Pricing Continues its Monthly Decline

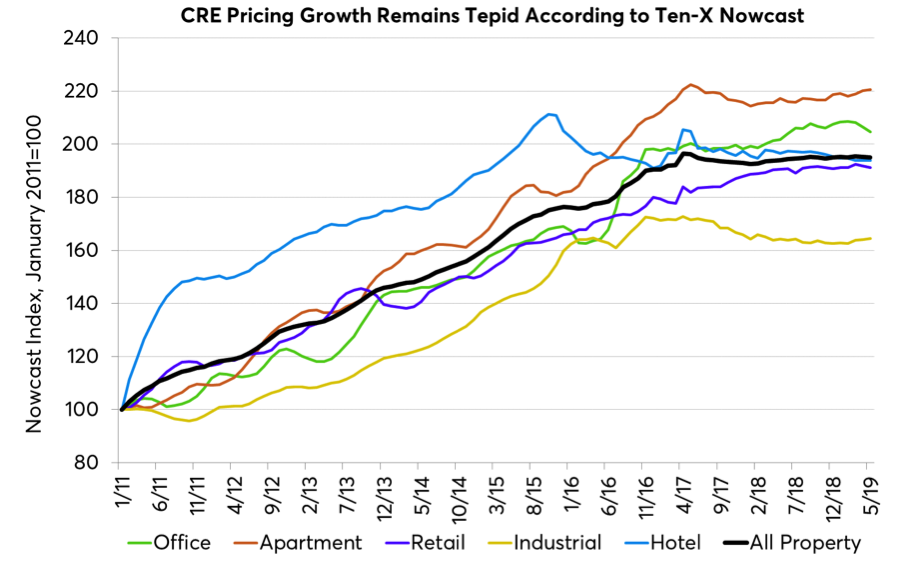

The Ten-X Commercial All-Property Nowcast fell 0.2 percent from the month prior, bringing the annual growth rate to just 0.4 percent.

The Ten-X Commercial Nowcast shows that commercial real estate pricing continued to languish in May, posting its second consecutive monthly decline. The Ten-X Commercial All-Property Nowcast fell 0.2 percent from the month prior, bringing the annual growth rate to just 0.4 percent.

The Ten-X Office Nowcast was the weakest performing sector in May, posting a 0.9 percent decline from the month prior. This marked the third consecutive monthly decline in pricing for the office sector, bringing annual growth down to 1.4 percent after measuring in the mid-4 percent range for much of the year. Office pricing declined in every sector except the Midwest, which saw an increase of 1.1 percent from the month prior.

The Ten-X Retail Nowcast was the only other sector that saw an outright monthly decline, with pricing falling 0.3 percent from April and bringing its annual growth to just 0.4 percent. Retail pricing has been steadily decelerating over the course of the last two years and this marks the slowest year-over-year growth in the Nowcasts’ history. Pricing was weakest in the Northeast, which saw a 1.6 percent decline on the month. The Southwest was the only other sector to see a monthly decline, as platform trading was weaker there as well. The Midwest actually saw pricing increase 1.4 percent from April.

The Ten-X Hotel Nowcast remained flat from the month prior, but nearly all regions saw pricing erode except for a solid gain in the Southwest. Hotel pricing on a national level is now 1.4 percent lower than a year ago and has been negative on an annual basis in 12 of the last 16 months. Pricing in the Southwest increased 1.4 percent from the month prior as investor survey data and platform performance were both positive. All other regions saw modest monthly declines.

The Ten-X Industrial Nowcast eked out a 0.2 percent gain in May, bringing it up the same amount from a year ago. Industrial pricing had been negative on an annual basis for a year and a half before stabilizing in the second quarter. Pricing saw modest gains in the Midwest and West, though the Southeast and Southwest saw pricing erode, with Southwest seeing an outsized 1.3 percent decline due to weak pricing trends.

Finally, the Ten-X Apartment Nowcast saw pricing rise 0.2 percent in May and is now 1.5 percent higher than a year ago, continuing the slow but steady gains it has seen throughout 2019. The performance regionally was notably more mixed though, with the Northeast and Southeast seeing solid gains of 1.3 percent and 1.5 percent from the month prior, respectively, while pricing fell 1.7 percent in the Midwest.

Peter Muoio is the chief economist at Ten-X.

You must be logged in to post a comment.