Portland’s Silicon Forest Continues to Grow

Multifamily demand remains elevated, fueled by a healthy job market and an influx of young people. Oregon’s GDP grew 4.6 percent as of the third quarter of 2016, placing it in the top 10 fastest-growing states in the nation.

By Adina Marcut

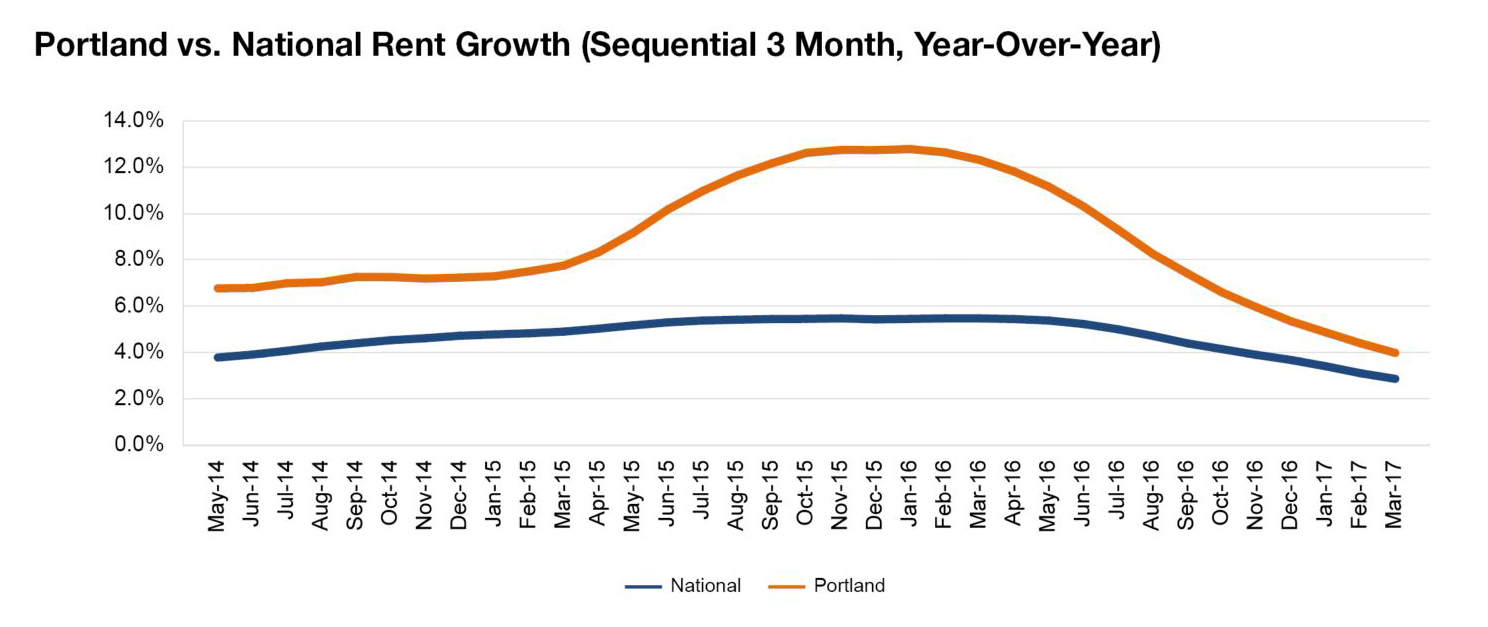

Portland rent evolution, click to enlarge

Portland’s multifamily demand remains elevated, fueled by a healthy job market and an influx of young people for professional and lifestyle purposes. Affordability remains a concern, and high rents have started to drive some renters to more affordable submarkets outside the city core.

Oregon’s Gross Domestic Product grew 4.6 percent as of the third quarter of 2016, placing it in the top 10 fastest-growing states in the nation. Employment is thriving, with more than 28,000 jobs added in 2016, led by mining, logging and construction, and education and health services. The relatively lower cost of doing business compared to other West Coast metros has helped drive hiring, a boost to household formation. To speed delivery to the growing base of consumers in the metro, Amazon will open an 850,000-square-foot fulfillment center in the Port of Portland’s Troutdale Reynolds Industrial Park.

While supply growth has increased, the number of new units delivered in recent months has not been able to meet demand, as occupancy remains high. Significant in-migration will likely allow the more than 25,000 units in the development pipeline to be absorbed smoothly. New supply is mainly focused in urban core submarkets, but the suburban submarkets of Tanasbourne and St. Johns/University Park are also showing considerable supply increases. Due to continued strong demand, we expect rents to grow by 5.0 percent in 2017.

Read the full Yardi Matrix report.

You must be logged in to post a comment.