Oversupplied Self-Storage Markets Face Further Rent Decline

Street-rate rents have dropped 4.1 percent across the U.S. Metros on the west, however, continued to elevate as supply lags demand.

By Evelyn Jozsa

Self-storage rents further declined in August due to new projects coming online. On a year-over-year basis, street-rate rents have contracted by 4.1 percent for 10×10 non-climate-controlled and 2.8 percent for 10×10 climate-controlled units. In oversupplied Texas metros, such as Austin and Dallas, rents were down 4.7 and 6.6 percent. Rent rates remained flat in Houston where existing supply per capita is 60 percent higher than the national average of 6 net rentable square feet.

Las Vegas remained the best-performing market, as rent growth reached 6.3 percent for non-climate controlled and 9.4 percent for climate-controlled units year-over-year. Limited opportunity for new development pushed rents up in the Inland Empire. Year-over-year, street-rate rents reached 2.8 percent for non-climate-controlled and 5 percent for climate-controlled units. Additionally, the highest asking rents for the average 10×10 non-climate-controlled unit were recorded in California metros, such as San Francisco ($194), Los Angeles ($183) and San Jose ($187). In the Pacific Northwest, the asking rent for the average 10×10 non-climate-controlled unit was $158 in Seattle and $151 in Portland.

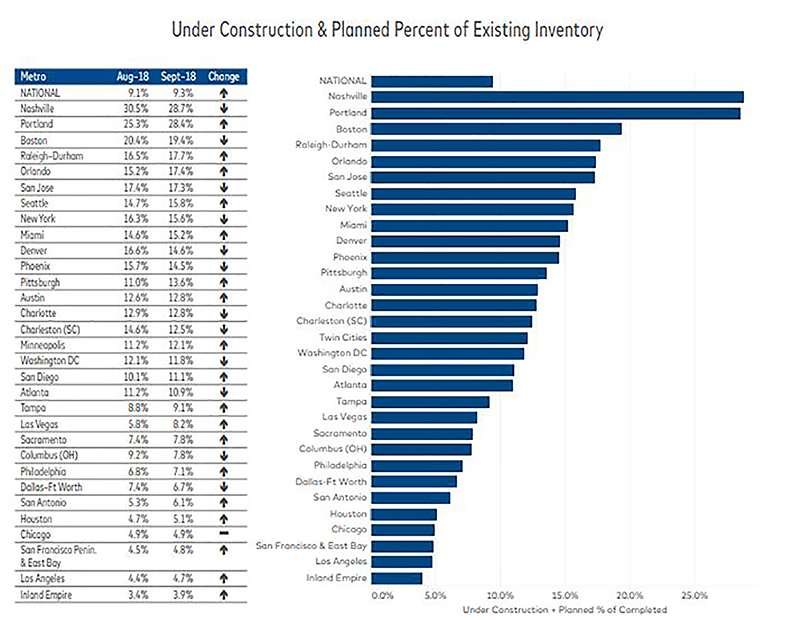

Across the country, development activity hit a new milestone year-to-date. Planned and under construction projects represent a total of 9.3 percent of existing inventory, representing a 20-basis-point increase over the previous month. Metros such as Nashville, Portland and Boston maintained heightened activity—demand for new development is driven by in-migrating Millennials for a diverse job market and students moving into the area for college. Robust population and employment growth also boosted activity in Orlando and Seattle, where new-supply pipelines account for 17.4 and 15.8 percent, which represented 220- and a 110-basis-point increases over July levels.

You must be logged in to post a comment.