Phoenix Named Top Growth Market for Big-Box Industrial: CBRE

Transactions in this category totaled 349 million square feet in the top 22 North American markets last year.

The latest report from CBRE has named Phoenix as the top growth market in the U.S. when it comes to big-box leasing activity, with a 2020 inventory absorption of 9.1 percent.

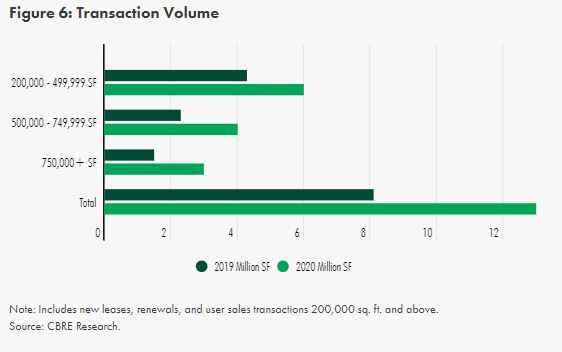

Transaction activity has hit a record high, with the metro being named a top 10 market, registering 13 million square feet of transactions—those of 200,000 square feet or larger. Transactions in this category totaled 349 million square feet in the top 22 North American markets last year, up from 280 million square feet in 2019.

Phoenix is one of the fastest-growing metros in the U.S., with close to five million people living within 50 miles of the population center, and is expected to grow 8 percent over the next five years. The local warehouse labor force of 58,167 is expected to grow by 10.1 percent over the next 10 years.

“Inbound migration from coastal cities, both east and west, has driven demand for all product types in Phoenix. New home sales increased more than 13 percent in 2020, which has brought an incredible labor supply to the Valley, and quality manufacturing companies are taking notice,” Jackie Orcutt, senior vice president, CBRE, told Commercial Property Executive.

“In the first quarter of this year, more than 15 million square feet were planned for new construction, with half of that space already spoken for prior to delivery,” she said.

Metro Incentives Aid Growth

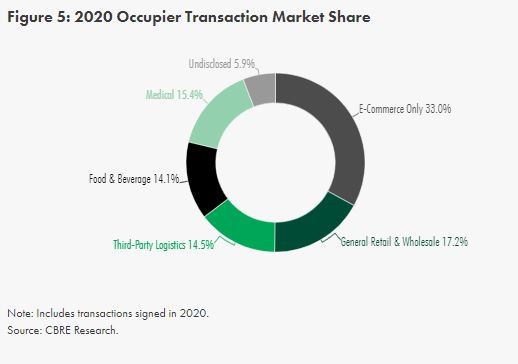

Net absorption also doubled to 10.5 million square feet and the direct vacancy rate fell by 2 percentage points to 7 percent. Ecommerce occupiers accounted for 33 percent of total transactions, followed by medical at 15.4 percent.

In addition, Phoenix has 8.3 million square feet of big-box space under construction with demand increasing and preleasing for new space already at 48.4 percent.

According to the report, over the past five years there have been 140 economic incentive deals totaling close to $223 million at an average of $6,083 per new job in the Phoenix metro area.

The top programs include the Arizona Competes Fund that provides grants to businesses that achieve certain performance and create new jobs with wages equal to or above the median county wage, as well as the Quality Jobs Tax Credit Program, which awards income tax credits of up to $9,000 per job to create high-quality employment opportunities in the state.

“Phoenix boasts strong infrastructure, a stable environment free from natural disaster, and ample room for growth, both with available land for development, and a growing population,” added Orcutt.

You must be logged in to post a comment.