Placer.ai Office Index—November 2024 Recap

Find out how visits are trending in major cities.

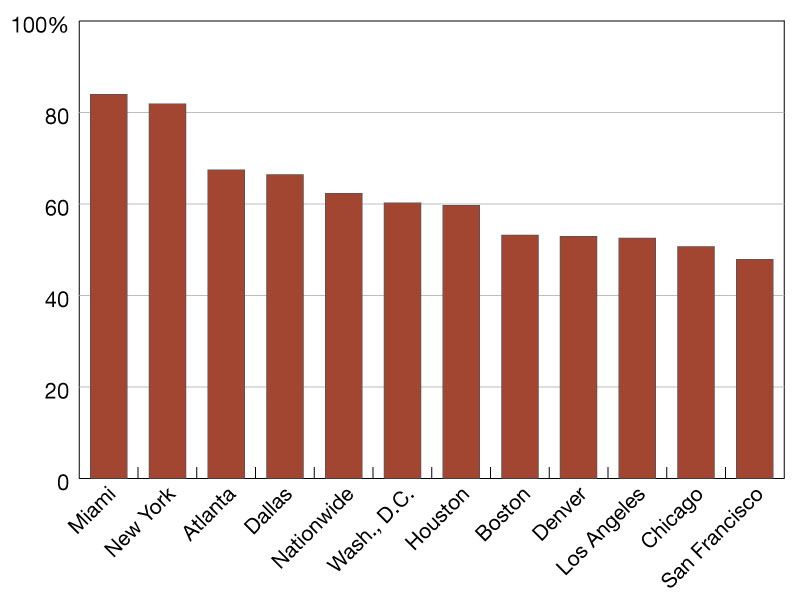

In November, visits to office buildings nationwide were 62.4 percent of November 2019 (pre-pandemic) levels, down from 66.7 percent in November 2023.

Miami led the regional office recovery pack with visits at 84.0 percent of November 2019 levels, followed by New York (81.9 percent).

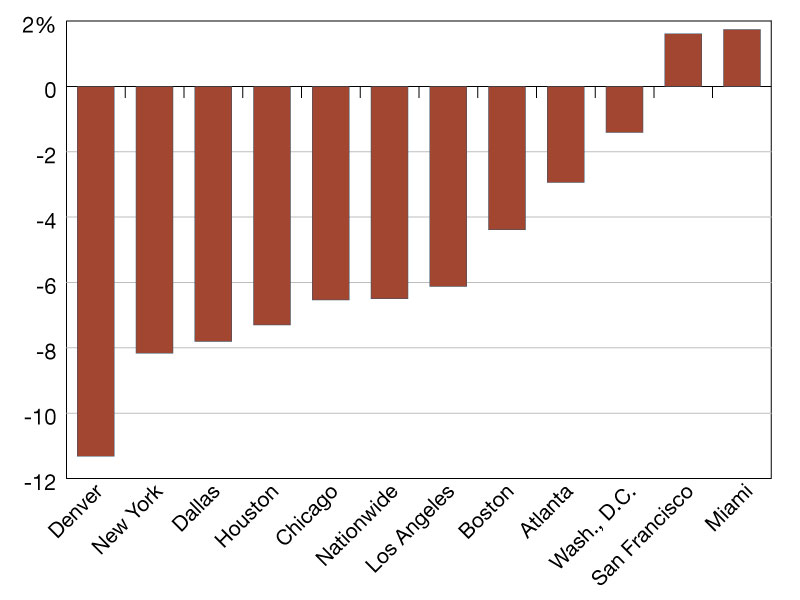

Year over year, office foot traffic dropped 6.5 percent in November 2024—likely due to record-breaking Thanksgiving travel. But some cities, including San Francisco and Miami, continued to see year-over-year visit growth.

After reaching new heights in October 2024, how did the office recovery fare in November? We dove into the data to find out.

Two steps forward, one step back…

In November 2024, visits to office buildings nationwide were 62.4 percent of what they were in November 2019, down from 66.7 percent in November 2023. This marks the most substantial drop in office foot traffic since January 2024—and a sharp decline from October 2024.

But though significant, November’s downturn is likely a reflection of this year’s record-breaking Thanksgiving travel rather than of any real office recovery slowdown. Millions of Americans took to the skies and roads to spend the holiday with loved ones. And with remote work making it easier than ever before for professionals to plug in from virtually anywhere, many likely extended their trips without taking extra days off—leading to fewer office visits in the days leading up to the holiday.

READ ALSO: When Office Meets Hospitality: A Love Story

Taking a look at regional trends, Miami continued to outshine other cities in November 2024, with visits at 84.0 percent of pre-pandemic levels—perhaps due in part to strict return-to-office policies implemented by major players within the city’s growing tech and finance sector. New York came in second with recovery at 81.9 percent, while San Francisco continued to lag behind other major cities. But with major projects like the September 2024 grand opening of the revamped Transamerica Pyramid set to revitalize the city’s Financial District, more accelerated recovery may be ahead for this West Coast hub.

Indeed, San Francisco was among November 2024’s regional leaders for year-over-year office visit growth. Nationwide, office building foot traffic was down 6.5 percent year-over-year. But in San Francisco, visits increased 1.6 percent—likely bolstered by recent RTO mandates from major local employers like Salesforce. The city’s temperate climate may also have played a role in encouraging residents to stay local for the holidays. Miami, too—a popular holiday destination in its own right—saw visits increase 1.7 percent year-over-year.

Denver, meanwhile, experienced its fourth snowiest November on record, which may have contributed to a larger portion of its workforce embracing remote work during the month—and an 11.3 percent year-over-year visit decline. And in New York, extended “workcations” by remote-capable finance employees, as well as potential disruptions in public transit and increased congestion during the holiday season, may have fueled a larger-than-average drop. Given the Big Apple’s strong overall recovery trajectory, we will likely see a rebound to more robust year-over-year growth by January, when the holiday season winds down.

This blog includes data from Placer.ai Data Version 2.1, which introduces a new dynamic model that stabilizes daily fluctuations in the panel, improving accuracy and alignment with external ground truth sources.

—Posted on December 26, 2024

You must be logged in to post a comment.