Peak Carbon Emissions Fall, But Faster Decline Needed

Global carbon emissions peaked in 2019, but the world is heading for a 3.3-degree rise in temperature by 2100, Bloomberg research says.

Image by Gerd Altmann via Pixabay

The coronavirus pandemic has disrupted all industry sectors and all aspects of our lives. But one positive effect, research shows, was a substantial drop in energy demand, which is estimated to remove some 2.5 years’ worth of energy sector emissions through 2050.

In its New Energy Outlook 2020, BloombergNEF projects the evolution of the global energy system over the next three decades. The report focuses on three components:

- the Economic Transition Scenario, which is a combination of near-term market analysis, least-cost modeling, consumer uptake and trend-based analysis to describe the deployment and diffusion of commercially available technologies;

- the NEO Climate Scenario, which studies ways to reduce greenhouse gas emissions to meet a well-below-two-degree emissions budget;

- the Implications for Policy section, which offers perspective on some of the most important policy areas that emerge from the two core scenario analyses.

Economic Transition Scenario

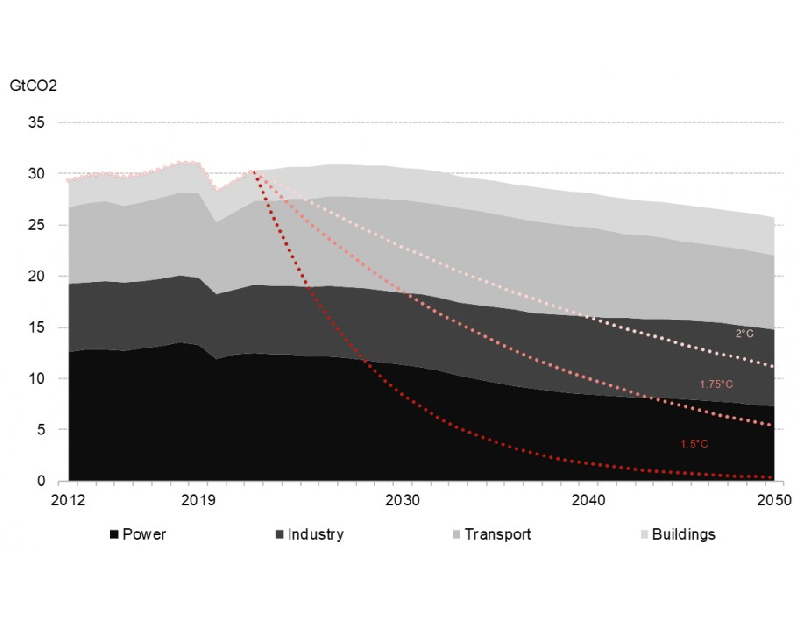

Global carbon emissions from energy use have peaked in 2019 at almost 32 gigatons, as the current health crisis caused them to drop 8.6 percent in 2020. Alongside the projected economic recovery, carbon emissions will rise again toward 2027 and then decline again 0.7 percent year-over-year to 2050 to almost 27 gigatons, which is 16 percent below 2019 levels. This will put the world on track for 3.3 degrees of warming by 2100. To avoid such a major temperature increase and keep global warming below 2 degrees, carbon emissions need to fall 10 times faster, at 6 percent year-over-year to 2050. To reach the 1.5 degrees goal, the required rate is 10 percent.

Emissions in the NEO Economic Transition Scenario, by sector, and a 1.75 degrees Celsius carbon budget. Chart courtesy of BloombergNEF

The power sector, which currently makes up approximately 42 percent of emissions from fuel combustion split mostly between coal and gas, will register the biggest decrease. After peaking in 2018, the carbon emissions are projected to decline 2 percent year-over-year to 2050—specifically by 46 percent from their peak—accounting for 27 percent of emissions from fuel combustion. Emissions from all transport will peak in 2035 as a result of ongoing growth in aviation and shipping. Furthermore, emissions from fuel combustion in buildings will grow steadily at 0.7 percent to return to 2018 in 2050.

Wind and photovoltaics will grow to meet 56 percent of world electricity demand in 2050—up from 9 percent in 2020—with nuclear, hydro and other renewables providing a further 20 percent, the report shows. Leading countries will hit economic limits at about 70 – 80 percent. Wind is projected to retake the lead from solar.

READ ALSO: Energy Demand During Pandemic Times and Beyond

Renewables and batteries capture 80 percent of the total $14.1 trillion invested in new power capacity, around $2 trillion of which is invested by households and businesses. Asia Pacific is estimated to attract 45 percent of all new capital. However, to enable the power system of the future, $14 trillion in grid investment is needed over the next 30 years, according to the analysis.

“Our projections for the power system have become even more bullish for renewables than in previous years, based purely on cost dynamics. What this year’s study highlights is the tremendous opportunity for low-carbon power to help decarbonize transport, buildings and industry—both through direct electrification and via green hydrogen,” said Seb Henbest, chief economist at BNEF and lead author of NEO 2020.

The study shows that oil demand will peak in 2035, then fall 0.7 percent year-over-year and then fall back to 2018 levels in 2050. Electric vehicles will reach price parity with internal combustion engine vehicles before 2025 and will register a faster adoption thereafter.

The outlook shows that gas is the only fossil fuel to continue on an upward path, gaining 0.5 percent year-over-year to 2050. Specifically, the cumulative growth of 33 percent in buildings and 23 percent in the industry is matched by declining gas use in power, where consumption peaked in 2019, although gas-fired power capacity continues to grow worldwide.

Coal demand—which peaked in 2018—will collapse to 18 percent of primary energy by 2050, from 26 percent today. Even though it will be declining across Europe and the U.S., coal-fired power will peak in China in 2027 and in India in 2030.

READ ALSO: IEA’s World Energy Outlook 2020

Energy Use and Buildings

Demand for energy in residential and commercial buildings will increase to 47,000TWh by 2050, up 42 percent from 33,000TWh in 2019. Growth will be driven largely by rising population and GDP, which will outweigh the impacts of efficiency gains and warmer winter temperatures.

Air conditioning and appliances are projected to boost energy use substantially. Appliances will overtake space heating in 2040 and energy demand for cooling will grow faster, more than doubling in 2050. Geographically, growth in energy demand from buildings will come from warmer countries that are set to become more populous and wealthier over the 30 years analyzed in the report. Residential building energy demand will rise 76 percent in these countries.

In colder climates, the combination of better energy efficiency, slower population growth and a warming climate will keep residential energy demand relatively unchanged between 2019 and 2050. However, in these regions, demand will grow faster in commercial buildings—up 37 percent in 2050.

Emissions from energy use in buildings will rise 26 percent between 2019 and 2050. According to the report, this is almost all due to growth in gas and oil use in India and other rapidly developing countries. Still, emissions will rise in China, the U.S. and Europe as well, but at a much slower pace.

Overall, worldwide power capacity will almost triple between 2019 and 2050—but it will become much more distributed, with behind-the-meter consumer photovoltaics and batteries accounting for 13 percent of installed capacity. Consumer decisions are essential in this scenario: Initially, household decisions to add photovoltaics, behind-the-meter batteries, or purchase electric vehicles will be few, but they will grow exponentially, mainly due to cheaper technology and imitation effects.

NEO Climate Scenario

This scenario looks for a clean electricity and green hydrogen pathway to keeping temperatures well below 2 degrees.

“The next 10 years will be crucial for the energy transition. There are three key things that we will need to see: accelerated deployment of wind and photovoltaics; faster consumer uptake in electric vehicles, small-scale renewables, and low-carbon heating technology, such as heat pumps; and scaled-up development and deployment of zero-carbon fuels,” said Jon Moore, CEO of BNEF.

READ ALSO: NortH2: Europe’s Largest Green Hydrogen Facility

This scenario describes a low-carbon future energy economy supplying 100,000TWh of clean energy by 2050, which is five times the electricity produced in the world today. Such a capacity requires a power system that is six to eight times larger. Of this energy capacity, two-thirds would go to direct electricity provisions in transport, buildings and industry, and the remainder would be allocated to manufacturing hydrogen. Even so, green hydrogen will provide just under a quarter of total final energy in 2050. To manufacture this amount of green hydrogen, an additional 14 terawatts of renewables, 9.5 terawatts of offshore wind or 4 terawatts of new nuclear is needed. And while the renewable route might be cheaper, land is an issue, as the power system would take up an area the size of India.

Between $78 trillion and $130 trillion in new investment is required to reach this enhanced capacity of clean energy and green hydrogen by 2050, according to the report. These funds would cover growth in electricity generation and the power grid, as well as costs related to manufacturing, storing and transporting hydrogen.

You must be logged in to post a comment.