Power Generation Feels Winds of Change

Renewable sources achieved a milestone this spring, and new projects could lead to a dramatic expansion of green power over the next several years.

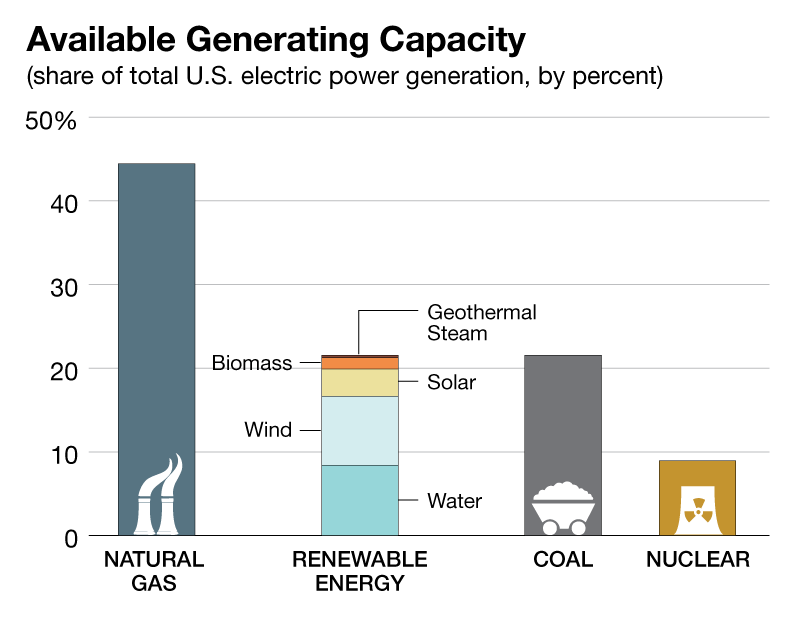

Current trends in electric generation are a sure sign that it’s no longer business as usual. Renewable renewable energy sources recently reached a milestone, as As UtilityDive recently pointed out. As of April, 21.56 percent of capacity is provided by water, wind, solar, geothermal and biomass sources. That edges out coal’s 21.55 percent share, according to the Federal Energy Regulatory Commission’s monthly report, and moves renewables to second place among power sources behind only gas-fired generation, which accounts for 44.44 percent of the nation’s electric power capacity.

Current trends in electric generation are a sure sign that it’s no longer business as usual. Renewable renewable energy sources recently reached a milestone, as As UtilityDive recently pointed out. As of April, 21.56 percent of capacity is provided by water, wind, solar, geothermal and biomass sources. That edges out coal’s 21.55 percent share, according to the Federal Energy Regulatory Commission’s monthly report, and moves renewables to second place among power sources behind only gas-fired generation, which accounts for 44.44 percent of the nation’s electric power capacity.

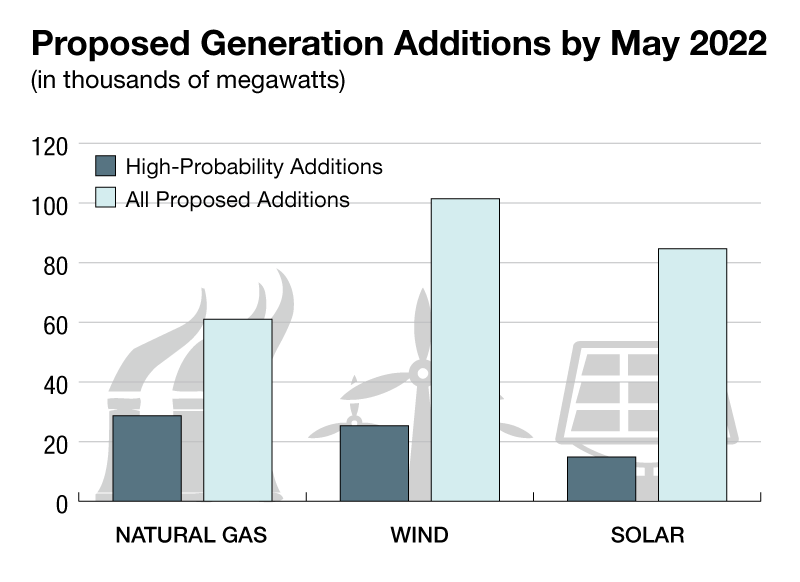

Gas-fired power won’t be going away any time soon. For the first four months of 2019, new gas-fired capacity totaled nearly 5,000 megawatts, handily outpacing the 3,600 Mw of new wind and solar capacity that came online over the same period. And the agency’s projections of proposed new generating capacity that is most likely to come online by May 2022 call for 28,000 megawatts of gas-fired power, more than for any other source.

Developers continue to bring major gas-fired projects on line. In April, Duke Energy held a formal grand opening for the Citrus Combined Cycle Station, a $1.5 billion facility on Florida’s Gulf Coast. Part of Duke’s Crystal River Energy Center, the 1640-megawatt power plant is located about 85 miles north of Tampa.

Developers continue to bring major gas-fired projects on line. In April, Duke Energy held a formal grand opening for the Citrus Combined Cycle Station, a $1.5 billion facility on Florida’s Gulf Coast. Part of Duke’s Crystal River Energy Center, the 1640-megawatt power plant is located about 85 miles north of Tampa.

But those numbers tell only part of the story. The latest figures from FERC underscore the gradual transition to renewable sources. Proposed wind and solar projects categorized by the agency as likely to come to fruition encompass some 40,000 Mw between them (25,000 megawatts of wind and 15,000 megawatts of solar).

Americas Solar Power Market: Forecast to 2022, a March 2019 report from the Frost & Sullivan consulting firm, projects that the U.S. solar market will expand by 8 to 10 gigawatts annually through 2022. Thanks to low system costs, utility-scale installations are on track to keep rising, import duties notwithstanding, the study predicts.

Citrus Combined Cycle Station Image courtesy of Duke Energy

Although gas-fired capacity is still the leading source of generation, several projects announced this spring symbolize the transition from fossil fuels to renewable energy. In Somerset, Mass., the former site of a coal-fired plant is set to host a 300-acre complex that will serve the wind energy sector. Commercial Development Co. and Anbaric unveiled a plan to create Anbaric Renewable Energy Center, a 300-acre complex on the Taunton River. The centerpiece of the plan, which was announced in mid-May, is a 1200-megawatt wind transmission facility, along with400 megawatts of battery storage. Between them, the two components represent an estimated $650 million investment.

Conventional utilities are getting into the act, as well. Among the latest utilities to pledge an all renewable Green Mountain Power, a utility serving 75 percent of Vermont (is that by population or by area), announced in April a goal of carbon-free generation by 2025 and entirely renewable power sources by 2030.

The trend toward renewables is even more striking when considered from the perspective of total proposed capacity, which encompasses all proposed projects tallied by FERC, as well as those considered likely to move forward. If all the currently proposed wind capacity proposed to come online by 2022 were installed, new wind capacity would total some 101,000 megawatts, compared to 61,000 megawatts of gas-fired capacity in the pipeline.

The trend toward renewables is even more striking when considered from the perspective of total proposed capacity, which encompasses all proposed projects tallied by FERC, as well as those considered likely to move forward. If all the currently proposed wind capacity proposed to come online by 2022 were installed, new wind capacity would total some 101,000 megawatts, compared to 61,000 megawatts of gas-fired capacity in the pipeline.

New solar power installations would also exceed gas-fired capacity by a considerable margin, totaling some 84,000 megawatts. Also of note, some 13,000 megawatts of coal-fired power sources and 10,000 Mw of gas-fired generation is scheduled to be retired by 2022.

You must be logged in to post a comment.