Pre-Pandemic Confidence Returns to CRE: NAIOP

The organization's Sentiment Index rose to a level last observed in 2019.

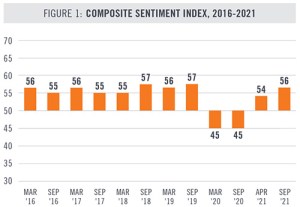

The sentiment for the commercial real estate industry in the U.S. has risen to pre-pandemic levels, according to NAIOP. The Sentiment Index rose to 56 in the organization’s fall 2021 report, up from 54 earlier in spring.

The organization’s Sentiment Index, released every spring and fall, is geared toward predicting the general conditions in the commercial real estate industry over the next 12 months. The score is generated by asking industry developers and brokers for predictions on a number of key indicators, including occupancy rates, rents, and the availability of debt and equity capital. The latest index saw a total of 357 respondents from 263 different companies, according to NAIOP.

READ ALSO: SIOR: Industrial Sales to Surpass 2019 Record

The new index reading matched NAIOP’s spring 2019 report prior to the start of the COVID-19 pandemic, which also came in at 56. Looking at the pandemic’s impact on the commercial real estate industry, the Sentiment Index fell to 45 in the spring and fall 2020 reports. RCLCO’s Sentiment Index that was released in January also saw a major increase in the last six months but showed that the 2021 levels were still far below the year-end 2019 levels.

The commercial real estate industry plays a significant role in the U.S. economy and the organization is cautiously optimistic that the industry and the national economy will continue to recover, according to Thomas Bisacquino, president & CEO of NAIOP, in prepared remarks.

Many survey respondents noted positive factors in regard to pricing for construction materials and labor. They indicated that they expect construction costs to continue to rise, but that they also expect to see the pace of material price inflation slowing down. The respondents also noted that construction material and labor costs are likely to increase over the next 12 months, but they were less pessimistic about material costs compared to the spring 2021 survey.

Industrial leading the road to recovery

The industrial sector of commercial real estate is expected to see the most momentum as 62.7 percent of survey respondents said they expect to be the most active in industrial projects or transactions when looking at the next year. A far smaller share of the respondents—22.6 percent—said they expect to be the busiest with multifamily properties, while office properties received 11.9 percent of respondents and the retail sector garnered 2.8 percent.

Overall, the respondents said they were optimistic about face rents, effective rents, occupancy rates and employment in their companies compared to the April survey. Respondents also said they expect cap rates to decline, contrasting past prospects of rates increasing or staying flat.

However, the Sentiment Index report also noted that the high levels of variation in the responses could be a sign of uncertainty. The direct comments from survey respondents pointed out some stark differences between sectors, with comments ranging from a strong outlook for the West Coast industrial markets to the delta variant reducing optimism for a return to offices. The comments also indicated a lack of supply across multifamily, single-family rentals and industrial, as well as a likely continuation of labor and material shortages.

Read the full report by NAIOP.

You must be logged in to post a comment.