Yardi Matrix Analysis: Positive News for Retailers

Retailers received some encouraging news on Tuesday, at the start of the holiday shopping season, in the form of newly released CCI and GDP numbers, reports Yardi Matrix Market Analyst Justin Dean.

By Justin Dean

Retailers received some encouraging news on Tuesday, at the start of the holiday shopping season: The release of two economic indicators included many positive signs that could point to a healthy holiday shopping season to close out the year. A strong shopping season should provide support to both retail and industrial real estate, as both traditional brick-and-mortar and e-commerce retailers stand to benefit.

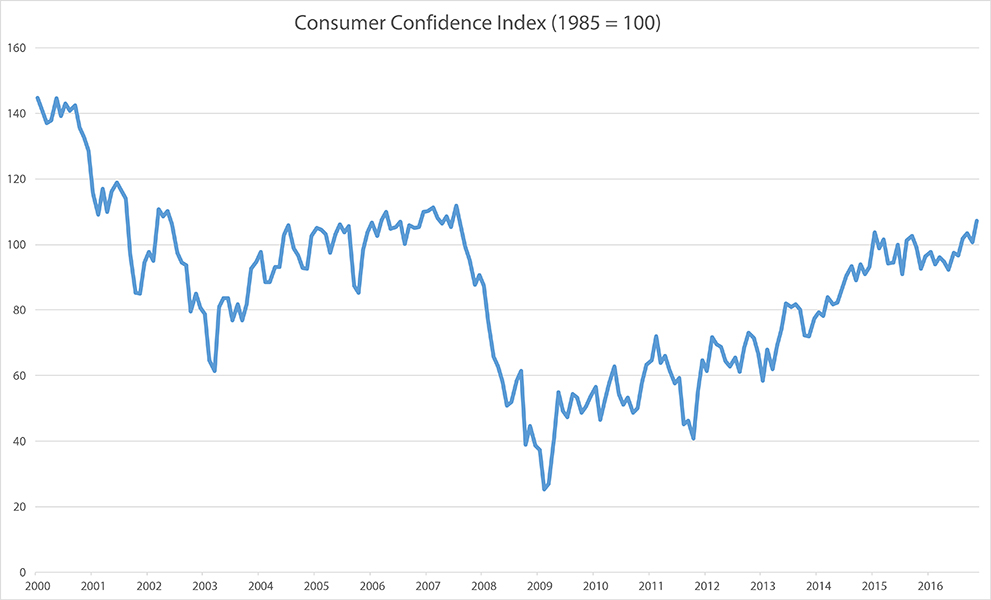

The Consumer Confidence Index (CCI) hit a high-water mark not seen in nearly a decade, The Conference Board announced on Tuesday. The index reached 107.1 in November, the highest the CCI has been since July 2007, shortly before the onset of the Great Recession. This was up significantly from 100.8 in October, a number that was revised upward from an original 98.6.

Within the CCI, the dichotomy between consumers’ evaluation of the current situation and expectations of the future remained clear, though both metrics grew considerably in November. The Present Situation Index, which accounts for two-fifths of the CCI, increased from 123.1 in October to 130.3. The Expectations Index, which makes up the other three-fifths of the CCI, jumped from 86.0 to 91.7 during the period.

Another encouraging indicator for retailers at the beginning of the holiday shopping season is the revision to third-quarter GDP, also released on Tuesday. Annualized GDP growth was revised upward 30 basis points to 3.2 percent, up from 2.9 percent, according to the Commerce Department. More reassuring for retailers is the fact that much of this upward revision was driven by increases in consumer spending, with annualized personal consumption expenditures (PCE) growth revised upward from 2.1 percent to 2.8 percent. In raw dollars, the PCE increased $78.7 billion over the second quarter and $307.6 billion since the third quarter of 2015.

That consumers both are more optimistic about the economy and have increased spending is much welcome news to retailers. In particular, these figures should help stem the tide of the creative destruction brought on by Internet retailers. However, the long-term outlook for traditional brick-and-mortar retail locations remains dismal, as e-commerce continues to rapidly absorb market share.

Online retailers, which have had the advantage in holiday shopping sales over brick and mortar for four straight years and look likely to maintain that for a fifth, can be even more encouraged by this news. And their growth should drive further demand for industrial spaces such as order fulfillment centers. Moreover, as consumers’ desire for same-day delivery intensifies, so too will the demand for localized distribution centers. In effect, this would reduce e-commerce firms’ ability to operate out of only a handful of large warehouses across the country and instead could lead to the tightening of industrial markets in numerous cities across the country.

While these numbers should boost expectations at the beginning of the holiday season, official figures giving a better idea of the season’s strength are set to be released on Dec. 14, when the Census Bureau comes out with its retail sales report for November.

You must be logged in to post a comment.