Property Funds Reported Strong Returns in Q1 2022

MSCI's Global Quarterly Property Fund Index tracked the investment performance of 109 open-end real estate funds with a total gross asset value of USD $678 billion.

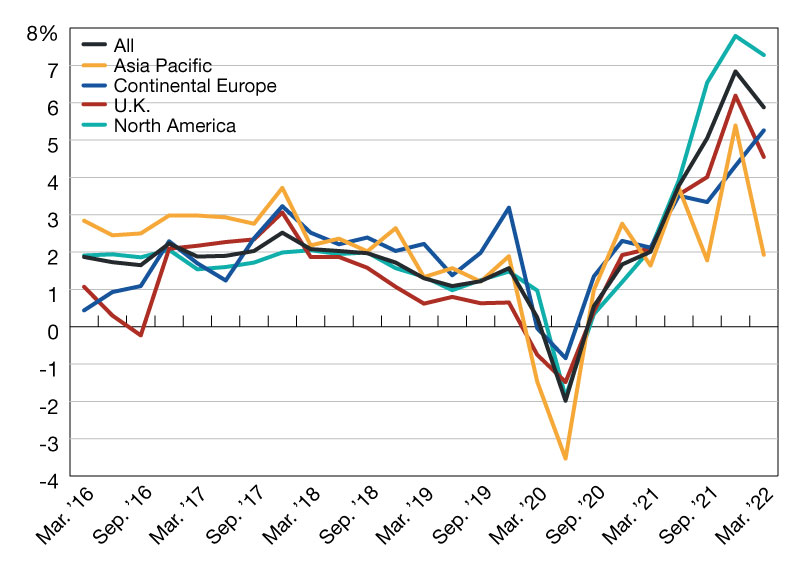

Quarterly Net Fund Return

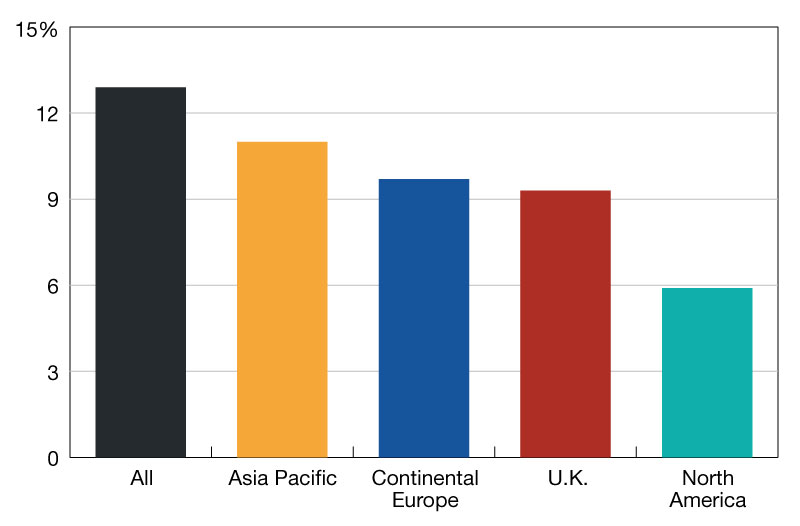

Annualised Net Fund Return Since December 2019

Global real estate funds delivered another solid performance in the first quarter of 2022. A quarterly total return of 5.9 percent boosted the annual return of the MSCI Global Quarterly Property Fund Index to 23.3 percent, the highest since its inception in March 2008.

At the end of March, the index tracked the investment performance of 109 open-end real estate funds with a total gross asset value of USD $678 billion across 9,469 quarterly valued properties. Funds domiciled in North America, the largest region in the index by value, continued to outperform and has since December 2019 produced an annualised total return of 12.9 percent. At the same time, Asia Pacific domiciled property funds recorded a return of 5.9 percent as their return tapered off in the first quarter of 2022.

Looking at asset-level returns, North American real estate funds also had a particularly strong first quarter as its return accelerated to 23.0 percent p.a. followed by the United Kingdom at 20.8 percent and Continental Europe at 16.7 percent. While Asia Pacific domiciled funds saw their returns slow, the region’s performance still compares favorably across longer time horizons. In fact, since the index’s inception in 2008, it is the top performing region with an annualised compound total return of 7.5 percent.

MSCI is a leading provider of critical decision support tools and services for the global investment community. With over 45 years of expertise in research, data and technology, we power better investment decisions by enabling clients to understand and analyze key drivers of risk and return and confidently build more effective portfolios. We create industry-leading research-enhanced solutions that clients use to gain insight into and improve transparency across the investment process.

You must be logged in to post a comment.