Outpatient Facilities Step Into the Spotlight

This shift marks one of the most significant trends in the health-care industry’s recent history.

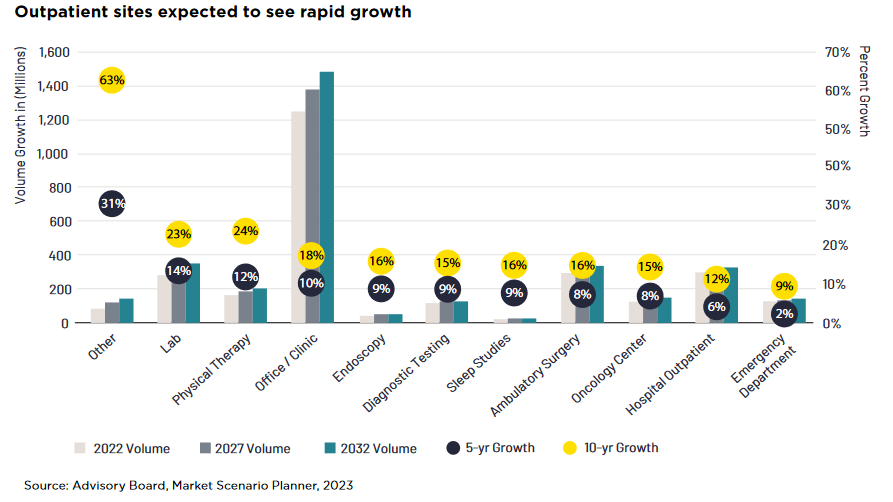

A salient feature of the current health-care industry is an increasing demand for outpatient care, due to the chronic diseases of an aging U.S. population, according to a new white paper by Savills. Outpatient volumes are expected to increase by 26 percent over the next 10 years, the report notes, citing data from Sg2, a Vizient company.

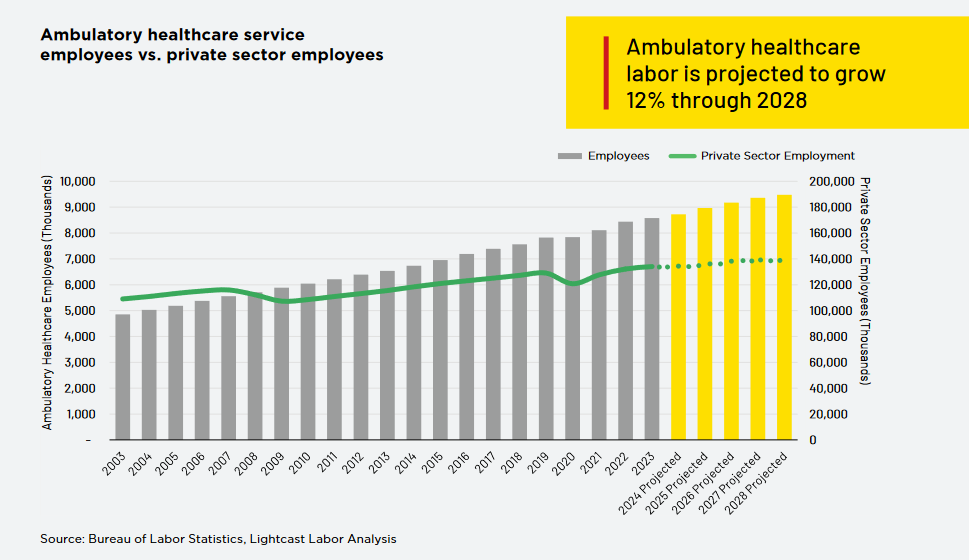

The shift is expected to drive significant growth in health-care employment, which is projected to increase by 12 percent through 2028. That in turn will require new health-care real estate.

Moreover, health-care systems are focusing on construction and design projects that support this shift, with an emphasis on adaptable environments.

That trend doesn’t automatically benefit health-care real estate, however. Health-care providers need a data-driven real estate strategy to optimize their portfolios, which includes the right locations and property types for outpatient facilities. Factors such as patient demand, demographics and competitor locations also need to be taken into account.

READ ALSO: MOB Tenants: What’s Hot and What’s Not

The report also details various types of outpatient facilities, including single-tenant buildings, repurposed office spaces, standard medical office buildings, “Medtail” (medical retail) and adaptive reuse of commercial buildings. Each of these facilities comes with its own advantages and challenges.

For example, a single-tenant building provides complete control over parking, branding and signage. But it can also be a costly option.

Redevelopment of other types of commercial buildings for conversion to medical office can offer unique attributes such as high ceilings, brick facades and wide-open space. Such space is also easily customizable. On the other hand, the extent of the redevelopment varies depending on the condition of the property.

“Medtail” involves converting retail spaces into medical. In retail centers with high vacancy, such a redevelopment can yield solid transaction terms. By contrast, construction costs can be high, considering the high ceilings and low level of infrastructure common in retail buildings.

As for traditional medical office buildings, they offer institutional credibility and proximity to ancillary services, such as imaging. Still, negotiating lease terms can be challenging, with less flexibility due to the owner’s perception of tenants as confined to the campus.

The steps health-care real estate needs to take

The transition to outpatient represents an opportunity for health systems to optimize their real estate, the report noted.

By focusing on convenient locations and adaptable facilities, providers can not only adapt to this shift but also thrive in the evolving health-care landscape.

Owners of health-care real estate need to evaluate their existing portfolios to identify opportunities for renovation, repurposing or divestiture, and do thorough market analysis to identify optimal locations that balance cost, accessibility and patient demographics, Savills explained.

You must be logged in to post a comment.