Sobering Outlook for Office Values: Global Investor Survey

Widespread upgrades and repurposing will be needed to boost the sector, according to AFIRE’s annual report.

Commercial real estate investors from around the world are forecasting a deep decline in office values, coupled with a surge in conversion projects to multifamily. The latest survey from the Association for Foreign Investment in Real Estate reveals that a majority of commercial real estate investors from around the world anticipate asset value declines in nearly all of their U.S.-based office investments.

Additionally, nearly two-thirds of the survey’s respondents widely agree that the majority of U.S. office buildings need to either undergo significant upgrades, be demolished or should be converted to residential spaces. Gunnar Branson, CEO of AFIRE, attributes this in part to the nation’s aging office stock. “70 percent of office properties were built before 1990, and as leasing has become more and more challenging, the question of obsolescence, especially for buildings constructed between 1950 and 1990, comes up frequently,” Branson told Commercial Property Executive.

Persistent declines

The yearly report was conducted by a PwC Research team and was underwritten by Holland Partner Group. Surveying took place from Aug. 14 to Sept. 3, 2023. It included insights from 100 of the Association’s members, based in five continents, all of whom have portfolios valued at more than $1 billion, all the way up to $100 billion to $500 billion. Nearly half of the survey’s respondents, 49 percent, are institutional investors based outside the U.S., while 37 percent are investors or investment managers located within the country. The remaining 14 percent are accountants, law firms and brokerages. Response percentages average both domestically and internationally based firms.

According to AFIRE CEO Gunnar Branson, top concerns for many of the survey’s respondents included geopolitical tensions, the state of the U.S. economy and lending environment, as well as increasing insurance costs. All of the above take place as the sector faces generational changes to its in-person work environment, impacting the design process of new office spaces. Such trends magnify responses from last year’s survey, where a quarter of participants stated that they are likely to divest office properties, at a time when the sector’s longer-term outlook was more murky.

In terms of their overall outlooks for their investment portfolios, a combined 80 percent of participants expect the sum of their allocations toward U.S. real estate in general to either stay the same or decline through the rest of the year. Within these metrics, 38 percent anticipate unchanging investment volumes, 29 percent foresee a slight decrease and 13 percent anticipate a significant decline.

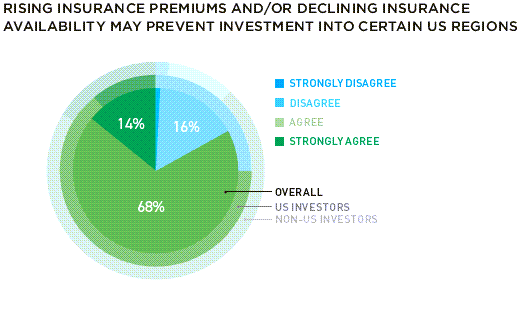

Such predictions are echoed by sentiments surrounding rising insurance premiums, taking place at a time of increasingly frequent severe weather events, alongside a volatile dealmaking landscape. More than two-thirds of respondents, 68 percent, stated that they agreed that a lack of availability and inaccessibly high premiums could complicate future investments into regions affected by the above. 14 percent strongly agree with these sentiments, while 16 percent remain unsure.

One consequence of these rising premia has been more realistic assessments of the risks that vulnerable properties face. “[It’s] an indication that environmental risk is beginning to get priced more accurately. The value of real estate in the most vulnerable markets is likely to adjust and will likely continue to change as losses mount due to increased storms, drought, and sea level rise,” Branson predicted. Within these markets, some properties are likely to fare more favorably in comparison to others. “Better constructed properties at higher elevations will likely command better valuations than those less resilient structures at lower elevations,” Branson added.

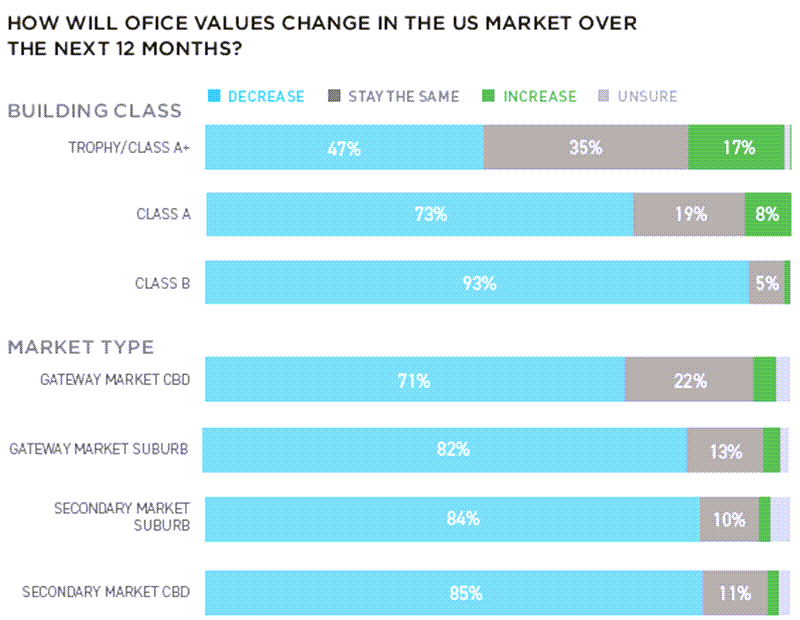

For office, a sector experiencing a significant amount of volatility in investment, development and leasing fundamentals, predictions were equally dire. Across asset classes, from trophy towers to Class B spaces, respondents broadly anticipate declines. 47 percent of investors surveyed see even amenity-driven class A+ and trophy space as going downhill in value over the next 12 months, while 35 percent see it as staying the same. Class A and B assets are likely to fare worse, with 73 and 93 percent of respondents, respectively, expecting that their values will tank over the next calendar year.

READ ALSO: Why CRE Insurance Challenges Are Intensifying

The locations of the office properties are also expected to impact asset values. Properties in the central business districts of high-performing gateway markets have the least gloomy of outlooks, with 71 percent of respondents stating that they foresee a slump in values. Of the bunch, properties in the central business districts of secondary markets are predicted to fare the worst, with 80 percent of respondents anticipating a decline.

Contexts and consequences

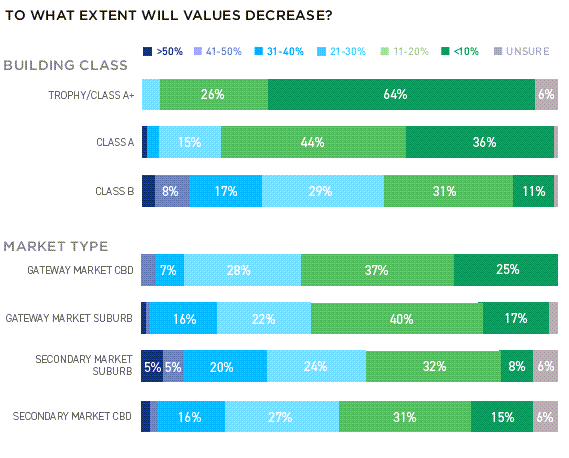

Context matters, however. Extent-wise, Trophy and Class A+ assets appear to be best poised to weather the storm, given their high occupancy rates, amenity offerings and rosters of lucrative tenants. 64 percent of respondents predicted that the values would decline by under 10 percent, with a further 26 percent anticipating an 11 to 20 percent slump. On the other end, Class B offices are anticipated to take a heavy valuation hit, with a combined 57 percent of respondents predicting decreases ranging from more than 50 percent of the assets’ values to 21 to 30 percent. Class A properties stand near their trophy counterparts, with a combined 80 percent of investors predicting declines ending up at less than 20 percent of the asset’s value.

Office properties in gateway markets are the likeliest to hold the largest portion of their present values, with a combined 62 percent of respondents seeing declines at a maximum of 20 percent. At the same time, more than a third of those—35 percent—are predicted to decrease from 21 to 40 percent, with the remaining 3 percent dipping into the territory of 50 percent or more. Assets in gateway suburbs are seen as facing a similar fate, with a total of 41 percent of respondents predicting anticipating declines in the realm of 21 to more than 50 percent. Offices located in the suburbs of secondary markets are likely to fare the worst across the board, with only 46 percent of respondents predicting them as retaining up to a fifth of their value, while 5 percent expect declines of more than 50 percent.

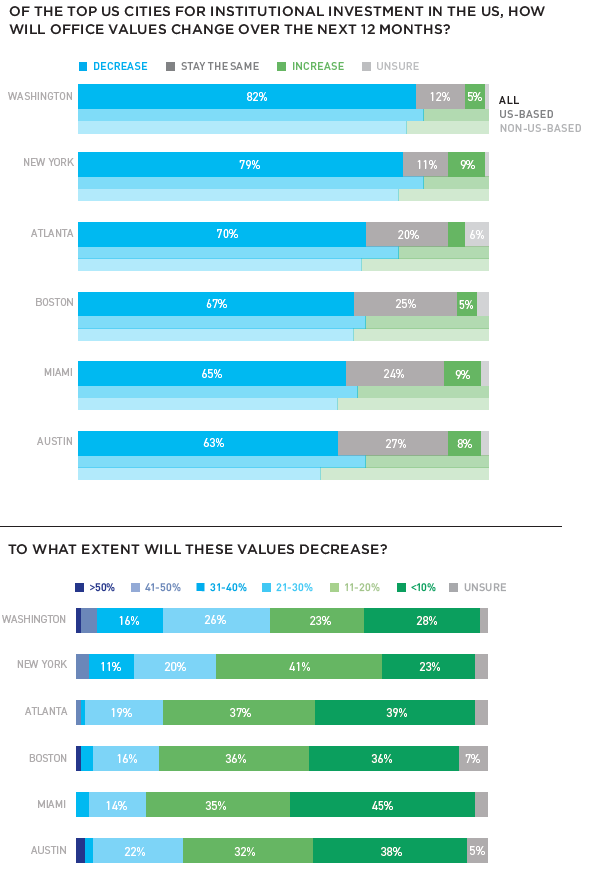

As for which metros will suffer the most, 82 percent of respondents, averaged between domestic and international investors, see Washington D.C. as possessing a majority of assets tanking in value, with New York City following closely. Atlanta, Boston, Miami and Austin are all hovering above a 60 percent prediction of decreases, even with the second city possessing the nation’s strongest office pipeline. Within these answers, U.S.-based investors ranked slightly above their foreign counterparts for every city, and slightly below for predictions around possible increases in asset values.

Are there any remedies?

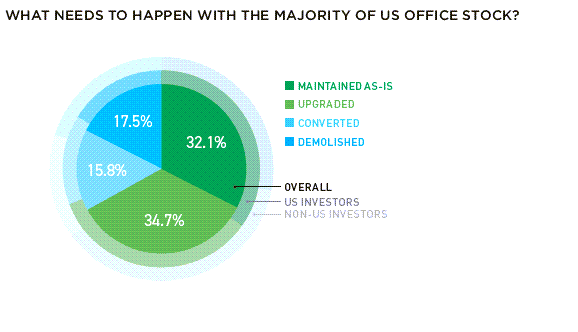

The report, referring to a majority of U.S. office stock as “philosophically obsolete” amid work from home trends and changing employee priorities, shows that a majority of AFIRE’s investors believe that the existing stock needs to be upgraded, demolished or converted over the next five years. 34.7 percent, averaged between American and international investors, believe that the buildings must be upgraded to adapt to shifting sentiments around office work. 17.5 percent see conversions and 15.8 percent see demolitions as the way to go, as many investors change pivot to multifamily and industrial.

Broken down, residential uses make up the majority of predictions, with more than 89 percent of investors anticipating at least 10 percent of properties being converted in the next half decade. Industrial storage and data centers come in second, with a combined 72 percent of respondents seeing them as the most likely conversions. In one segment, 32 percent of respondents see up to 10 percent of office stock as likely being converted to vertical farming uses.

Such a statistic surprised Branson. “This has been an idea considered for more than a decade in some circles, but not something generally approached by institutional capital. Given the challenges faced today, there may be an opportunity for breakthrough innovation in the years ahead,” Branson concluded.

You must be logged in to post a comment.