Pre-Tariffs, Construction Cost Hikes Ease

So far, economic shifts haven’t made their mark, according to Rider Levett Bucknall’s new report. But pressures may be building.

The national average increase in construction costs is decelerating, according to the latest quarterly cost report from Rider Levett Bucknall.

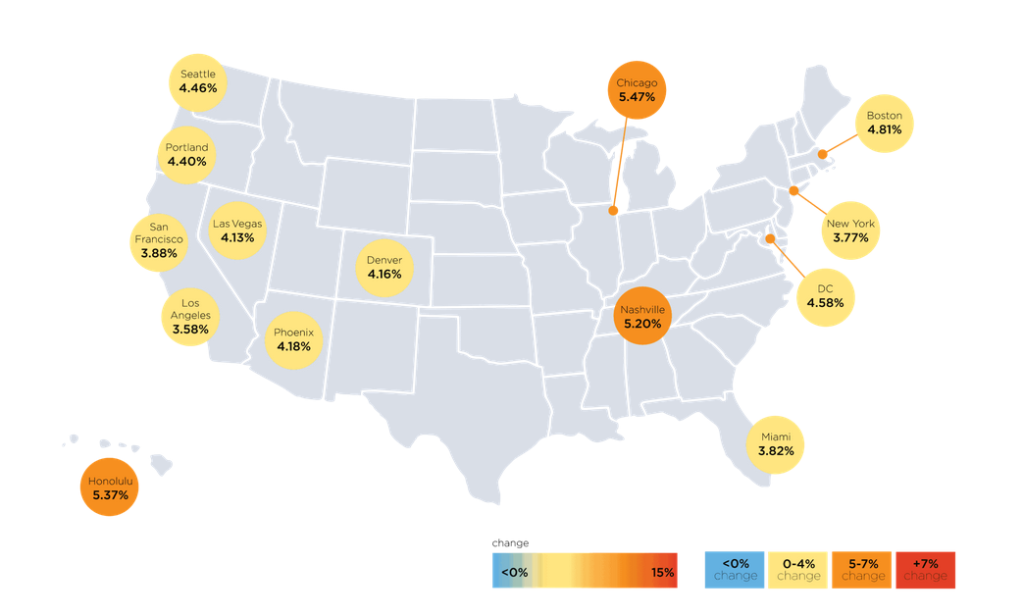

Based on data current to the middle of the first quarter of 2025, construction costs rose 0.98 percent, down from a 1.11 percent increase in the fourth quarter. The year-over-year growth rate is 4.35 percent, down from 5.86 percent this time last year.

Honolulu, Portland, Seattle, Boston and Chicago saw their costs higher than the national average increase, and Washington, D.C., Miami, Los Angeles, San Francisco, Las Vegas, Phoenix, Denver, and Nashville saw their gains below the national average.

This signals that economic shifts from the widely reported new tariffs haven’t significantly affected construction project expenses yet.

Items such as stamped steel, Canadian lumber and fuel are not expected to have much impact on prices, according to the report.

Ripple effects such as rising inflation and interest rates that are higher for longer could eventually be a factor.

“With all the volatility around tariffs, our financial market and the political landscape, the construction industry continues to adapt and is relatively stable with construction escalation getting closer to pre-pandemic levels,” Paul Brussow, president of RLB North America, told Commercial Property Executive.

“The ongoing tariff discussions is leading to many manufacturing companies poised to move to the U.S. This should be positive for the construction industry and our crane count as new plants will be needed to accommodate the expanded manufacturing.”

Costs vary project-by-project

While the national numbers show a cooling in cost escalation, Chris Curran, CEO at Curran Young Construction, said that he still sees variability on a project-by-project basis.

“Insurance hikes and permitting delays are having a more significant impact on total project cost than material tariffs right now, at least in our Southwest Florida market,” Curran said.

“We’re always watching global dynamics—if tariffs significantly affect steel or aluminum pricing, we’ll do what we’ve always done: adapt with alternate materials and creative design strategies. Construction has always been a dynamic business. The best builders are the ones who can pivot with the market, and that mindset has never been more essential.”

READ ALSO: What Trump’s Tariffs Could Mean for CRE

Robust backlogs and cautious optimism about hiring suggest the industry is still on solid footing, even as skilled labor availability and policy shifts introduce friction, according to Brian Gallagher, vice president of corporate development at Graycor.

“Notably, Associated Builders and Contractors recently reported that nonresidential construction spending hit its highest level on record in February, underscoring the strength of ongoing project activity—even as leading indicators begin to flash yellow,” Gallagher said.

The widening lag between design and construction phases remains a critical trend to monitor, as today’s design slowdown could challenge tomorrow’s volume if not addressed, he added.

“At the same time, growing uncertainty around potential new tariffs on construction materials adds another layer of risk, particularly for firms managing long-lead procurement and fixed-price contracts.”

Construction costs are definitely on the rise and have been for several years, Brian Sudduth, president & CEO at Miller Construction Co., told CPE.

“Recently, with the tariffs, we have seen an increase in structural steel and other steel-related products,” Sudduth said.

“However, much of the steel we use in construction is domestically produced or imported from countries unaffected by the tariffs. Still, it did impact the market, and the reality is that suppliers will always push costs up if the market is willing to absorb such costs. In addition, locally imported fill has seen a lot of cost increases from the local pits, and we continue to forecast more increases on imported fill.”

Crane Activity Falls in 7 Key Markets

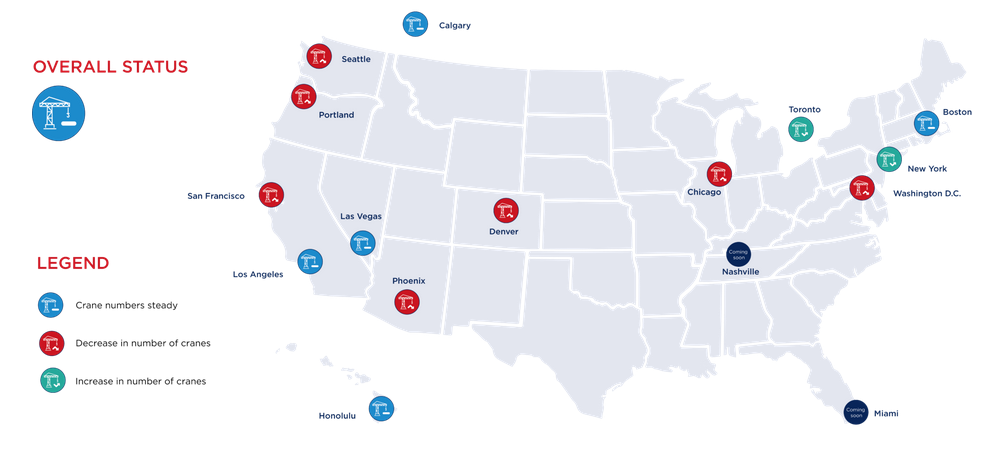

Only New York City and Toronto saw an increase in Rider Levett Bucknall’s 14-market crane index report for North America.

Seven key cities saw a reduction in crane activity by more than 20 percent in the first quarter this year.

San Francisco, Denver, Chicago, Washington, D.C., Portland, Seattle and Phoenix made the list. Meanwhile, Las Vegas, Boston, Honolulu, Calgary and Los Angeles went relatively unchanged.

This first-quarter data suggests a general hesitation to advance large-scale construction projects, according to the report. During that time, construction costs rose slightly, and interest rates declined.

“This offers a telling snapshot of shifting momentum across key North American markets,” Gallagher observed.

“The uptick in crane counts in NYC and Toronto suggests renewed investment and project confidence in dense urban centers—likely driven by infrastructure upgrades, mixed-use developments or institutional builds,” he said.

The significant decline in cities like Chicago and Seattle is a red flag, possibly reflecting permitting challenges, financing constraints, or a strategic slowdown in starts due to market uncertainty, Gallagher added.

“It reinforces the need to stay nimble in resource planning and deepen client relationships in growth markets while carefully navigating headwinds in cooling ones.”

Gallagher said he’s seeing a nuanced but telling story unfold across the construction industry, also factoring in data from the new 2025 CIRT Sentiment Index for the first quarter.

“While overall sentiment has improved, the sharp drop in the Design Index is particularly notable—especially given its historical role as a leading indicator,” he said. “When design activity slows, it often foreshadows a dip in construction starts six to 12 months later.”

The regional crane data aligns with this caution.

“Growth in NYC and Toronto is encouraging, but the sharp drops in markets like Chicago, Seattle and Phoenix may reflect a downstream impact of earlier design slowdowns or shifting capital priorities—particularly in cities grappling with permitting delays, regulatory headwinds, or demand volatility.”

Four more cranes stood in New York City between August 2024 and February 2025, bringing the active count to nine.

The location range is from 59th Street to 12th Street, between 2nd Avenue and 12th Avenue. Five developers are working on mixed-use developments: two in the Garment District, one on 7th Avenue and a pair in Midtown.

A couple of large-scale residential buildings are being built, giving the city an overall construction milestone not seen since February 2023.

In the prior quarter, commercial real estate professionals predicted more volatility this year than last and that the industry was prepared to respond.

You must be logged in to post a comment.