Office Renewal Intentions Reach All-Time High

The high follows six continuous quarters of growth since Q1 2018, according to research firm Kingsley Associates.

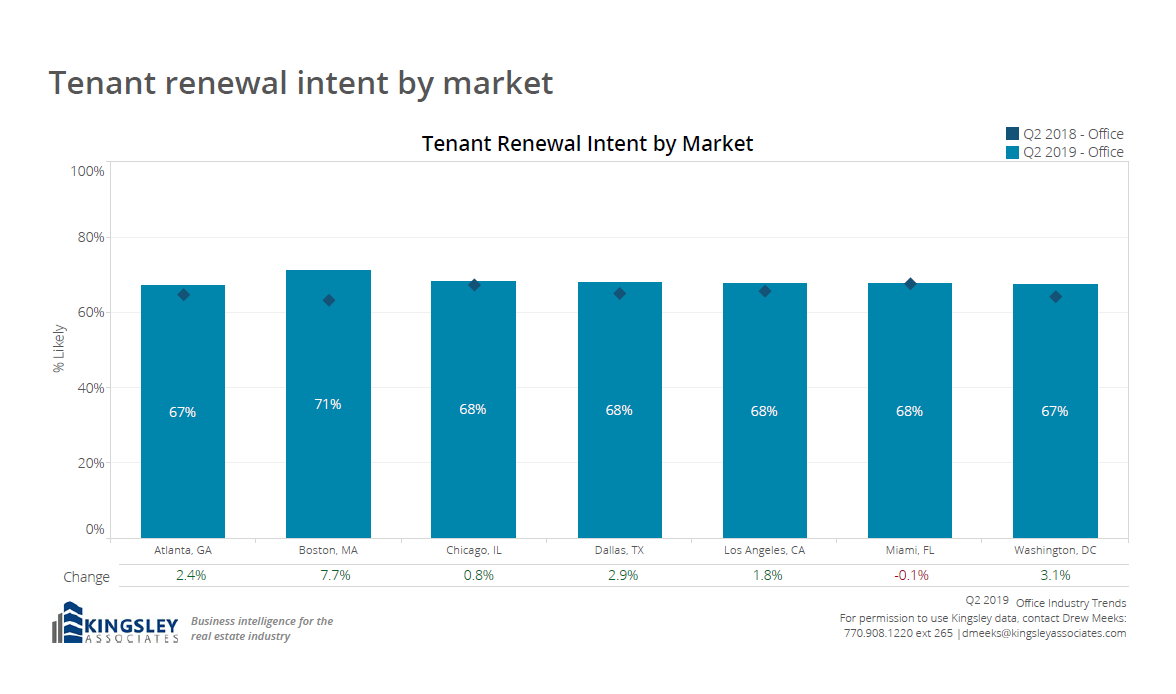

After many years of steady renewal intentions, national office renewal intentions increased again this quarter to 68.4 percent of office tenants indicating they are likely to renew their lease. This increase marks six continuous quarters of growth beginning with 63.8 percent intent in the first quarter of 2018 as well as the highest renewal intentions for office that we have ever documented. The lowest renewal intentions documented were in the fourth quarter of 2009 when only 57.5 percent of office tenants were likely to renew.

Ten of the eleven major markets saw a year-over-year increase in renewal intentions this past quarter. Miami is the only major market where renewal intentions have declined. The top markets of the second quarter of 2019 are Denver and Boston, both with 71 percent of tenants likely to renew. Conversely, Atlanta, New York, San Francisco, and Washington, D.C. are tied for the lowest renewal intent by market with only 67 percent of tenants likely to renew this quarter. Although San Francisco has the lowest renewal intent, it has the highest year-over-year increase with an 8.2 percentage point change from this time last year.

Office tenants indicate that location has the highest impact on their decision to renew; 59 percent of office tenants indicated location influenced their renewal decision. For tenants who indicated they were likely to renew, 78 percent of tenants indicated location as a factor in their renewal decision. Among tenants unlikely to renew, only 15 percent of tenants selected location as a reason they were unlikely to renew. The most common reason tenants indicate they are unlikely to renew is price at 43 percent followed by space requirements at 28 percent. For tenants likely to renew, location is the top factor, followed by quality of building, property management and space requirements.

Industrial: Down in Seattle, up in NYC

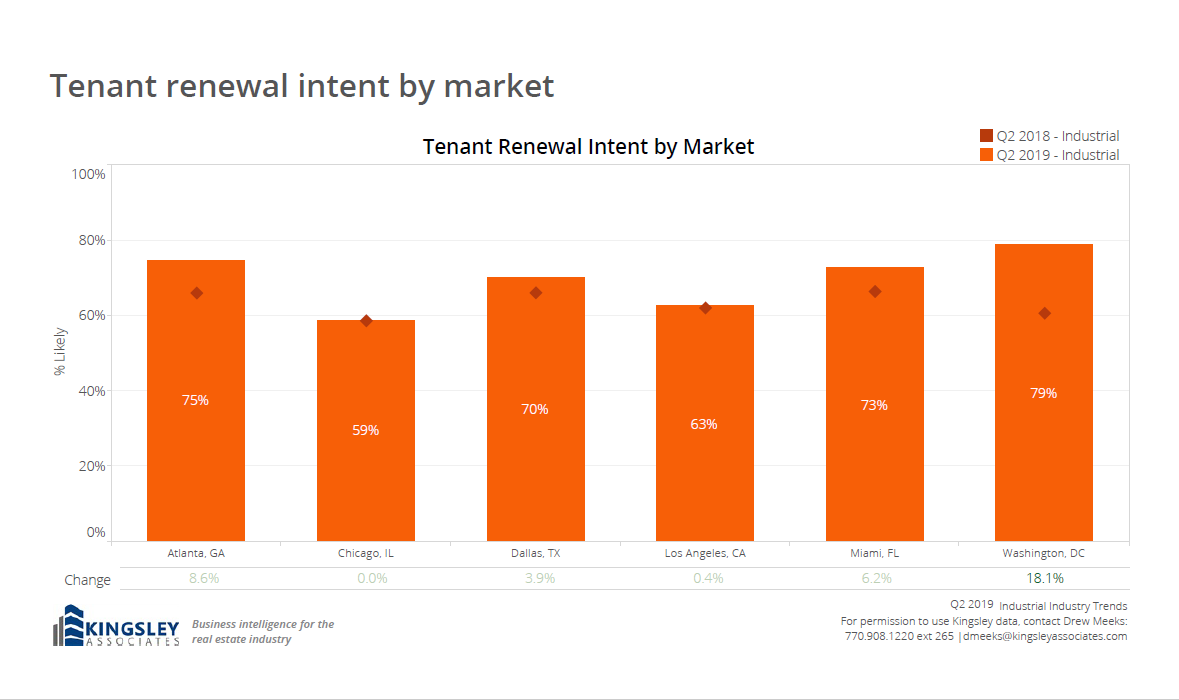

Industrial tenant renewal intent increased from 67.5 percent of tenants likely to renew in the first quarter of 2019 to 68.3 percent at the end of Q2 2019. The past six years have seen fluctuations of industrial renewal intentions. The lowest dip was to 60.1 percent in the third quarter of 2017. Since that time, the percentage of tenants likely to renew has risen relatively steadily with only a slight 0.4 percentage point loss from the fourth quarter of 2018 at 67.9 percent intent to 67.5 percent intent in the last quarter. Across the board, renewal intentions at industrial properties are generally lower than renewal intentions at office properties.

At the market level, industrial renewal intentions vary widely and have changed dramatically in some markets since this time last year. New York City has the highest renewal intent with 83 percent of tenants likely to renew. Seattle, on the other hand, has only 54 percent of industrial tenants indicating they are likely to renew and was the only market to see a year-over-year decrease in renewal intentions. Industrial renewal intentions in Seattle, decreased by 11.8 percentage points. On the other end of the spectrum, Washington, D.C. saw the highest year-over-year growth with the percent of tenants likely to renew increasing by 18.1 percentage points from 61 percent in the second quarter of 2018 to 79 percent likely to renew in the current quarter.

Forty-six percent of industrial tenants indicate that the building location influenced their renewal decision. For tenants who indicated they were likely to renew, the percent rose to 64 percent of tenants selecting location as a factor. Only 15 percent of industrial tenants selected location as a reason they were unlikely to renew. The most common reason tenants indicate they are unlikely to renew is price at 36 percent followed by space requirements at 32 percent. For tenants likely to renew, location is the top factor, followed by building functionality and space requirements.

Medical Office: Renewal Intentions Decline

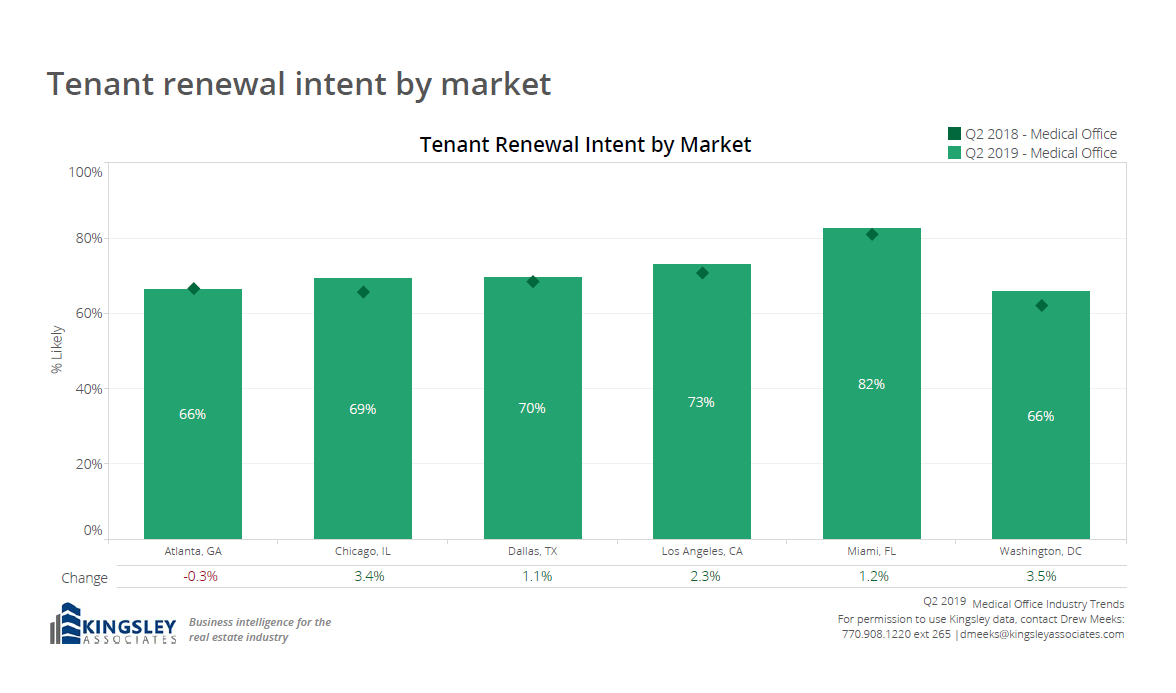

Medical office renewal intentions declined in the second quarter of 2019; the only sector to see a national decrease in tenant renewal intentions. Medical office renewal was on the rise starting at 69.6 percent in the fourth quarter of 2017 until the fourth quarter of 2018 where it peaked at 75.4 percent intent. Since that time, renewal intent has slipped to 75.3 percent in the first quarter of 2019 and further to 72.8 percent renewal intent in the second quarter of 2019.

The market with the highest percentage of likeliness to renew their medical office this quarter is Miami with 82 percent of medical office tenants in Miami likely to renew. Of the major markets, Atlanta and Washington, D.C. have the lowest renewal intentions; both cities have 66 percent intent. Atlanta not only is tied for the lowest renewal intentions, but was also the only major market to see a year-over-year decrease in renewal intentions. Washington, D.C., on the other hand, has the highest year-over-year increase with a 3.5 percentage point jump from this time last year.

Location remains the most important renewal decision factor for medical office tenants on a whole, just as it was for office and industrial. This quarter, 54 percent of respondents reported the building location influenced their renewal decision. Just as we saw with the office and industrial sectors, location is a bigger factor in the decision of those likely to renew than in those unlikely to renew, where price plays the biggest role. Relationship with hospital and proximity to the hospital are both important factors for tenants who are likely to renew their lease, but neither make the top ten factors for those who are unlikely to renew their lease. Interestingly, the percentage of tenants indicating that hospital proximity positively influenced their renewal decision has increased dramatically from 17 percent in the second quarter of 2018 to 28 percent this quarter.

Retail: Customer Traffic Impacts Renewal

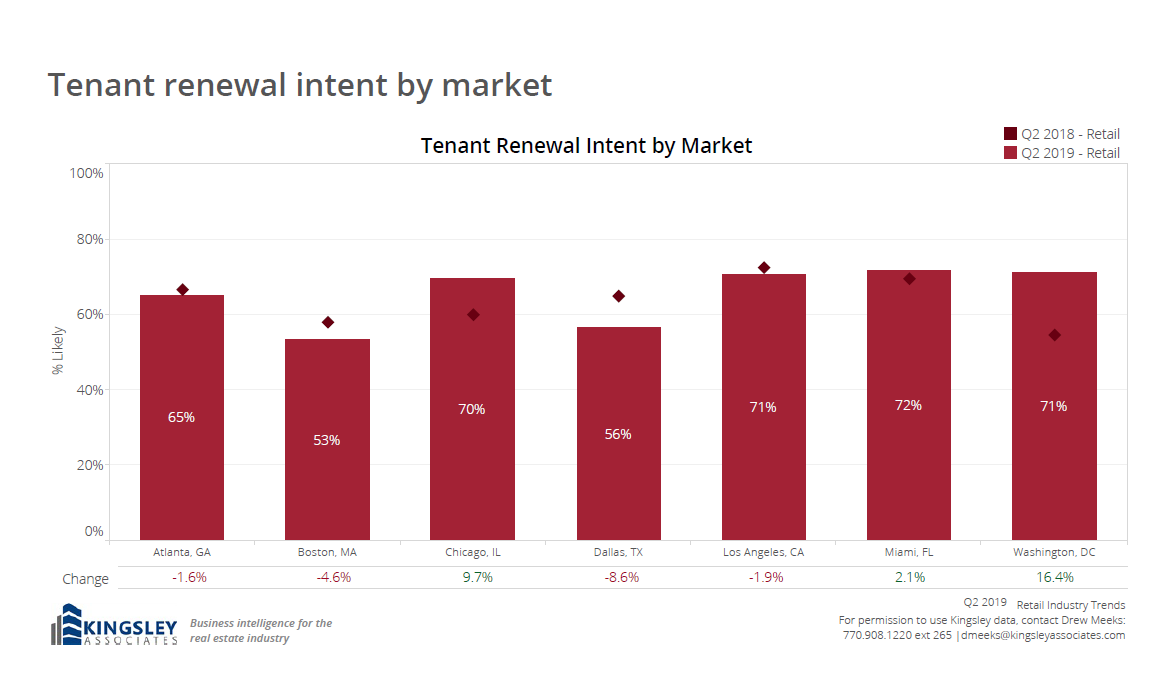

National retail renewal intentions have increased dramatically this quarter after two quarters of decline. In the first quarter of 2019, 65.1 percent of retail tenants intended to renew their lease. This quarter, the percentage has risen to 67.1 percent. The first quarter of 2017 was the lowest national percentage of the past six years, coming in at 60.6 percent of tenants likely to renew. Retail renewal intentions peaked at 67.3 percent of tenants likely to renew in the third quarter of 2014.

Despite a national increase in renewal intentions, many of the top markets tracked by Kingsley Associates, are seeing year-over-year decreases. Atlanta, Boston, Dallas, and Los Angeles all posted negative year-over-year changes. Dallas saw the largest decrease in renewal intentions with an 8.6 percentage point drop from this time last year. Boston saw a 4.6 percentage point drop and has the lowest renewal intentions of the major markets with only 53 percent of tenants likely to renew. Miami saw a 2.1 percentage point increase that landed them in the top spot with 72 percent of retail tenants likely to renew. Washington, D.C. reported a 16.4 percentage point increase, which is the highest market-level year-over-year increase.

The most influential factors on the renewal decision for retail tenants are location, customer traffic, and price. Location is most important to tenants who are likely to renew; 60 percent of tenants indicated their renewal decision was influenced by their location. Price, on the other hand, is most important to tenants who are unlikely to renew, with 57 percent of tenants indicating the price influenced their renewal decision. Customer traffic is the second most influential factor for both tenants unlikely and likely to renew. For those likely to renew, 34 percent selected customer traffic as a factor in their decision. For those unlikely to renew, 48 percent of tenants said customer traffic influenced their renewal decision. All four sectors saw location as the overall most important factor for renewal with price being the most important factor for those tenants who are unlikely to renew.

John Falco is the principal leading Kingsley Associates’ Atlanta office. With more than 25 years of real estate experience in the office, industrial, retail and residential sectors, Falco provides clients with insights into cross-industry trends.

You must be logged in to post a comment.