Office Leasing Trends in Uncertain Times

Is the increase in sublease space a sign of an economic slump or a harbinger of diminished office use in the future?

Spokane 1997 via Pixabay

There are many unanswered questions about the future of the office sector. Landlords and tenants don’t know the full extent of how working remotely will reshape the future office or how social distancing and a focus on sanitation will change the nature of work. The uncertainty is unsettling, but office leasing trends are surprisingly stable for now.

Despite these challenges, business continues to march forward with tenants still looking to lease space.

“Demand for our services is at an all-time high,” noted Chris White, vice chairman & Southeast region lead for tenant representation specialist Savills, noting that tenants want “flexibility, flexibility and more flexibility.”

Traditionally, landlords would push long leases that placed the burden of risk on the tenant. But White is seeing pushback from his clients who want office space but want to be agile enough to figure out what the future is going to look like.

Office occupiers, therefore, have been taking a wait-and-see approach to their long-term planning. Rebecca Rockey, global head of forecasting for Cushman & Wakefield, observes that most companies’ “focus is on getting through the pandemic and the related business cycle more so than changing their real estate strategy.”

“What we see in the market is a desire to do a near-term extension to get to the other side so they can figure out what their new normal is,” he said.

Asking rents hold

Along with a significant drop in office leasing activity, Rockey has observed record levels of negative absorption. “Our national data on office demand has registered some of the most significant declines ever recorded,” she said. “So far, we’ve had in Q2 and Q3 combined negative 64 million square feet of absorption. In Q3 alone, it was about 42 million to 43 million square feet in negative absorption, and that’s far and away the single-largest quarterly drop we’ve ever recorded.”

That negative absorption has yet to be reflected in asking rates, but Rockey thinks that this is to be expected. “In the great financial crisis, it wasn’t until the end of 2008, well into our experience of negative absorption, before asking rents started to move.”

Landlords have had little opportunity to adjust given the lack of current activity. “Generally speaking, asking rates are holding up in most markets,” Rockey said. “Nationally, we saw another quarter where our rents increased.”

In recent years, there has been a strong trend to increase employee density. Part of this is financially motivated, but it has also been driven by the social trend of creating more collaborative workspaces. In the wake of COVID-19, people are far more wary of working in close proximity to their coworkers. White believes that the solution may not require additional square footage.

“Most companies are set up that every desk, every office, every workstation is assigned to one person … A lot of our clients are asking, ‘what if that desk was used by 1.5 people or two people?’”

Some speculate that companies may want to expand their floorplans to accommodate social distancing. Savills’ White is not as certain: “There has been a lot of talk of that, but actually doing it is another thing. They are debating that and trying to give themselves as much time as possible … People are trying to wait as long as they can to figure out what the new normal is.”

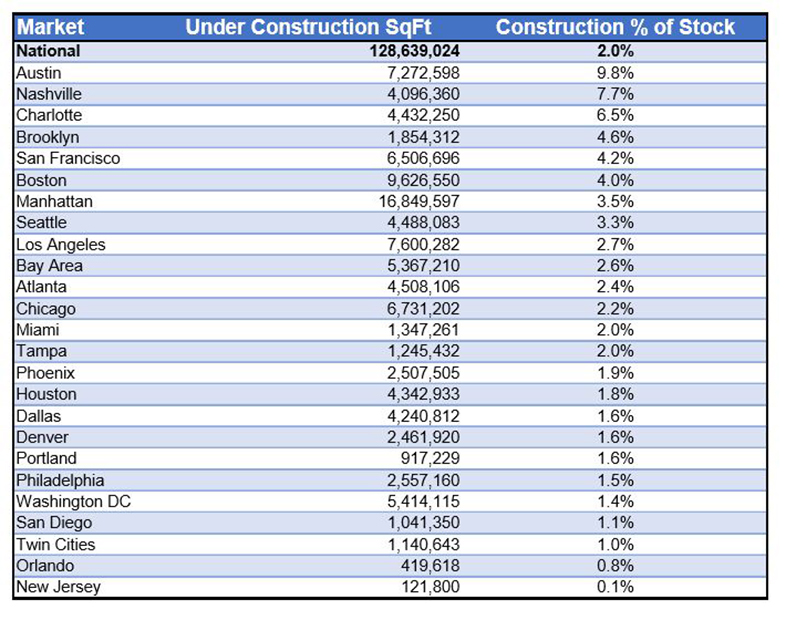

Construction pipeline clogs

Source: CommercialEdge as of October 2020. Data excludes owner-occupied buildings.

Industry professionals are busy innovating creative solutions to reduce office density. According to White, they’ve had to determine how to make workspaces more flexible.

That demand has also been noticed by Rockey. “There seems to be an appetite to use near-term strategies such as rotating shifts, staggered hours, and increased working from home,” she said.

RCLCO Senior Managing Director Taylor Mammen believes that so far office has been affected only minimally thanks to long office leases. “The data doesn’t necessarily show a great deal of decline in operating fundamentals,” he said.

While direct asking rents have not changed much, many investors see the increase in sublease space as a potential sign of weakness.

“(This) is always something that occurs during an economic downturn and doesn’t necessarily suggest a difference in how companies are planning to use office space,” said Mammen. “It certainly is a reflection of economic weakness but not necessarily yet an indicator that all companies are rethinking how they are going to use office space going forward.”

The construction pipeline has mostly stalled. As with most sectors, projects that had already broken ground are still being built; however, projects further back in the pipeline have been indefinitely delayed.

“It’s going to be a while before we see a lot of new office construction,” said Mammen. “There is likely to be a glut of what I describe as commodity office space. Office space that is indistinguishable from other office space.”

If Mammen is correct, much of that commodity office space could undergo adaptive reuse, converting into medical or other specialty office space. It could also potentially be repurposed as multifamily.

Mammen has seen very little transaction activity with RCLCO clients. “Sellers are taking a wait-and-see approach, and I think buyers are, too. Lenders are very hesitant to lend on office space, as well.”

This transaction slump is likely to continue until a medical solution to the current health crisis is implemented.

Businesses have been operating in offices for over three centuries, so it will almost certainly come back; however, the timing is unclear. In the meantime, commercial tenants watching the space are holding back on making big moves. Being too early on this trend could be a mistake.

You must be logged in to post a comment.