large market to keep its rate in the single digits throughout most of the pandemic, CommercialEdge data shows. Average listing rates in the market reached $39.31 per square foot at the end of June, accounting for a 12 percent growth year-over-year. This was attributed to new space coming to the market combined with high levels of positive absorption, as well a booming life sciences sector.

Despite posting some of the highest listing rates across the nation, gateway markets continued to struggle with high office vacancies: in San Francisco, office vacancy was 17.4 percent, up 260 basis points year-over-year; in Manhattan, vacancy increased by 320 basis points on a year-over-year basis, reaching 13.9 percent in June. Miami, on the other hand, had a vacancy rate of 12.9 percent, following a 200 basis-point decrease year-over-year.

You must be logged in to post a comment.