Office Refinancing Dollars Abound, But Not For Every Building

Lenders are willing, though some are getting more selective.

Borrowers planning on refinancing their office properties this year should have plenty of options.

If 2021’s robust financing trends continue, most of the deals will be done by bridge lenders, debt funds and CMBS. Banks and life companies will also be active, but they are likely to be more conservative when underwriting office properties due to shifting occupancy trends and tenants’ preference for newer properties.

So, while there is ample refi capital to go around, some borrowers will be asked to bring more money into the deal and a pay a higher cost depending on the market, building quality, occupancy and leasing velocity,

In New York, for example, there is a definite flight to quality, with new product being absorbed at all-time high rents.

“I think the winners in regard to absorption or leasing activity are really the Class A/repositioned assets where employers and their workforce desire more amenities and amenitized buildings that offer wellness options,” said Nipul Patel, head of real estate banking, Wells Fargo.

So, lenders are being very careful about refinancing older properties, and that will make it even more challenging for owners of older properties to make their properties competitive.

“We feel really good about lending into assets that are best in class, that are well amenitized, modern buildings,” said Adam Gibbons, managing director, investments, at CIM Group and head of credit originations of the CIM Real Estate Debt Solutions. “We are very, very cautious about lending on Class B commodity older products where there’s not a clear path to how and when those buildings will be leased up.”

CIM’s lending arm closed about $3.5 billion in total originations in 2021. Just over $1 billion was office lending, with office refinancing representing most of the transactions. The vast majority of the deals are floating-rate loans of three to five years.

2022 is starting off strong. In January, a CIM-managed fund provided a $175 million whole loan to an affiliate of Banyan Street Capital and funds managed by Oaktree Capital Management to refinance the 42-story Bank of America Plaza trophy tower in Tampa, Fla.

Lenders Are Eager

Overall, lenders are enthusiastic about 2022. Every commercial and multifamily firm polled by the Mortgage Bankers Association expected to increase originations this year and 63 percent expected an increase of 5 percent or more across the entire market.

Joseph Iacono

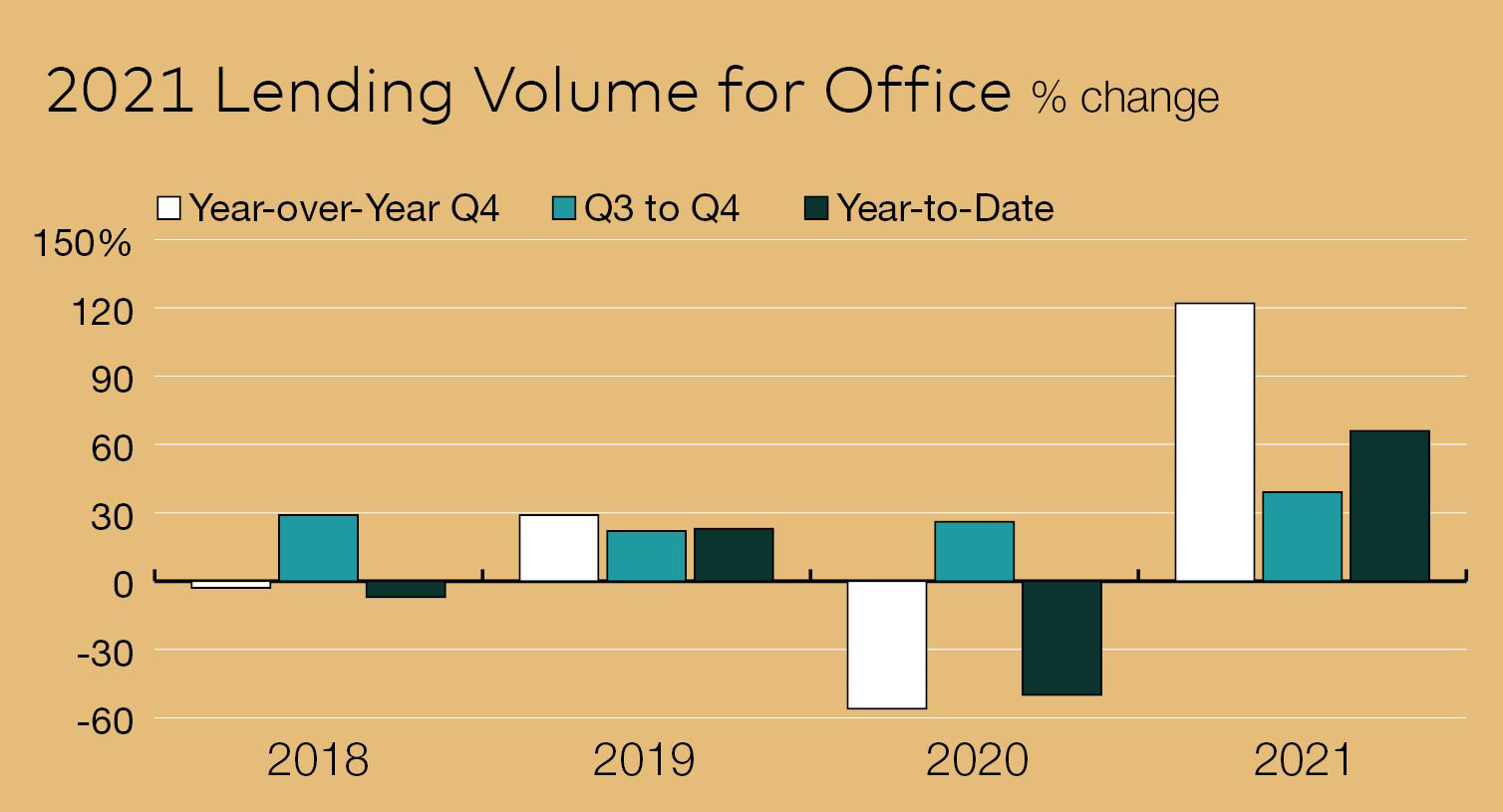

The MBA doesn’t break out refinancing originations from overall originations, but, preliminary figures show originations volumes in 2021 for office properties increased 66 percent over 2020. MBA also reported a 122 percent increase in the dollar volume of loans for office properties year-over year from Q4 2020 to Q4 2021. From the third quarter of 2021 to the fourth quarter, originations for office properties rose 39 percent.

Jamie Woodwell, MBA vice president for Research & Economics, explained part of the growth from 2020 was a bounceback from the worst of the recession. But he also pointed to rebounding property fundamentals and strong fundamentals, record sales transaction volumes and low interest rates for the overall jump in commercial and multifamily mortgage lending volumes.

Rising property values may also spur office transactions. Last year, overall commercial property values increased 23 percent, MBA stated.

“That increase in value puts a lot of opportunities in front of the owners either to sell their properties or refinance,” said Woodwell. “I’d expect there’d be a fair amount of influence from that in the coming year.”

A CIM Group-managed fund in December provided a $147.7 million loan to The Davis Cos. and Partners Group to refinance the recapitalization and partial conversion of One Cabot, a 319,000-square-foot office building in Medford, Mass., to a Class A office/R&D life science facility. Image courtesy of CIM Group.

Pending Rate Hikes

Other factors are driving office refi activity besides the Federal Reserve’s announced plan for multiple interest hikes this year.

“I believe this increase in (refinancing) activity has less to do with foreseeable rate hikes and more to do with loans coming due or landlords tripling covenants in their loan documents due to increasing occupancy and anemic leasing velocity due to the pandemic,” said Brad Zampa, an executive vice president on CBRE’s San Francisco Capital Markets team specializing in Debt & Structured Finance.

Borrowers seeking a value-add play or lease-up to achieve stabilization are also not motivated by the prospect of higher interest rates.

“Borrowers on non-stabilized deals are not overly concerned with a 50bps to 100bps potential interest rate increase,” said Jonathan Daniel, principal, Knighthead Funding, a national real estate finance company. “While owners will certainly look to lock in attractive rates for stabilized deals, in the bridge space, it has been about trying to attract tenants and establishing a compelling basis in the process.”

One of Knighthead Funding’s recent refinancing transactions was a $21.5 million, 24-month, non-recourse loan for the owner of a newly built, Class A, 125,750-square-foot office building in Colorado Springs, Colo., to have extra time for lease-up.

But for borrowers looking to refinance into CMBS or a fixed-rate loan, rising interest rates will play a role in how quickly they act.

“That’s a factor of why you’re also seeing CMBS prospects grow because, in a rising rate environment, people want to start to lock the rate if their property qualifies for it and if the cash flow is stabilized out,” said Joseph Iacono, CEO & managing partner of Crescit Capital Strategies in New York City.

CMBS issuance, which reached about $110 billion in 2021, the highest volume since 2007, should also remain high for office refis in 2022 because of the number of deals completed 10 years ago reaching maturity, noted Susan Hill, senior managing director, JLL Capital Markets.

“It’s not a wall, but there could be volume there, and I think CMBS will get their fair share,” Hill said.

Bond, Bonds, Bonds

Most of the CMBS issuance last year was single-asset, single-borrower transactions. The single-asset securitization market can be a great execution for cash-flowing loans over $300 million, Zampa noted.

SASB issuance last year reached $79 billion, of which $22 billion was office collateral, according to KBRA. While 2021 levels may be hard to repeat, KBRA Senior Director Larry Kay said six to eight deals were set to launch in February, which could include office SASB deals.

“This could bode well for the year, especially if they are well received and the pricing is favorable,” Kay said, “However, we expect that originators will use more conservative assumptions as it is still uncertain how the lingering effects of the pandemic and the ongoing shift toward hybrid work will weigh on demand and lease renewals.”

The $3 billion CMBS refinancing of Midtown Manhattan’s One Vanderbilt skyscraper in June was led by a Wells Fargo and Goldman Sachs consortium. The 10-year, fixed-rate debt, SASB CMBS transaction, which replaced $1.75 billion in construction financing, was the largest ever single-building securitized financing.

“That shows a Class A trophy building in New York, well leased to high-grade tenants that opened in a pandemic went to the CMBS market and executed flawlessly,” Patel said.

The One Vanderbilt transaction also demonstrates how select sponsors of higher-quality office buildings are able to create value through leasing, noted Shaunak Tanna, head of structured investments for Basis Investment Group.

Lenders willing to refinance older commodity office buildings, on the other hand, are looking for a rent roll with healthy occupancy that is not dependent on one tenant, an expiry schedule that doesn’t have too much roll at the same time and new cash to go into the deal, Tanna explained.

Taking Risks

Some lenders are focusing mainly on the Sun Belt, due to recent migration patterns. But Nuveen Real Estate isn’t shying away from cities like Chicago, where the debt fund provided a $296 million five-year, floating-rate loan to refinance 321 N. Clark, a 936,240-square-foot tower owned by a joint venture of Hines, American Realty Advisors and Diversified Real Estate Capital.

Citing a strong going-in debt yield, minimal rollover and bulletproof sponsorship, Jason Hernandez, head of debt originations, Americas, at Nuveen Real Estate, said the lender felt there was minimal business plan risk.

“And we were getting paid a very attractive return to take the risk that capital markets would be open for a trophy quality asset two to three years in the future when the sponsor went to refinance or sell the asset,” he said.

Nuveen also refinanced 121 W. Wacker, a B+ office asset near 321 N. Clark in the River North submarket.

“We were able to de-risk this transaction by hardwiring the senior syndication prior to the close to lock in our return so we felt comfortable taking on slightly more business plan risk in the asset,” Hernandez said.

Nuveen’s floating-rate bridge lending business executed $1.1 billion in office sector transactions in 2021 with traditional office comprising $850 million and life science $210 million. The fourth quarter was strong with $500 million in floating-rate bridge loans closing, representing 60 percent of overall office annual lending.

Debt funds will continue to be active in the office sector to earn incremental spread for their investors, Hernandez said, adding office is the most scalable sector, given the larger lot sizes.

Global alternative investment firm Värde Partners is focusing most of its lending in Sun Belt metros that have a large number of new jobs being created to hopefully offset some of the potential issues created by hybrid work, said Jim Dunbar, partner & head of real estate lending at Värde Partners.

But Värde is still making selective loans in cities like Los Angeles, where one of the firm’s fourth-quarter deals was a $23 million refinancing for an office building near the Arts District that has a mix of tenants. He said the loan is consistent with Värde’s thesis that there will be continued demand for office buildings even in a hybrid environment.

ESG concerns are also top of mind for lenders. Värde, for example, is targeting more modern, top-quality buildings that don’t need capital improvements and amenities to attract tenants in a post-pandemic. In newer properties, the wellness features that tenants demand today are already built in.

“Those buildings that meet certain requirements will get more favorable pricing from certain lender types with buckets of capital focused on ESG,” said JLL’s Hill.

Another trend expected to grow is life science conversions. Life science markets like the San Francisco Bay Area, San Diego and Cambridge, Mass., were particularly active for office refinancing in the past year.

CIM Group’s Gibbons said several of its office refinance deals last year were in the life sciences sector, including in the Boston area. In some areas, life science tenants have become the primary source of positive office absorption.

In 2021, Nuveen financed several life science conversion and lease-up deals.

“We love the tailwinds/liquidity in the sector and have been fortunate to partner with the right sponsors,” Hernandez said.

You must be logged in to post a comment.