Pricing Remains Stagnant into Second Half

Apartment pricing remains the strongest among property sectors, as the Ten-X Apartment Nowcast is the only one showing annual growth in excess of 1 percent, measuring 1.9 percent in July.

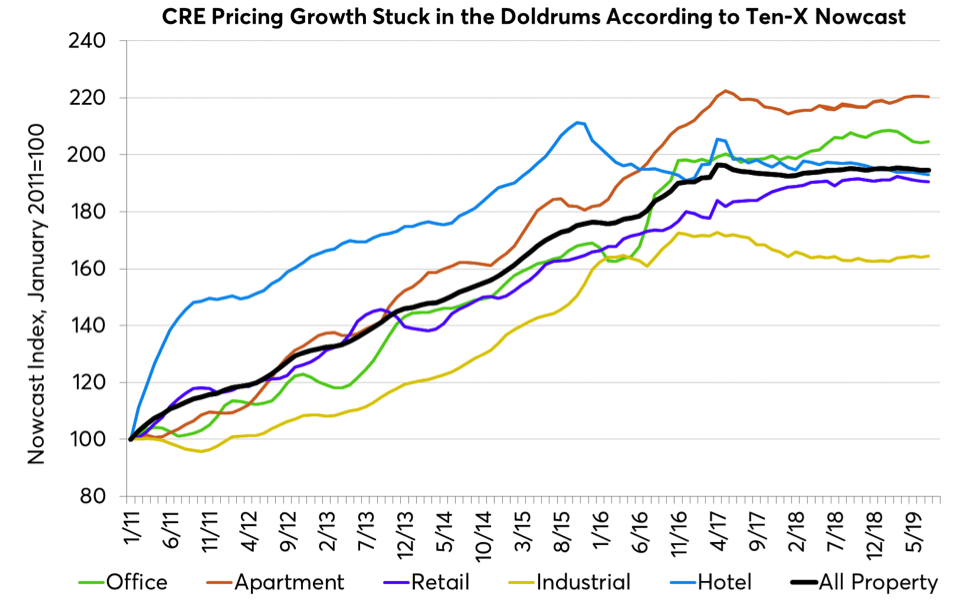

Commercial real estate pricing has entered the summer doldrums, as pricing remained flat from the month prior and a year ago per the Ten-X Commercial Real Estate Nowcast. The All Property index has now remained flat or declined in five of the last six months. The All Property stagnation does mask some variation by property type, as three property types saw price declines while two saw increases.

The hotel sector remained a laggard in July, as the Ten-X Hotel Nowcast showed pricing slid another 0.2 percent from June. Hotel prices are now 2.1 percent lower than a year ago, marking a slight acceleration in pace from previous months. The Southwest was the only region that bucked the trend, seeing a pricing gain of 0.3 percent. The Midwest saw a slightly larger decline than the national average, with pricing falling 0.5 percent from the month prior.

The office sector bucked a string of declines in July, as pricing rose 0.2 percent from June. However, the Ten-X Office Nowcast is now 0.8 percent lower than a year ago owing to some stronger comparison periods. This is the largest annual decline in the Ten-X Office Nowcast’s history. Regionally the story was mixed, as the Northeast saw pricing increase 1.1 percent from the month prior and the West saw gains of 0.7 percent. Pricing declined modestly in the Midwest, Southeast and Southwest.

Apartment pricing remains the strongest among property sectors, as the Ten-X Apartment Nowcast is the only one showing annual growth in excess of 1 percent, measuring 1.9 percent in July. More recently, the index fell just 0.1 percent from June. Apartment pricing was weakest in the West, where prices fell nearly 1 percent from the month prior. The Midwest and Northeast also saw prices fall modestly, owing to predominantly dour investor sentiment. However, the indexes for the Southeast and Southwest saw gains owing to positive survey outlooks and strong bidding trends on the Ten-X platform.

Retail pricing remains soft, as the Ten-X Retail Nowcast declined for the fourth consecutive month in July. The index is now just 0.7 percent above its year ago level. Regionally, the performance was mixed, as the Southeast and Southwest actually saw moderate gains in July from June of 0.7 percent and 0.8 percent respectively. The West saw the largest monthly pricing decline, with the index falling 0.8 percent from the month prior.

The Ten-X Industrial Nowcast shows the sector has stabilized following annual declines in late 2018 and into the start of the year. Currently the index measures 0.2 percent higher than the month prior and just 0.1 percent above its year ago level. That said the Ten-X Industrial Nowcast has now risen in four of the last five months. The Southeast was the only region that saw significant gains however, with the index rising 1 percent from the month prior. The Northeast and Midwest saw much more modest growth. The Southwest saw pricing fall just over 1 percent on the month, while the West saw a very minimal decline.

Peter Muoio is the chief economist at Ten-X.

You must be logged in to post a comment.