Pan-European vs. U.S. Funds

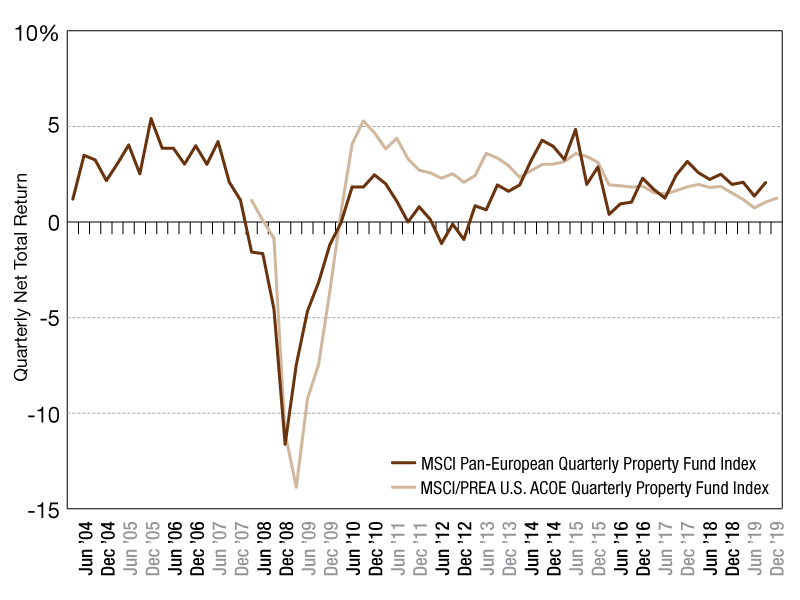

Pan-European funds underperformed compared to U.S. funds in the years following the financial crisis and during the European Sovereign debt crisis, but that in more recent years, Pan-European fund returns have been out-performing U.S. funds.

comparing European and U.S. unlisted real estate fund returns

While real estate has historically had a strong home bias, the asset has become increasingly globalized. A good example of this is the rise of regional investment indexes like the MSCI Pan-European Quarterly Property Fund Index, which has grown from €406 million at its inception in Q4 2004, to €29 billion as at September 2019.

The performance of the index has varied over time. Between March 2008 and March 2010, quarterly returns were negative as the impact of the global financial crisis was felt across property markets.

After returning to positive territory in 2010, total returns softened again and became negative in 2012 amid the uncertainty of the European sovereign debt crisis. The index returned to growth in March 2013 and has posted 27 quarters of positive total returns since then.

If we compare the performance of the MSCI Pan-European Quarterly Property Fund Index, against that of the MSCI/PREA U.S. ACOE Quarterly Property Fund Index, we observe that Pan-European funds underperformed compared to U.S. funds in the years following the financial crisis and during the European Sovereign debt crisis, but that in more recent years, Pan-European fund returns have been out-performing U.S. funds.

Insights and data provided by MSCI Real Estate, a leading provider of real estate investment tools. A Vice President in MSCI’s global real estate research team, Reid focuses on performance measurement, portfolio management and risk related research for asset owners and investment managers. Based in Sydney, he covers APAC as well as global markets.

You must be logged in to post a comment.