Placer.ai Office Index—December 2024 Recap

Find out how visits are trending in major cities.

Nationwide office visits closed out December 2024 at 39.2 percent below December 2019 levels—a bigger visit gap than that seen in November (37.6 percent), but a narrower one than last December’s 42.8 percent.

Office visits in New York and Miami hovered around 20.0% below pre-pandemic levels. Atlanta (down 34.1 percent) and Dallas (down 35.2 percent) also outpaced the national average.

San Francisco finally pulled out of last place for year-over-five-year recovery—thanks in part to recent RTO mandates from local heavyweights like Salesforce.

Return-to-office mandates are once again the talk of the town, with companies from Amazon to AT&T set to crack down on remote work in the new year—in some cases, demanding that workers show up in person five days a week.

But how did the office recovery shape up in December 2024? We dove into the data to find out.

December doldrums

December is typically a quiet month for offices, with many Americans taking time off for the holidays to enjoy vacations and family gatherings. So, it may come as no surprise that office visits in December 2024 dropped to their lowest point of the year.

Compared to December 2019, office visits in December 2024 lagged by 39.2 percent—a bigger visit gap than that seen in either November (37.8 percent) or October (34.0 percent), as employees likely embarked on extended “workations” and enjoyed greater WFH flexibility during the holiday season. Put another way, December 2024 office foot traffic clocked in at 60.8 percent of pre-pandemic (December 2019) levels.

Still, offices were busier this December than last—in December 2023, the recovery compared to December 2019 stood at just 57.2 percent.

New York, Miami, and … San Francisco?

New York and Miami once again led the regional return to office charge with year-over-five-year visit gaps of 19.6 percent and 20.9 percent, respectively—though both cities’ year-over-five-year numbers were weaker than those seen in either October or November.

Atlanta (-34.1 percent) and Dallas (-35.2 percent) also outperformed the nationwide average for year-over-five-year office foot traffic. And with Dallas-based companies like AT&T and Southwest Airlines starting to enforce stricter in-office policies in the new year, the Texas hub may experience even more accelerated recovery in the coming months. (AT&T also has a strong presence in Atlanta, which may also benefit from the company’s crackdown.)

Meanwhile, San Francisco, which has long lagged in post-pandemic office recovery, finally pulled out of last place in December 2024 with a year-over-five-year visit gap of 48.0 percent, just edging out Chicago. The impressive year-over-year office visit growth seen by the West Coast hub in recent months—likely fueled in part by Salesforce’s recent RTO mandate—appears to have finally left a tangible mark on the city’s year-over-five-year ranking.

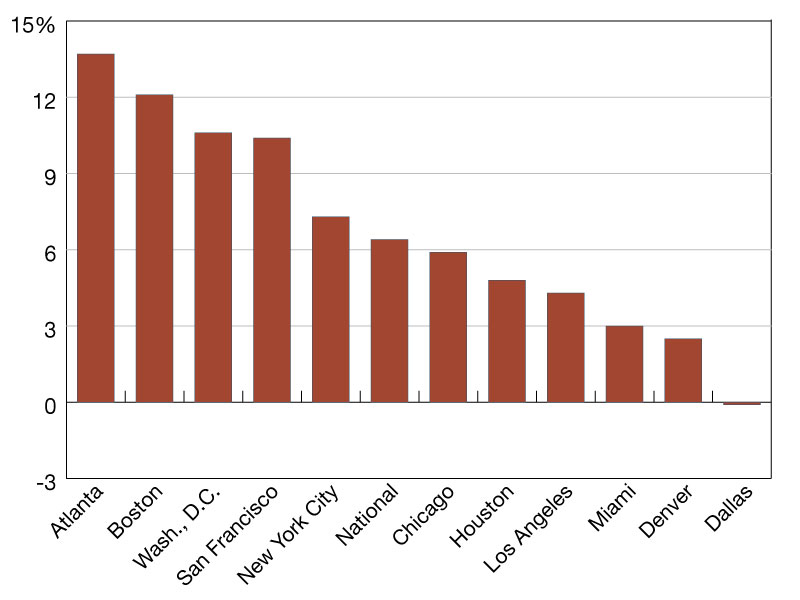

Year-over-year, visits to office buildings nationwide were up 6.4 percent in December 2024—showing that despite seasonal setbacks, office visits remain overall on an upward trajectory. Atlanta (13.7 percent) and Boston (12.1 percent) led the way for year-over-year office recovery, followed by Washington, D.C. (10.6 percent) and San Francisco (10.4 percent).

As additional RTO mandates go into effect in the new year, the office recovery needle may move once again. Will additional companies jump on the full-time in-office bandwagon—or will hybrid work models continue to dominate?

Follow placer.ai’s data-driven office index reports to find out.

This blog includes data from Placer.ai Data Version 2.1, which introduces a new dynamic model that stabilizes daily fluctuations in the panel, improving accuracy and alignment with external ground truth sources.

—Posted on January 29, 2025

You must be logged in to post a comment.