Property Management Success: Reimagining Retail

Strategies for staying on top of fast-changing tenant and customer needs.

After struggling under the twin pressures of the pandemic and e-commerce, the retail sector has mounted a comeback that’s one of real estate’s biggest success stories. No small share of the credit goes to the technology, events and entertainment offerings that drive experiential retail strategies.

Yet rethinking how customers interact with retail spaces, brands and products remains a distinct challenge.

For the in-person experience, this means making shopping about as seamless and convenient as ordering from Amazon. Kristin Mueller, president of retail property management at JLL, believes that this relationship exists at every level, from the store layout and products to the way that a customer views a brand. “Our goal is to meet the customer where they are, and to help retailers meet them where they are,” Mueller said. This can occur through social media, digital advertising, events and other channels.

READ ALSO: What’s Ahead for Retail in 2024?

Within the stores, this translates to borrowing e-commerce ideas that complement brick-and-mortar shopping. “If a person enjoys going to a store so they can touch it, feel it or try it on, but they aren’t in a situation to carry out everything with them, (people) are waiting to help them get it to their homes,” Mueller observed.

That idea can also work in reverse, taking the form of proprietary digital strategies that aim to meet customers at the property level. At Avison Young, this “omni-retail” approach “starts with the digital customer journey, and drives (both) visitation to the property and sales to our tenants,” reported Meghann Martindale, principal & director of retail market intelligence at the firm.

No matter what form it takes, the boundary between online and in-person experiences should be blurred as much as possible, and managers should strive to be flexible above all, experts say.

That holds true for smaller local tenants which may not have the resources or expertise to make the most of these strategies. Sean Daly, executive vice president at American Realty Advisors, stresses the importance of working closely with these tenants “to ensure that their websites are up to date with active links and relevant information to improve interactions with potential customers.”

Meeting customers where they are (and aren’t)

In a more literal sense, online shopping can exist within the store, with apps that scan and order product becoming a mainstay. “One of the more notable changes has been the open adoption and even embracing of blending online shopping activity while physically (being) in a retail store,” observed David Verwer, managing director at Mode Commercial Property Management. The expanded use of apps that enable customers to scan and order products within the store translates to the critical need for strong Wi-Fi and cell service to serve the experiential retail environment, he added.

In the same vein, curbside delivery has evolved from a pandemic-era precaution to a convenient amenity. “It’s become almost a requirement for many retailers, and this impacts both parking and traffic flow patterns,” Verwer said.

American Realty Advisors has addressed these trends by expanding non-exclusive short-term parking at some retail centers, as well as creating permanent parking spaces for customer pick-up. “They can work to improve turnover, but they also require more active management with our site team,” in part to keep employees from accidentally using them, Daly reported.

Also in the transportation realm is rideshare signage, allowing for quick transportation via valet parking or Uber and Lyft pickup spots. These offerings are in line with digitized aspects of the in-person shopping experience, such as navigation apps and automated promotional texts to shoppers.

Optimizing the experience

Equally important to what happens inside retail centers is what goes on around them. Experiential offerings should complement—and, when possible, extend beyond—the conventional food and entertainment offerings that centers rely on to extend visitor dwell times.

One idea that Mueller endorses is inviting shoppers to bring their pets, particularly to open-air and lifestyle properties. “I asked our head of marketing, who talked about the increase in visitors and photo sales year-over-year, (about) how much of that is pets,” Muller recounted. “She said probably half.”

The key takeaway is to be creative. Verwer advises retailers to seek out new brand partnerships at grocery-anchored centers and in-store kiosks. Those features, he said, “would not have been considered a few years ago.”

Avison Young shares this approach with its Pop-Up & Grow program, which allows local brands to fit into turnkey spaces. Martindale attributes the success of the program in part to changing expectations of tenants, which task property managers with “driving placemaking, marketing, events and activation.”

Traditional local resources still have a valuable role to play. The power of farmers’ markets and local craft offerings to synergize with brick-and-mortar stores should not be overlooked. Here, the goal is to make the shopping “more of a unique experience every visit,” according to Verwer.

Attracting attention

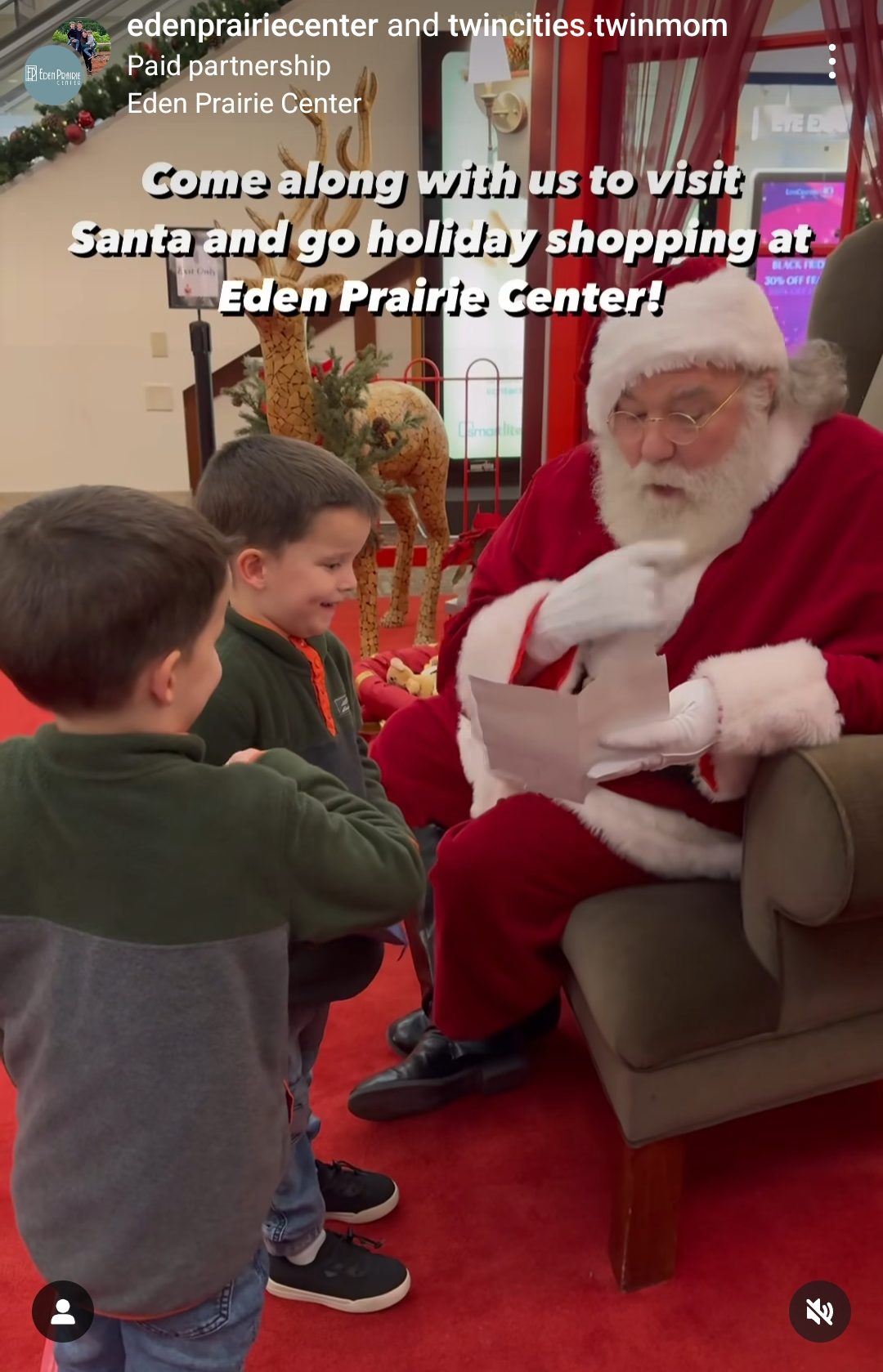

The necessity to make the most of social media continues to generate creative ideas for marketing and customer engagement. One successful approach is a holiday partnership with local influencers who showcase a center’s offerings and experiences. “(They) navigate it, take shoppers into a store and show them why it’s a fun place to be and the interesting stuff they have, or a business that may be more entertaining,” Mueller reported.

The goal is to showcase the experience as much as the merchandise. “It needs to be what the consumer and shoppers in the area want, where they want to spend time, and to make them aware of it.” Mueller concluded.

You must be logged in to post a comment.