Single-Tenant Net Lease Cap Rates Creep Downward

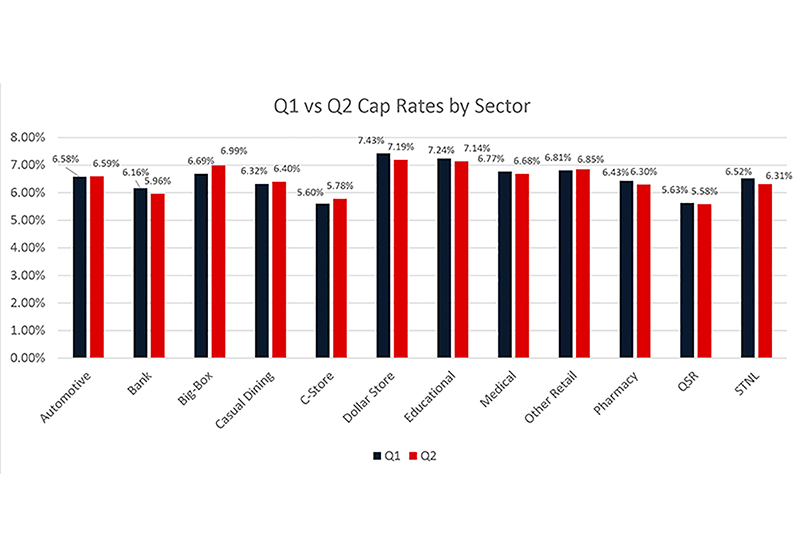

The dollar store sector posted the most significant change, with average cap rates falling from 7.43 percent to 7.19 percent, according to Calkain Research.

Source: Calkain Cos. Q2 Rate Report

Thus far in 2019, the average single tenant net lease cap rate average fell overall from 6.52 percent to 6.31 percent. The dollar store sector posted the most significant change, with average cap rates falling from 7.43 percent to 7.19 percent. The influx of 1,000 new Dollar General stores per year combined with abundance of tertiary locations were the significant factors impacting this sector.

On the opposite end of the spectrum, the big-box sector increased 30 bps, hitting 6.99 percent. The sector staying nearly static was the automotive sector, which was up 1 bps at 6.59 percent. Rates continue to be at an all-time low and with the recent news of an expected additional drop in rates by the Feds, the net lease market shouldn’t see much of an impact on rates, which will likely remain static for the near term.

You must be logged in to post a comment.