Office Owners Scale Back Concessions

And how this trend is expected to play out, according to CBRE’s latest research.

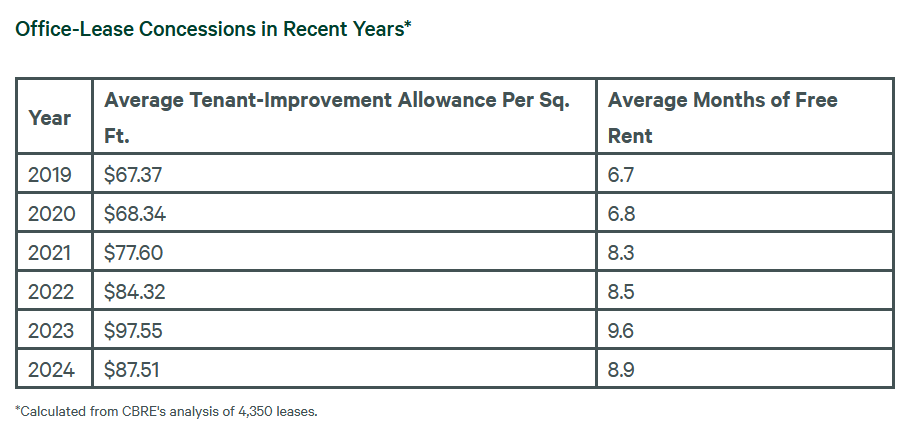

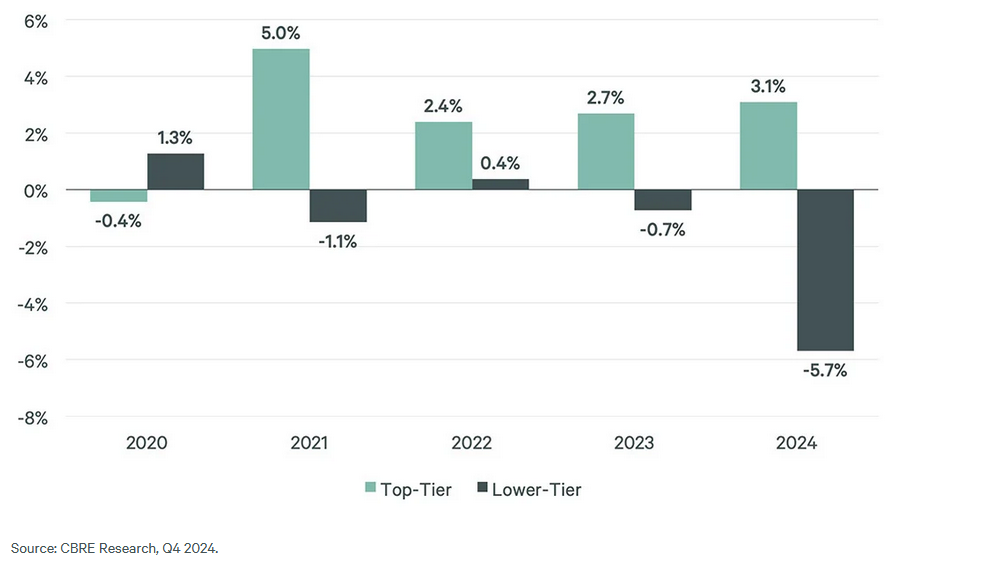

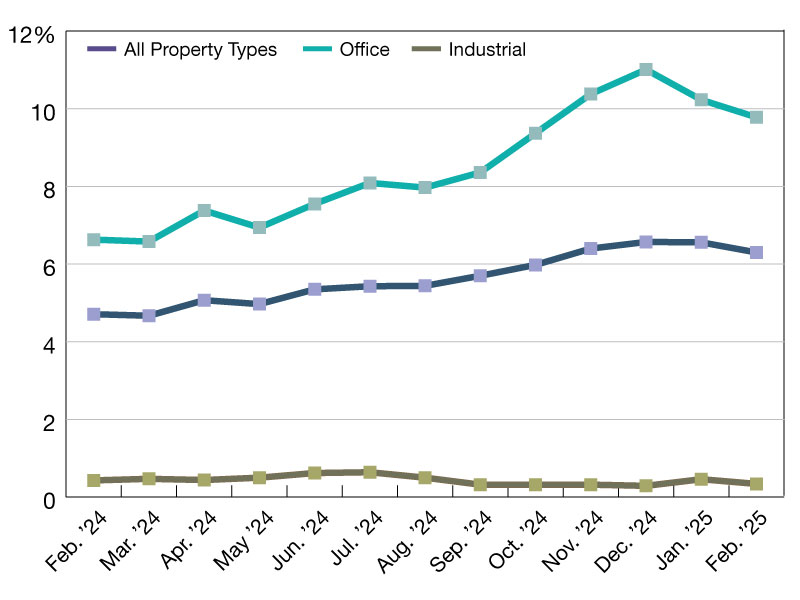

Office lease incentives dropped last year for the first time since CBRE began tracking this metric in 2019. The firm’s latest report also shows that Class A+/A office building rents and those in Class B and C continue to go in opposite directions.

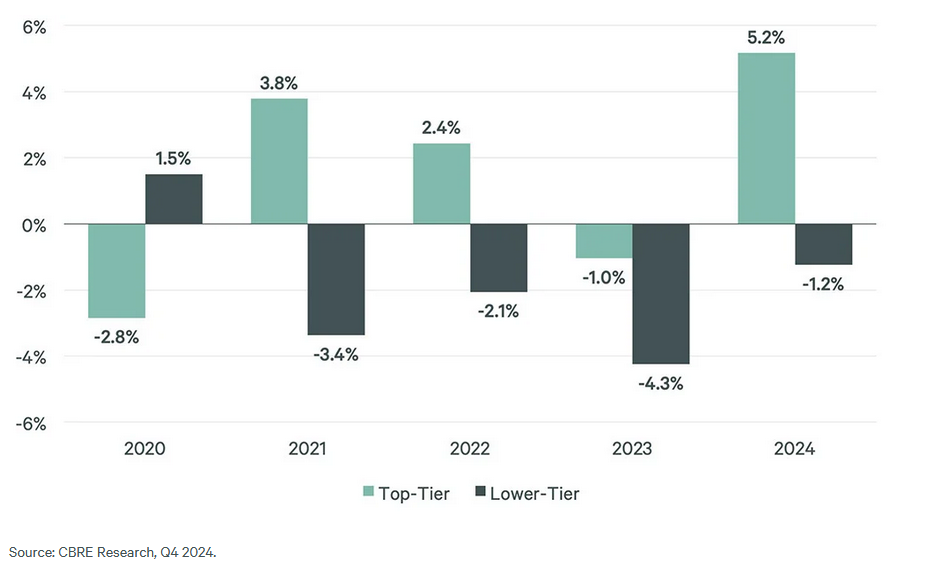

For top tier assets, base and effective rents are up by 3.1 percent and 5.2 percent, respectively, since 2023. Base and effective rents for Class B/C office buildings have dropped by 5.7 percent and 1.2 percent.

CBRE analyzed 4,350 new lease comparables across the Atlanta, Boston, Chicago, Dallas-Fort Worth, Denver, Houston, Los Angeles, Manhattan, Philadelphia, San Francisco, Seattle and Washington, D.C., markets.

READ ALSO: Net Effective Office Costs Edge Up

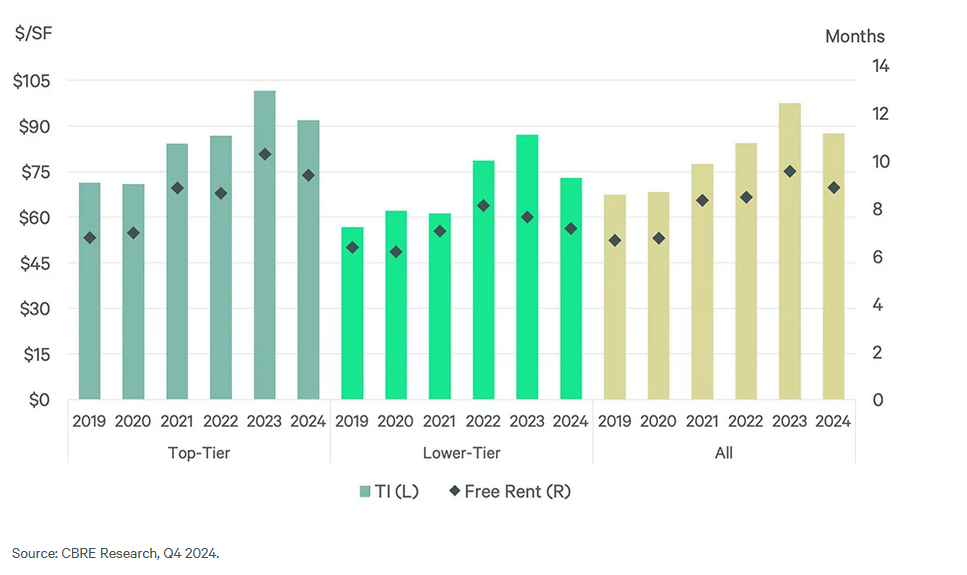

Top-quality, amenity-laden office buildings in prime locations are in limited supply and high demand. The report showed a growing rent base and fewer concessions for these properties’ tenants last year. Incentives include rent-free months and landlord-funded office space improvements.

“We expect those owners of prime buildings to continue to dial back concessions over the next 24 months, especially given the dwindling supply of premium office space coupled with a lack of new construction,” Mike Watts, CBRE president of Americas investor leasing, told Commercial Property Executive.

Top-tier buildings are commanding a premium, especially given that landlords are offering tenant-improvement allowances to accommodate high-quality fit-outs.

A bifurcated office market

Meanwhile, effective rents for lower-tier office buildings are slipping steadily. CBRE showed that landlords kept base rents relatively flat until the second half of 2024. At that point, financing requirements came into play in order to maintain property values.

Landlord concession packages topped out in 2023; however, they are still greater than in 2019.

For the lower-tiered offices, the tenants have the upper hand, given the high volume of available assets. Conversely, owners of the highest-quality buildings in the most sought-after locations are in great bargaining shape, given the flight-to-quality trend and diminishing new supply.

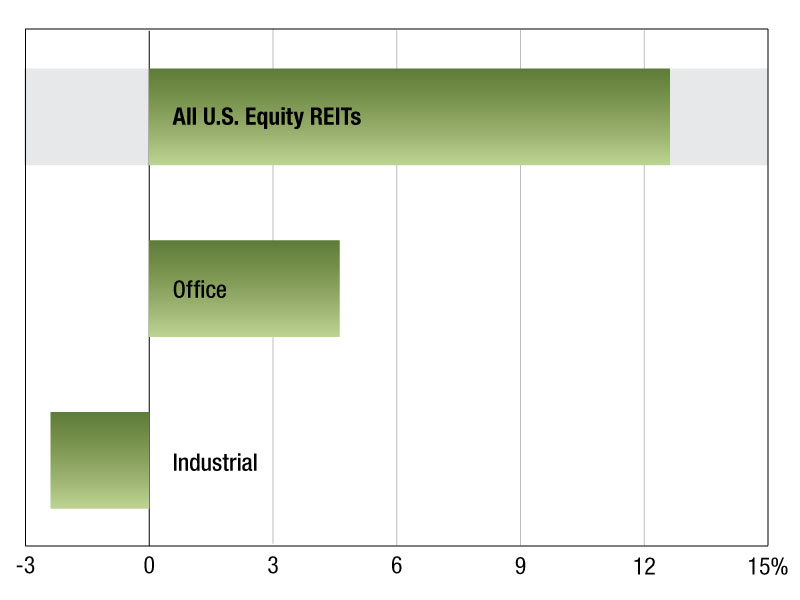

Last month, CommercialEdge reported that office prices have retreated and discounts are plentiful. The average price fell 11 percent year-over-year due to uncertainty and the continued domination of remote and hybrid work schedules, according to its February report.

In 2023, prices fell by 24 percent and since 2019, office values have dropped by 37 percent.

You must be logged in to post a comment.