Office Tenant Costs Stay Surprisingly Steady: Savills

The U.S., Europe and EMEA markets still showed striking differences, according to this first-quarter survey.

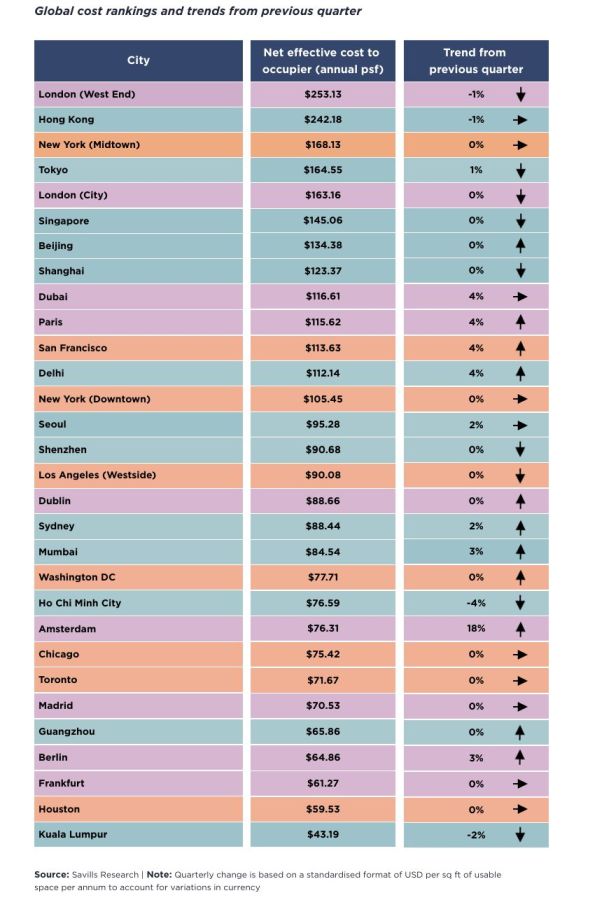

Occupiers’ costs for prime top-tier offices worldwide were mostly steady in the first quarter, with the “all-in” cost rising only 1.1 percent from the previous quarter, according to Savills’ latest Savills Prime Office Costs report.

Researchers from Savills said the slight rise in net effective costs—which include tenant-improvement costs, rents, service charges and property taxes—for the top 30 global office markets was largely due to the flight to quality trend and continuing desire for best-in-class office spaces for occupiers and their staff.

Similar to the 2022 Savills report, the rising costs are being driven by increasing tenant-improvement costs, which are caused by inflation in materials and labor costs. The report notes the pandemic-related supply chain delays seem to have abated in most locations. Savills also found face rents are beginning to inch up globally, rising an average of 1 percent in the first quarter of 2023.

READ ALSO: The Rise of Office-to-Residential Conversions

Savills reports markets in the Americas, which include seven in the U.S. and Toronto in Canada, saw flat rental levels and net effective costs in the first quarter as landlords attempt to attract and retain office tenants. While tenant-improvement costs have leveled out, vacancy rates and availability rates are being monitored as firms reassess space needs as more workers embrace hybrid work schedules. The tech industry has seen layoffs in recent months, although Houston’s technology sector has been more resilient.

Kelcie Sellers, associate in Savills World Research team, said in a prepared statement while there has been turbulence in the tech market resulting in some firms adjusting space needs, the office overall remains a focal point for the sector. Sellers said smaller tech firms can take advantage of space being released by larger technology companies, which is generally high quality and can help them attract talent.

By the numbers

While U.S. markets and Toronto saw flat rental levels and net effective costs, EMEA locations had increases of 3 percent on average. Amsterdam was the outlier on the high end with an 18 percent increase in costs. Both Dubai and Paris had 4 percent increases and Berlin saw a 3 percent increase in costs. By comparison, two markets in New York City—Downtown and Midtown—along with the Westside of Los Angeles, Chicago, Houston, Washington, D.C., and Toronto, were flat with no increase in net effective costs. San Francisco was the only U.S. market with rising costs, charting a 4 percent increase.

Savills researchers noted the increases in Dubai, Paris, Berlin and Frankfurt were mainly due to rental increases rather than higher tenant-improvement costs although rising tenant-improvement costs are contributing to the overall 3 percent increase in costs for the region. The EMEA region has seen the annual gross rent increase by 2.1 percent in the first quarter of 2023, mainly caused by occupiers seeking best-in-class office spaces.

The Asia Pacific markets were much less volatile in the past year, leading to flat office costs for the first quarter, according to Savills. There were some outliers throughout the region. In India, Delhi costs were up 4 percent for the quarter and Mumbai costs rose 3 percent. Sydney and Seoul each saw costs increase by 2 percent. In Hong Kong, office costs decreased by 1 percent. Meanwhile, Ho Chi Minh City tallied a 4 percent decrease in net effective costs to occupiers. Compared to the first quarter of 2022, Asia Pacific net effective costs rose 1.2 percent in the first quarter of 2023. The Savills report states that the number is significantly lower than the 9.7 percent seen on average across the EMEA markets in 2022, a figure in line with the headline inflation rate for the region last year.

Christina Sigliano, head of EMEA occupier services at Savills, said in prepared remarks that despite all the headlines about corporate occupiers’ space strategies, prime office space remains in high demand in many key markets. She notes pipelines for high-quality new office space will be lower in many cities so corporations looking to make future moves need to start considering their options now.

You must be logged in to post a comment.