Office Leasing to Recover by 2025, Cushman & Wakefield Report Predicts

The study expects office sector recovery to be slow, but employment will eventually help spur improvements in absorption, vacancy and rental rates.

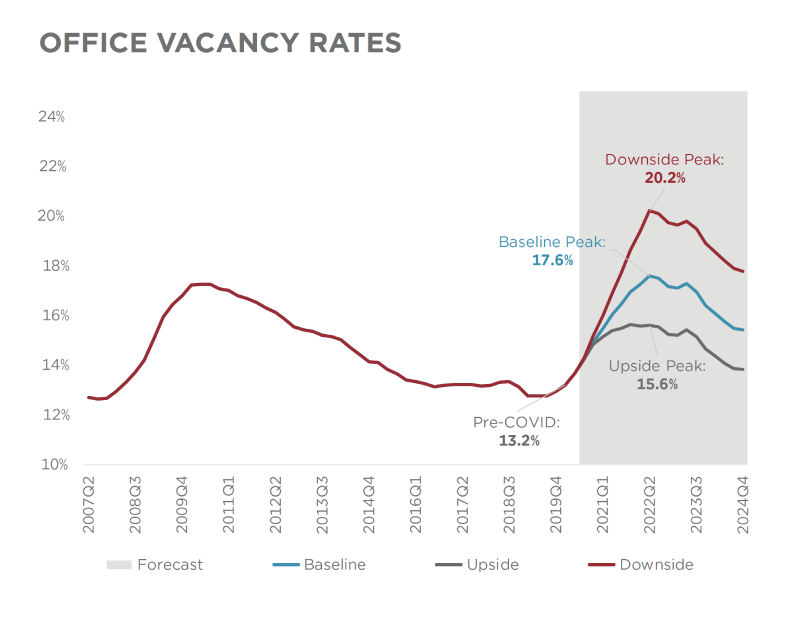

Office vacancy rates forecast through 4Q 2024. Chart courtesy of Cushman & Wakefield

A new report from Cushman & Wakefield examining the global impacts of the pandemic on commercial real estate predicts office leasing fundamentals will be significantly affected for years to come with increasing vacancies and decreasing rents. Vacancy will peak in the U.S. in the second quarter of 2022 and return to pre-crisis levels by 2025. The work-from-home trend, which will continue and permanently double, is expected to slow recovery more than recent recessions.

Kevin Thorpe, Cushman & Wakefield’s chief economist & global head of research who co-authored with Rebecca Rockey, global head of forecasting, told CNBC the impacts from the COVID-19 crisis will be significant, but the global office leasing sector will recover “largely due to employment growth.”

Thorpe noted in a prepared statement that the company’s first-ever Global Office Impact Study analyzes coronavirus-related cyclical and structural changes impacting the office market—including job losses, office vacancy and rental rates, geographical characteristics and work-from-home expansion—to establish three scenarios for each part of the world. While not every market will follow the same path, Thorpe said the report ultimately projects a full global office market recovery.

READ ALSO: Office Occupancy Varies as Virus Keeps Many Workers Home

To prepare the report—the first in a four-part series—Cushman & Wakefield assembled a global think tank, a team of senior researchers and economists from around the world. In the CNBC interview, Thorpe said they also talked to the largest companies around the world for input. The report includes three scenarios—baseline, upside and downside.

Despite the near-term challenges, the report projects global office vacancy to return to pre-crisis levels of 11 percent by 2025. It is expected to peak at 15.6 percent by the second quarter of 2022. In the U.S., under the baseline forecast, the study expects the average vacancy rate to be 14 percent this year, hit 16.2 percent in 2021, peak at 17.4 percent in 2022, and come down to 16.9 percent in 2023 and 15.7 percent in 2024. Also under the baseline forecast, rents are expected to be up 3 percent this year followed by two years of rate decreases, with the highest rent projecting a 6.5 percent drop in 2021 and a smaller drop of 2.3 percent in 2022, before increasing by 2.6 percent in 2023 and 3.5 percent in 2024.

The U.S. upside forecast paints a slightly better picture, with a projected 15.4 percent vacancy rate in 2021, followed by 15.5 percent in 2022, 15.1 percent in 2023 and back to 14 percent by 2024. Rents would grow by nearly 3 percent this year and drop by 5.1 percent in 2021, before beginning to rise in 2022 by 1.7 percent, by 3 percent in 2023 and by 2.6 percent in 2024.

The U.S. downside forecast, which assumes job losses continue into 2021 with no new fiscal packages from Congress, is much gloomier, with vacancy rates peaking at 20.2 percent in mid-2022, hitting 19.5 percent in 2023 and 18.1 percent in 2024. Rents would drop by 8.4 percent in 2022 and by 7.5 percent in 2023, before turning around in 2023 with a 0.8 percent increase and a 4.6 percent increase in 2024. Under the downside scenario, office rents in the U.S. would not recover to pre-crisis levels until the beginning of 2028.

Working from home and densification

Thorpe told CNBC the “work-from-home trend is very real,” noting there will likely be a permanent doubling of the work-from-home office population. The study puts the number of people working from home in the U.S. at about 5 percent to 6 percent before the crisis to about 10 percent to 11 percent permanently. And “agile workers,”—those who will work some hours at home or another remote location and some at the office—will also increase permanently post-pandemic. Cushman & Wakefield’s report cites multiple surveys showing about 70 percent of CFOs and real estate executives plan to reduce their office footprint as a result of the increasing agility of their workforce.

READ ALSO: CRE Executives See Glimmers Emerging from Tough Times

The report does expect there could be a reversal of the decades-long trend of densification. For years now, businesses have been absorbing less space per office-using employee. Social distancing requirements both during COVID-19—and even after the crisis passes—and increased work-from-home employees are expected to disrupt that trend.

If densification were to stop or begin to reverse, the report suggests that could offset some or all of the loss caused by more remote working. In the U.S. baseline scenario, the report states a halt in densification combined with the increase in remote working could cause absorption rates to be “marginally lower (20 bps) over the coming decade than they otherwise would have been.” The study adds, “If companies were to expand per-worker footprints by 50 percent permanently, the effect of work-from-home is fully offset.”

Read the full report by Cushman & Wakefield.

You must be logged in to post a comment.