Orange County Gives Its Best Performance

At the end of the first half of 2017, the metro reached its lowest vacancy rate since the recession, continuing the previous year’s positive net absorption streak.

By Corina Stef

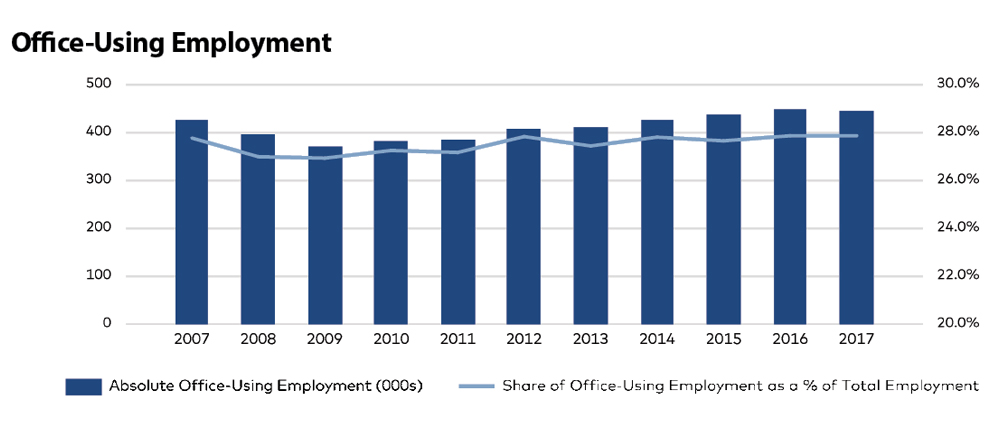

In 1994, Orange County declared the largest municipal bankruptcy in U.S. history, but today, it is heading toward full employment and high consumer confidence. More than two decades later, it has emerged as one of the most promising West Coast metros, due to its ideal geographic location, improved infrastructure, new multifamily developments and thriving local economy. The metro is home to many Fortune 500 and Fortune 1000 companies, and is part of the Tech Coast, bearing a strong academic print that creates a highly educated labor pool. With more than 2.6 million square feet currently under construction and a booming tourism industry, construction and hospitality jobs outperformed the office-using employment sector.

At the end of the first half of 2017, the metro reached its lowest vacancy rate since the recession, continuing the previous year’s positive net absorption streak. Lease rate growth picked up at a slow pace, with outer-ring submarkets such as Newport Center recording the highest lease rates. Corporate giants like Toshiba and Mazda relocated to the metro, and many small and midsize businesses are keen on keeping their local footprint by extending their lease.

Leasing activity is concentrated within five Irvine-area submarkets, while Santa Ana’s affordable rent rates also attract tenants. Vacancy is high in low-density areas such as Buena Park.

Despite a slowdown in sales activity, investor interest remains high. Nearly 6.7 million square feet was sold across the metro for a combined $1.5 billion in the 12 months ending in August.

You must be logged in to post a comment.