Olshan Properties Lands $106M for Mixed-Use Complex

The deal ends all foreclosure proceedings at this Ohio property.

Olshan Properties has refinanced The Greene Town Center, a 1.1 million-square-foot mixed-use property in Dayton, Ohio. Wells Fargo Bank and Argentic originated the $106.3 million loan, according to Greene County public records. The 10-year financing ends all foreclosure proceedings at the property.

In April 2013, Olshan took out a $137.3 million CMBS loan from Citibank, CommercialEdge information shows. The note was split into two loans that were transferred to Wells Fargo, Dayton Daily News reported.

Wells Fargo initiated a foreclosure lawsuit against Olshan earlier this year, as the owner had failed to pay the debt, according to WDTN. The outstanding balance was estimated at around $113 million.

READ ALSO: Why Mixed-Use Developments Are All About the Right Synergies

Developed in two phases, The Greene came online in 2006; at the time, the estimated cost of the project was $200 million. The mixed-use campus comprises 760,000 square feet of retail space, alongside some 125,000 square feet of office space and 206 apartments. The property spans 72 acres and is home to more than 100 businesses.

The Greene is at 51 Plum St., just west of Interstate 675. Downtown Dayton is within 10 miles, while Dayton International Airport is some 23 miles away.

Mixed-used destinations to revitalize the U.S.

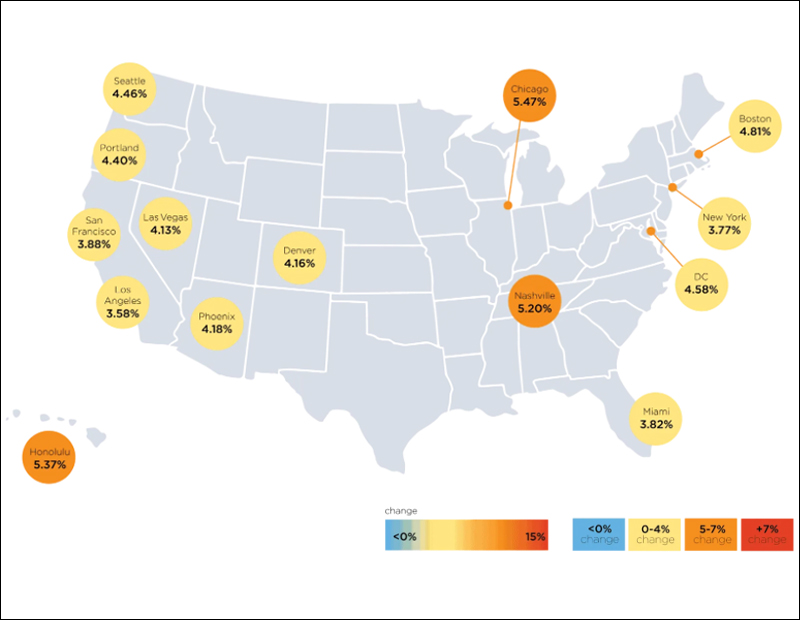

According to a CBRE report, vibrant mixed-use destinations which often include office, multifamily retail and recreational space post vastly improved fundamentals in comparison to their counterparts.

For example, after analyzing 68 such asset types in 19 U.S. markets, the paper shows that the office vacancy rate in those mixed-use districts was 18 percent on average, compared to 22 percent in the cities’ nonprime business districts.

You must be logged in to post a comment.